The landscape of cryptocurrency regulation continues to evolve, and recent developments have brought significant clarity to financial advisers navigating the digital asset space. The Securities and Exchange Commission has issued new SEC crypto custody guidelines that permit registered investment advisers to utilize qualified state-chartered trust companies as custodians for client cryptocurrency holdings. This groundbreaking development marks a pivotal moment in the ongoing integration of digital assets into traditional financial infrastructure. The SEC crypto custody guidelines represent a temporary but crucial step forward, offering advisers a compliant pathway to manage client crypto portfolios while the regulatory framework continues to mature. Understanding these new provisions is essential for any financial professional seeking to incorporate cryptocurrencies into their service offerings.

New SEC Crypto Custody Guidelines

The Securities and Exchange Commission’s recent guidance addresses a long-standing challenge in the cryptocurrency industry: how registered investment advisers can legally and compliantly hold client digital assets. The SEC crypto custody guidelines specifically clarify that qualified state-chartered trust companies can serve as acceptable custodians under the Investment Advisers Act’s custody rule.

What Are Qualified State-Chartered Trust Companies?

Qualified state-chartered trust companies are financial institutions chartered by state banking authorities to hold and manage assets on behalf of clients. These entities must meet rigorous regulatory standards, including:

- State banking supervision: Regular examinations and oversight by state financial regulators

- Capital requirements: Minimum capital thresholds to ensure financial stability

- Fiduciary duties: Legal obligations to act in the best interests of clients

- Segregated asset storage: Maintaining client assets separately from company assets

- Insurance and bonding: Protection mechanisms for client holdings

Under the new SEC crypto custody guidelines, these state-chartered institutions can now extend their custodial services to include cryptocurrencies and other digital assets, provided they meet specific qualifications and operate within established regulatory parameters.

The Investment Advisers Act Custody Rule Framework

The custody rule under the Investment Advisers Act requires registered investment advisers to protect client assets through qualified custodians. Historically, this framework was designed for traditional securities and did not explicitly account for the unique characteristics of digital assets. The latest SEC crypto custody guidelines bridge this gap by:

- Recognizing digital assets as securities under certain circumstances

- Extending custody protections to cryptocurrency holdings

- Establishing clear standards for qualified custodians in the crypto space

- Requiring surprise examinations and audits to verify asset holdings

- Mandating client disclosures about custody arrangements

This framework ensures that client cryptocurrency holdings receive the same level of protection and oversight as traditional investment portfolios.

Why the SEC Issued These Crypto Custody Guidelines Now

The timing of these SEC crypto custody guidelines reflects several converging factors in the financial and regulatory landscape. The cryptocurrency market has matured significantly, with institutional adoption accelerating and mainstream financial institutions developing digital asset services.

Institutional Demand for Clear Regulations

Financial advisers have faced mounting pressure from clients seeking cryptocurrency exposure in their investment portfolios. Without explicit regulatory guidance, many advisers were forced to turn away clients or operate in a legal gray area. The SEC crypto custody guidelines address this demand by:

- Providing regulatory certainty for advisers offering crypto services

- Enabling institutional participation in the digital asset market

- Protecting investors through established custody safeguards

- Leveling the playing field between traditional and crypto-native financial services

The SAB 121 Controversy and Its Resolution

The SEC’s Staff Accounting Bulletin 121 (SAB 121) has created significant challenges for banks and financial institutions that hold cryptocurrencies. SAB 121 required institutions to recognize crypto custody liabilities on their balance sheets, effectively discouraging them from participating in the digital asset market. The new SEC crypto custody guidelines represent a more balanced approach that acknowledges the unique nature of cryptocurrency custody while maintaining investor protections.

How State Trust Companies Meet SEC Crypto Custody Guidelines

For state-chartered trust companies to serve as qualified custodians under the SEC crypto custody guidelines, they must demonstrate comprehensive capabilities in digital asset management and security.

Technical Infrastructure Requirements

Cryptocurrency custody requires sophisticated technical infrastructure that is far more advanced than traditional asset custody. Qualified state trusts must implement:

Multi-Signature Wallet Systems: Multiple authorization signatures are required for transaction approval, preventing single points of failure and reducing internal fraud risk.

Cold Storage Solutions: The majority of client crypto assets are stored offline in cold wallets, isolated from internet connectivity and potential cyber threats.

Hot Wallet Management: Limited operational balances in hot wallets for necessary transactions, with robust security protocols including multi-factor authentication and encryption.

Disaster Recovery Protocols: Comprehensive backup systems and redundancy measures ensure asset accessibility even in catastrophic scenarios.

Cybersecurity Frameworks: Enterprise-grade security measures, including penetration testing, intrusion detection systems, and continuous monitoring.

Regulatory Compliance Mechanisms

Beyond technical capabilities, institutions meeting SEC crypto custody guidelines must establish comprehensive compliance programs addressing:

- Anti-Money Laundering (AML) procedures: Transaction monitoring and suspicious activity reporting

- Know Your Customer (KYC) verification: Robust identity verification and ongoing customer due diligence

- Bank Secrecy Act compliance: Recordkeeping and reporting obligations for financial institutions

- State banking regulations: Adherence to charter requirements and state supervisory standards

- Federal securities laws: Compliance with SEC registration and reporting requirements

Insurance and Risk Management

The SEC’s crypto custody guidelines require qualified custodians to maintain appropriate insurance coverage that protects client assets from theft, loss, or misappropriation. This includes:

- Crime insurance policies covering employee dishonesty and cyber theft

- Errors and omissions coverage protects against operational mistakes

- Directors and officers insurance for governance and management decisions

- Cryptocurrency-specific policies addressing unique digital asset risks

Implications for Registered Investment Advisers

The new SEC crypto custody guidelines create significant opportunities and obligations for registered investment advisers seeking to offer cryptocurrency services to clients.

Compliance Requirements for Advisers

Investment advisers utilizing state-chartered trust companies for cryptocurrency custody must:

Conduct Due Diligence: Thoroughly vet potential custodians to ensure they meet all SEC crypto custody guidelines and possess necessary technical and financial capabilities.

Implement Written Agreements: Execute detailed custody agreements specifying responsibilities, liabilities, insurance coverage, and operational procedures.

Perform Ongoing Monitoring: Regularly assess custodian performance, security measures, and continued compliance with regulatory standards.

Maintain Client Communications: Provide clear disclosures to clients about custody arrangements, associated risks, and fee structures.

Enable Account Verification: Facilitate client access to account statements and verification of cryptocurrency holdings.

Operational Considerations and Best Practices

Financial advisers incorporating cryptocurrencies under the SEC crypto custody guidelines should implement comprehensive operational frameworks:

- Investment policy development: Creating clear guidelines for cryptocurrency allocation, selection, and rebalancing within client portfolios

- Risk assessment protocols: Evaluating client suitability for crypto investments based on risk tolerance, investment objectives, and financial circumstances

- Fee transparency: Clearly disclosing all costs associated with cryptocurrency custody, trading, and advisory services

- Performance reporting: Providing accurate, timely reporting of cryptocurrency holdings and performance

- Tax compliance support: Assisting clients with cryptocurrency tax reporting obligations and documentation

The “For Now” Qualifier: Temporary Nature of Current Guidelines

The provisional nature of these SEC crypto custody guidelines reflects the evolving regulatory landscape surrounding digital assets. Several factors suggest the current framework may be temporary:

Pending Comprehensive Crypto Legislation

Congress continues to debate comprehensive cryptocurrency legislation that could fundamentally reshape the regulatory landscape. Potential legislative developments include:

Market Structure Bills: Proposals defining which federal agency has primary jurisdiction over different types of digital assets, potentially transferring specific oversight from the SEC to the Commodity Futures Trading Commission.

Stablecoin Regulations: Dedicated frameworks for stablecoin issuers and custodians that could impact how advisers hold and manage these assets.

Digital Asset Securities Laws: Clarifications about which cryptocurrencies constitute securities and which fall outside SEC jurisdiction.

Custody-Specific Requirements: Potential statutory requirements for cryptocurrency custodians beyond current SEC guidance.

Evolving SEC Leadership and Priorities

The SEC’s approach to cryptocurrency regulation has varied significantly with leadership changes. The current SEC crypto custody guidelines reflect specific policy priorities that could shift with:

- New SEC commissioners bringing different regulatory philosophies

- Changes in administration affecting overall crypto policy approaches

- Industry feedback highlighting unintended consequences or implementation challenges

- Market developments revealing new risks or opportunities requiring regulatory adjustment

Technological Innovation and Regulatory Adaptation

Cryptocurrency technology continues to evolve rapidly, with innovations potentially rendering current SEC crypto custody guidelines outdated:

Decentralized Finance (DeFi) Protocols: Emerging custody solutions using smart contracts and decentralized networks challenge traditional custodian models.

Self-Custody Technologies: Advanced user-friendly self-custody options may reduce reliance on institutional custodians.

Layer 2 Solutions: Scaling technologies creating new custody considerations for assets on secondary blockchain layers.

Cross-Chain Interoperability: Assets moving between different blockchains create complex custody tracking and security challenges.

Comparing State Trust Custody with Alternative Solutions

The SEC’s crypto custody guidelines authorize state-chartered trust companies; however, how does this approach compare with other cryptocurrency custody models?

State Trusts vs. Federally Chartered Banks

Federally chartered banks face different regulatory frameworks than state trust companies:

State Trust Advantages:

- More flexible state regulatory environments

- Specialized focus on custody services

- Potentially faster adaptation to crypto-specific needs

- Lower regulatory burden than full banking operations

Federal Bank Advantages:

- FDIC insurance for dollar deposits (though not crypto assets)

- Federal Reserve access and liquidity options

- Comprehensive federal oversight and examination

- Broader financial service integration capabilities

Qualified Custodians vs. Crypto-Native Exchanges

The SEC crypto custody guidelines distinguish between qualified custodians and cryptocurrency exchanges:

Qualified Custodian Benefits:

- Regulatory oversight and investor protections

- Segregated client assets with clear ownership rights

- Insurance coverage and capital requirements

- Compliance with established financial regulations

- Surprise examination requirements ensuring accountability

Exchange Custody Limitations:

- Regulatory uncertainty in many jurisdictions

- Commingled assets and potential insolvency risks

- Variable security standards across platforms

- Limited insurance coverage in many cases

- Historical instances of exchange failures and client losses

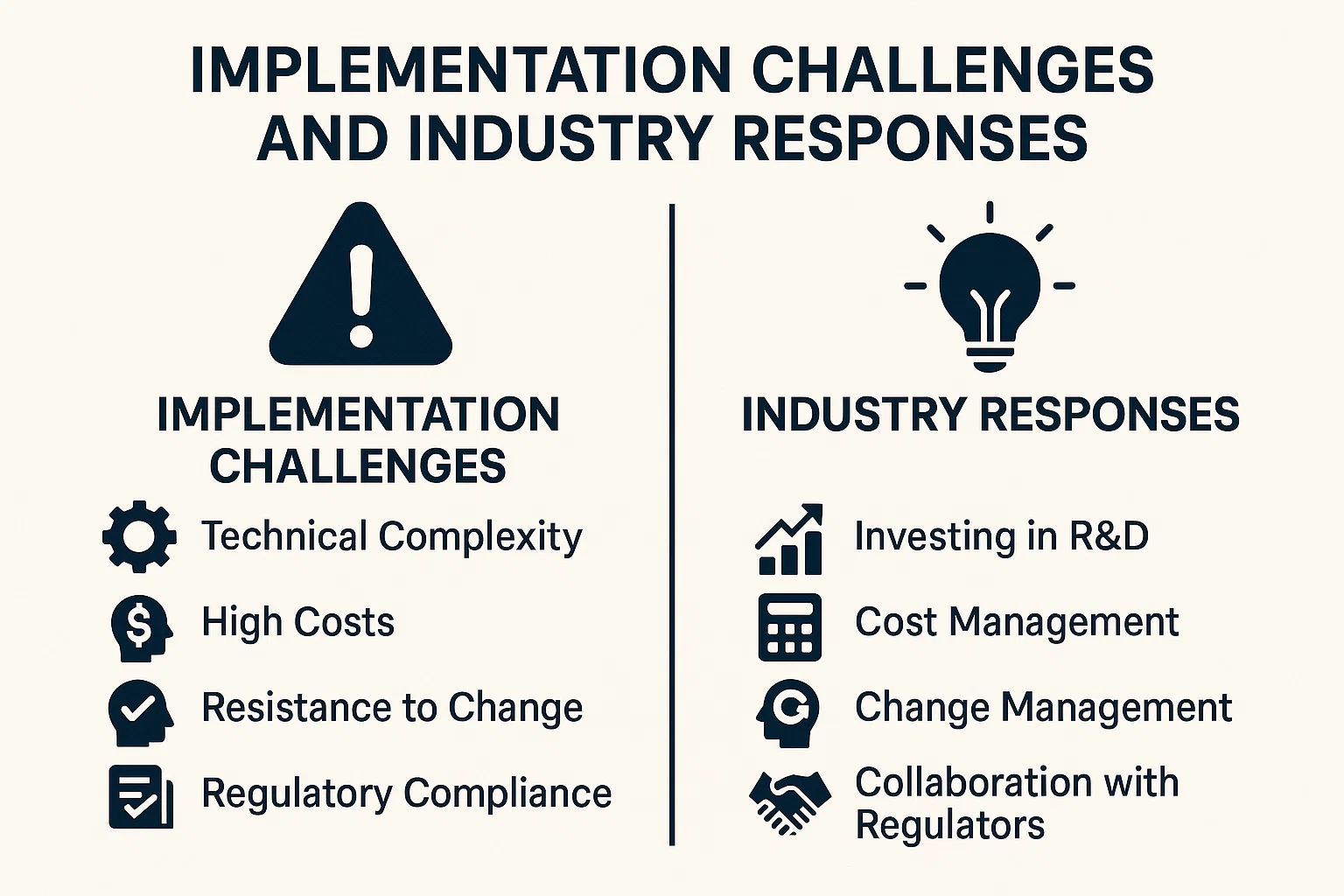

Implementation Challenges and Industry Responses

Despite the clarity provided by the SEC’s crypto custody guidelines, implementation challenges persist for both custodians and investment advisers.

Technical Integration Complexities

State-chartered trust companies must develop sophisticated technical capabilities while maintaining regulatory compliance:

Legacy System Integration: Connecting traditional custody infrastructure with blockchain-based asset management systems requires extensive technical development and testing.

Multi-Blockchain Support: Custodians must support various blockchain protocols, each with unique technical requirements and security considerations.

Transaction Processing: Balancing speed and security in cryptocurrency transactions while maintaining audit trails and compliance documentation.

Reporting Systems: Developing valuation methodologies and reporting capabilities for assets trading on fragmented, global markets 24/7.

Regulatory Examination Preparedness

Institutions following SEC crypto custody guidelines must prepare for enhanced regulatory scrutiny:

- Documentation standards: Maintaining comprehensive records of all custody operations, security measures, and client interactions

- Internal controls testing: Regular assessment of control effectiveness and remediation of identified weaknesses

- Examination readiness: Ability to quickly produce requested documentation and explain custody operations to regulators

- Surprise examination facilitation: Processes enabling independent verification of client crypto holdings

Industry Collaboration and Standards Development

The cryptocurrency custody industry is developing collaborative standards to support the SEC crypto custody guidelines implementation:

Industry Working Groups: Organizations like the Digital Asset Custody Association are developing best practices and technical standards.

Professional Certifications: Emerging credentials for cryptocurrency custody professionals demonstrating expertise and competence.

Insurance Market Development: Specialized insurers creating coverage products addressing unique digital asset risks.

Audit Methodology Evolution: Accounting firms are developing procedures for verifying cryptocurrency holdings and custodian controls.

Client Benefits from SEC Crypto Custody Guidelines

Individual investors and institutional clients gain significant advantages from the SEC crypto custody guidelines:

Enhanced Asset Protection

The custody framework provides multiple layers of protection:

Segregated Holdings: Client cryptocurrencies held separately from custodian assets, protecting against custodian insolvency.

Bankruptcy Protections: In custodian bankruptcy scenarios, client assets typically receive priority treatment and can be returned rapidly.

Regulatory Oversight: Regular examinations by state banking regulators and SEC oversight ensure operational integrity.

Insurance Coverage: Custodian insurance policies providing additional loss protection beyond operational safeguards.

Professional Investment Management

The SEC crypto custody guidelines enable clients to:

- Access expert guidance: Work with professional financial advisers, incorporating cryptocurrencies into comprehensive financial plans

- Maintain portfolio oversight: Receive regular reporting and performance monitoring of cryptocurrency holdings

- Benefit from rebalancing: Systematic portfolio management maintains target allocations across asset classes

- Simplify tax reporting: Consolidated statements and tax documentation, reducing compliance burdens

Reduced Operational Burdens

Self-custody of cryptocurrencies involves significant responsibilities and risks. Professional custody under SEC crypto custody guidelines eliminates:

Technical Complexity: No need to manage private keys, wallet software, or blockchain technical details.

Security Concerns: Professional-grade security measures protecting assets from hacking, phishing, and theft.

Inheritance Planning: Simplified estate planning without complex cryptocurrency key transfer protocols.

Operational Mistakes: Reduced risk of irreversible errors like sending assets to incorrect addresses.

Global Context: How US SEC Crypto Custody Guidelines Compare

The SEC crypto custody guidelines exist within a global regulatory landscape with varying approaches to cryptocurrency custody.

European Union’s MiCA Framework

The EU’s Markets in Crypto-Assets Regulation (MiCA) establishes comprehensive custody requirements:

- Crypto Asset Service Providers (CASPs): Licensed entities providing custody services with capital and organizational requirements

- Investor protection standards: Segregation requirements and safeguarding rules for client assets

- Passporting rights: Authorized CASPs can operate across EU member states

- Operational resilience: Business continuity and disaster recovery requirements

The SEC crypto custody guidelines take a more incremental approach, leveraging existing qualified custodian frameworks rather than creating entirely new licensing regimes.

Asia-Pacific Regulatory Approaches

Different jurisdictions in the Asia-Pacific have adopted varied custody frameworks:

Singapore: Comprehensive licensing for Digital Payment Token services, including custody, with capital requirements and cybersecurity standards.

Hong Kong: Virtual Asset Service Provider licensing with custody authorization requiring security, insurance, and segregation measures.

Japan: Crypto Asset Exchange Service Provider registration, including custody services with stringent security and financial requirements.

The SEC crypto custody guidelines align with global trends toward institutional-grade custody standards while maintaining US-specific regulatory structures.

Future Developments and What to Watch

Several developments may influence the evolution of SEC crypto custody guidelines:

Regulatory Rulemaking Initiatives

The SEC may formalize current guidance through official rulemaking:

Formal Custody Rule Amendments: Explicit incorporation of cryptocurrency custody standards into Investment Advisers Act regulations.

Qualification Standards: Detailed criteria for custodian approval, including technical, operational, and financial requirements.

Examination Priorities: Published guidance on examination focus areas for advisers and custodians handling digital assets.

Technology Evolution Impact

Emerging technologies may necessitate SEC crypto custody guidelines updates:

Tokenized Securities: Traditional securities issued on blockchains create hybrid custody considerations.

Central Bank Digital Currencies (CBDCs): Government-issued digital currencies potentially requiring different custody treatments.

Quantum-Resistant Cryptography: Future security standards addressing quantum computing threats to current blockchain encryption.

Market Maturation Indicators

The cryptocurrency market’s continued evolution will influence regulatory approaches:

- Institutional adoption rates: Increasing mainstream financial institution participation may accelerate regulatory normalization

- Market infrastructure development: Enhanced trading venues, clearing systems, and pricing mechanisms supporting traditional custody models

- Asset diversification: Expanding beyond Bitcoin and Ethereum to specialized digital assets requiring tailored custody solutions

- Integration with traditional finance: Cryptocurrency features incorporated into conventional financial products and services

Practical Steps for Advisers and Clients

Investment advisers and clients can take specific actions to navigate the SEC crypto custody guidelines:

For Registered Investment Advisers

Immediate Actions:

- Review current compliance programs and policies to incorporate cryptocurrency custody considerations

- Research qualified state-chartered trust companies offering cryptocurrency custody services

- Evaluate client demand and suitability for cryptocurrency investment offerings

- Consult legal counsel regarding specific implementation requirements and obligations

- Develop client disclosure documents explaining cryptocurrency custody arrangements

Medium-Term Planning:

- Establish relationships with qualified cryptocurrency custodians meeting SEC crypto custody guidelines

- Implement staff training on cryptocurrency fundamentals, custody operations, and regulatory requirements

- Create investment policies addressing cryptocurrency selection, allocation, and risk management

- Develop reporting and valuation methodologies for cryptocurrency holdings

- Build examination preparedness for regulatory reviews of cryptocurrency custody practices

For Investors and Clients

Due Diligence Questions:

- Does your investment adviser use custodians that are compliant with SEC crypto custody guidelines?

- What specific state-chartered trust company holds your cryptocurrency assets?

- What insurance coverage protects your cryptocurrency holdings?

- How are your cryptocurrency assets segregated from the custodian’s own holdings?

- What security measures protect your digital assets from theft or loss?

- How frequently are cryptocurrency holdings verified through independent examinations?

Risk Considerations:

- Understand that cryptocurrency investments carry significant volatility and risk of loss.

- Recognize that FDIC insurance does not cover cryptocurrency holdings

- Consider your overall portfolio allocation to high-risk digital assets

- Evaluate your time horizon and liquidity needs before investing in cryptocurrencies

- Assess your adviser’s expertise and experience with cryptocurrency investments

Conclusion

The Securities and Exchange Commission’s authorization for advisers to use qualified state-chartered trust companies as custodians for cryptocurrencies represents a significant milestone in digital asset regulation. These SEC crypto custody guidelines provide much-needed clarity for financial professionals seeking to offer cryptocurrency services while maintaining regulatory compliance and investor protections.

However, the temporary nature of these guidelines reminds us that cryptocurrency regulation remains a work in progress. Investment advisers, custodians, and investors must stay informed about regulatory developments and be prepared to adapt as frameworks evolve.

Read more: Kraken Makes Advanced Crypto Trading Simple for Regular Investors.