XRP price prediction 2017 bull run: The cryptocurrency market is buzzing with excitement as XRP, one of the most closely watched digital assets, appears to be exhibiting patterns reminiscent of its legendary 2017 bull run. Leading market analysts are drawing compelling parallels between the current price action and the explosive rally that saw XRP surge by over 3,000% during the last major crypto bull market cycle.

Current Market Position and Technical Indicators

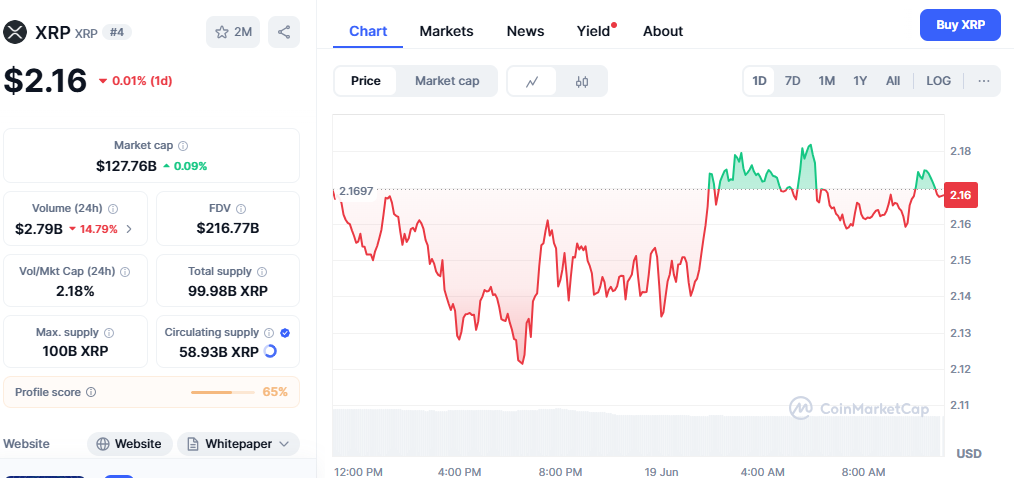

As of June 2025, XRP is trading around $2.13 to $2.26, representing a significant recovery from recent lows and demonstrating resilience amid broader market volatility. The digital asset has shown remarkable strength, rebounding by over 10% from its lows in late May, while many other cryptocurrencies struggled with market uncertainty. This price action has caught the attention of seasoned analysts who recognize familiar patterns from XRP’s historic performance.

The technical landscape for XRP presents an intriguing setup that mirrors conditions seen before major breakouts in previous cycles. The token is currently consolidating between key moving averages, with the 200-day exponential moving average providing crucial support while the 50-day EMA acts as resistance. This technical configuration often precedes significant price movements, and analysts are closely monitoring these levels for potential breakout signals.

Drawing Parallels to the Historic 2017 Rally

The comparison to 2017 is not made lightly, as that year marked one of the most spectacular rallies in cryptocurrency history. During the 2017 bull market, XRP experienced a significant rise from under $0.20 to nearly $3.40, delivering returns that exceeded 30 times the initial investment for early investors. This performance made XRP one of the best-performing major cryptocurrencies of that cycle and established it as a force to be reckoned with in the digital asset space.

Market analysts are identifying several key similarities between current market conditions and the setup that preceded the 2017 explosion. The consolidation patterns, accumulation phases, and technical indicators are showing striking resemblances to the pre-rally conditions of 2017. Additionally, the broader cryptocurrency market environment shares many characteristics with the early stages of the previous bull cycle, including increased institutional interest and evolving regulatory clarity.

Analyst Predictions and Price Targets

Leading cryptocurrency analysts are expressing bullish sentiment about XRP’s potential trajectory, with many drawing direct comparisons to the 2017 performance. Some analysts suggest that if XRP can replicate even a portion of its 2017 rally, the price could reach double-digit figures. Market analyst Bobby A believes XRP has the potential to get $15 if it can replicate just 50% of its 2017 rally performance.

More ambitious predictions are also circulating within the analyst community. Crypto analyst Egrag Crypto has stated expectations for XRP to reach between $27 and $33 in the current market cycle, citing the potential for a repeat of the 2017 historical performance. These price targets would represent substantial gains from current levels and would require XRP to demonstrate the kind of explosive growth it showed during the previous primary bull market.

Short-term forecasts are also painting an optimistic picture. CoinDesk’s AI model forecasts XRP reaching $2.85 by July 2025, while some analysts predict a potential retest of the previous high around $3.40 in the near term. More aggressive short-term predictions include analyst WatersAbove’s bold forecast of XRP surging to $15 by July 24, 2025, signaling what he terms an ‘XRP Summer.’

Fundamental Catalysts Supporting the Rally Thesis

Beyond technical analysis, several fundamental factors are aligning to support the bullish thesis for XRP. The ongoing resolution of regulatory uncertainties surrounding Ripple’s legal challenges has created a more favorable environment for the cryptocurrency. This regulatory clarity is seen as a crucial catalyst that could unlock institutional adoption and drive significant price appreciation.

The potential approval of an XRP Exchange-Traded Fund (ETF) is another major catalyst that analysts are closely monitoring. Market sentiment around XRP ETF approval has reached optimistic levels, with some prediction markets showing high probability odds for approval. Analysts suggest that ETF approval could drive XRP to the $20-$27 range, mirroring the impact that Bitcoin ETF approvals had on Bitcoin’s price performance.

Additionally, Ripple’s continued expansion of its cross-border payment solutions and partnerships with financial institutions worldwide provides fundamental support for XRP’s long-term value proposition. The company’s focus on revolutionizing international payments continues to generate real-world utility for XRP, distinguishing it from many other cryptocurrencies that lack clear use cases.

Risk Factors and Market Considerations

While the parallels to 2017 are compelling, analysts also acknowledge the risks and differences in the current market environment. The cryptocurrency market has matured significantly since 2017, with increased institutional participation, better regulatory frameworks, and more sophisticated trading infrastructure. These changes could result in different price dynamics compared to the previous cycle.

Market volatility remains a significant consideration, as XRP has shown substantial price swings in recent months. The broader macroeconomic environment, including interest rate policies and global economic conditions, continues to influence cryptocurrency markets and could impact XRP’s performance regardless of technical patterns.

Some analysts also caution that while historical patterns can be instructive, they don’t guarantee future performance. The cryptocurrency market’s evolution means that past rallies may not be perfectly replicated, and investors should consider multiple scenarios when evaluating potential investments.

Looking Ahead

As XRP continues to trade within its current range, several key factors will determine whether the comparison to the 2017 rally proves accurate. Technical breakouts above key resistance levels, particularly the $2.60 mark, could signal the beginning of a more substantial upward movement. Volume confirmation will be crucial for validating any breakout attempts and providing confidence in the sustainability of upward price action.

Regulatory developments will continue to impact the XRP price prediction 2017 bull run trajectory significantly. Any positive news regarding ETF approvals, additional legal clarity, or expanded institutional adoption could serve as catalysts for significant price appreciation. Conversely, any adverse regulatory developments could dampen the bullish sentiment and delay the anticipated rally.