Bitcoin, the pioneer of cryptocurrencies, has revolutionized the financial world since its inception in 2009. As Bitcoin matures, traders and investors increasingly turn to algorithmic trading to capitalize on its volatility and liquidity. Algorithmic trading uses automated systems that follow pre-programmed instructions to execute trades, which can be based on various indicators, strategies, or market conditions. In this article, we explore modern algorithms for Bitcoin trading and how they help traders succeed in the ever-changing cryptocurrency landscape.

The Basics of Algorithmic Trading

Algorithmic trading involves creating and utilizing computer programs that execute trades based on specific criteria. These programs can be simple, executing trades only when Bitcoin’s price hits a certain threshold, or complex, utilizing machine learning and advanced mathematical models to analyze patterns in market data and predict future price movements.

Key Components of an Algorithm

- Data Collection: Historical and real-time data on Bitcoin prices, market volume, and other metrics are gathered.

- Signal Generation: The algorithm identifies trading opportunities based on predefined criteria.

- Risk Management: The algorithm manages risk by setting stop-loss levels, position sizes, and portfolio limits.

- Execution: The algorithm executes Trades automatically, reducing the need for human intervention.

Why Use Algorithmic Trading for Bitcoin?

- Speed: Algorithms can analyze and execute trades far faster than any human.

- Accuracy: Pre-programmed instructions minimize human error, ensuring trades are executed exactly as planned.

- Consistency: Algorithms work without emotion, avoiding psychological biases like fear or greed.

- Customization: Algorithms can be tailored to meet individual trading strategies or adapt to various market conditions.

Common Bitcoin Trading Algorithms

The strategies behind Bitcoin trading algorithms vary in complexity, but they are often categorized into a few key types. Below are the most popular ones.

Trend-Following Algorithms

Trend-following algorithms identify patterns in the price movement and execute trades based on the assumption that trends, once established, will continue for some time. These algorithms track indicators like moving averages (MA), exponential moving averages (EMA), and other technical tools to detect trends.

Example: Moving Average Crossover

One of the simplest strategies, this algorithm buys Bitcoin when a short-term moving average crosses above a long-term moving average (a bullish crossover) and sells when the short-term moving average crosses below the long-term moving average (a bearish crossover).

- Advantages: Easy to implement and works well in trending markets.

- Challenges: Poor performance in range-bound markets where prices don’t trend significantly.

Arbitrage Algorithms

Arbitrage algorithms exploit Bitcoin’s price differences across various exchanges. For instance, Bitcoin may trade for a higher price on one exchange and lower on another. The algorithm buys from the cheaper exchange and sells on the more expensive one, pocketing the difference.

Example: Triangular Arbitrage

Triangular arbitrage involves exploiting inefficiencies between three cryptocurrencies (e.g., Bitcoin, Ethereum, and Litecoin). The algorithm executes a series of trades, starting with Bitcoin, converting it into Ethereum, and then back into Bitcoin, all while taking advantage of price discrepancies.

- Advantages: Relatively low-risk strategy and highly profitable in volatile markets.

- Challenges: Profits are often slim, and transaction fees can erode margins.

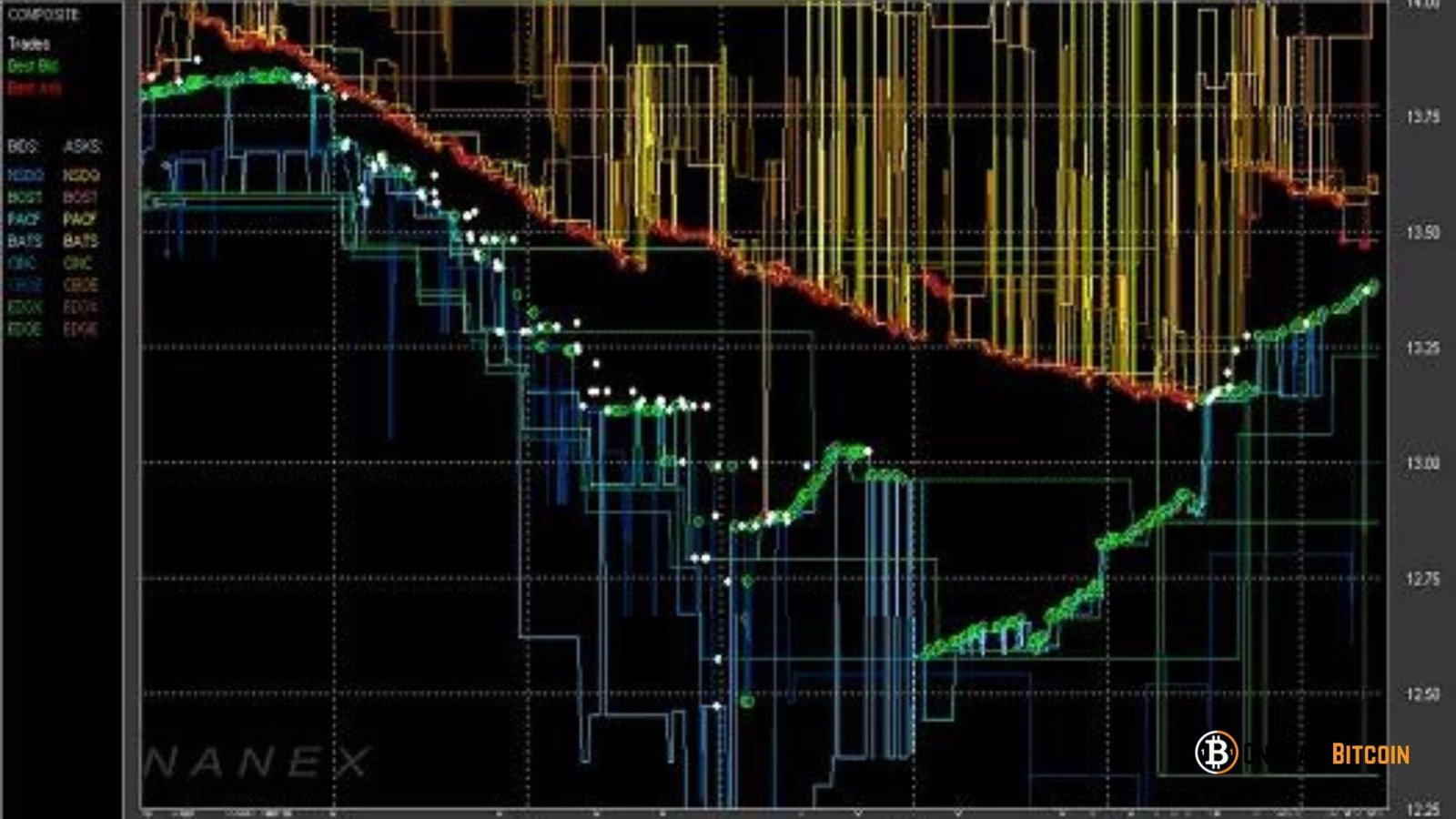

Market-Making Algorithms

Market-making algorithms provide liquidity to Bitcoin exchanges by placing buy and sell orders on both sides of the order book. These algorithms profit from the bid-ask spread, the difference between the buy (bid) price and the sell (ask) price.

Example: Spread Trading

The algorithm continuously buys Bitcoin at the bid price and sells it at the ask price. While profits per trade are small, the sheer volume of trades can accumulate substantial gains.

- Advantages: Low-risk strategy if market volatility is managed.

- Challenges: Risk of significant losses during sudden price movements or low liquidity conditions.

Mean Reversion Algorithms

Mean reversion strategies operate on the belief that Bitcoin’s price will revert to its average or historical price after deviating from it. When the price moves too far in one direction, the algorithm assumes a reversal is imminent.

Example: Bollinger Bands

Bollinger Bands use standard deviations around a moving average to identify high or low volatility periods. The algorithm buys Bitcoin when the price hits the lower band, anticipating a return to the mean, and sells when it reaches the upper band.

- Advantages: Effective in markets with frequent reversals.

- Challenges: This can result in losses if the price continues to trend rather than revert.

Momentum-Based Algorithms

Momentum algorithms capitalize on the strength of price movement in a particular direction. They assume that assets that have performed well in the past will continue to do so.

Example: RSI (Relative Strength Index) Strategy

The RSI indicator identifies overbought or oversold conditions in the Bitcoin market. The algorithm buys when the RSI falls below 30 (oversold) and sells when it exceeds 70 (overbought), aiming to catch momentum reversals.

- Advantages: Highly customizable and works well in trending markets.

- Challenges: Requires precise timing; early or late entries can lead to losses.

High-Frequency Trading (HFT) Algorithms

HFT strategies are highly sophisticated algorithms designed to execute many trades at incredibly high speeds, typically within microseconds. HFT algorithms can analyze market trends, arbitrage opportunities, and order book depth to make decisions.

- Advantages: The execution speed allows traders to capitalize on opportunities that human traders would miss.

- Challenges: It requires specialized infrastructure, access to low-latency networks, and significant computational power. However, it is highly competitive with other HFT algorithms.

AI and Machine Learning in Bitcoin Trading

In recent years, the application of artificial intelligence (AI) and machine learning (ML) in Bitcoin trading has gained prominence. These advanced techniques can create algorithms that learn from past data and adapt to new conditions without constant human input.

Neural Networks

Neural networks are a popular form of AI used in algorithmic trading. They can analyze large datasets, learn patterns, and predict future price movements. Training the network on historical data can identify trends that are not visible through traditional indicators.

Reinforcement Learning

Reinforcement learning algorithms use trial and error to learn the best trading strategies. The algorithm is rewarded for profitable trades and penalized for losses, gradually improving its decision-making process. This dynamic approach allows the algorithm to adapt to changing market conditions.

Sentiment Analysis

Machine learning algorithms can be trained to analyze market sentiment by processing news articles, social media posts, and other forms of textual data. By understanding the market’s mood, these algorithms can anticipate price movements based on shifts in public opinion.

Risk Management in Algorithmic Trading

Despite the efficiency and speed of algorithms, risks remain. Effective risk management strategies are essential for success in Bitcoin trading.

- Position Sizing: Limit the amount of capital allocated to any trade to reduce risk exposure.

- Stop-Loss Orders: Use automated orders to exit losing trades and prevent excessive losses.

- Diversification: Don’t rely on a single algorithm or strategy. Diversify across multiple strategies and time frames to spread risk.

The Future of Algorithmic Bitcoin Trading

The field of algorithmic Bitcoin trading continues to evolve. With the rise of decentralized finance (DeFi) and automated market makers (AMMs), traders are increasingly looking at algorithmic strategies that can interact with decentralized protocols. Additionally, the development of quantum computing could revolutionize the speed and complexity of these algorithms, opening new opportunities and challenges.

As Bitcoin and the broader cryptocurrency market grow, algorithms will only become more critical in ensuring traders can keep up with rapid price changes, liquidity fluctuations, and new market entrants. Whether through simple trend-following algorithms or advanced AI-driven models, algorithmic trading will likely remain at the forefront of the Bitcoin trading revolution.

In conclusion, algorithmic trading is an indispensable tool for modern Bitcoin traders. With the right strategy, infrastructure, and risk management, algorithms can significantly enhance trading efficiency, profitability, and consistency. However, traders should remain vigilant, continuously refine their models, and adapt to the fast-paced world of cryptocurrency.