New cryptocurrency surpasses the impressive $17.8 million funding threshold and captures the attention of retail and institutional investors worldwide. This remarkable achievement demonstrates the growing appetite for innovative blockchain projects and alternative investment opportunities in the digital asset space.

As traditional financial markets face uncertainty, investors are increasingly turning to emerging cryptocurrencies that promise substantial returns during their presale phases. The new crypto coin surpasses expectations by delivering compelling tokenomics, real-world utility, and a strong community-driven approach, setting it apart from countless other projects competing for investor attention in today’s saturated marketplace.

Why This New Crypto Coin Surpasses Market Expectations

The cryptocurrency landscape has evolved dramatically over the past decade, with thousands of digital assets vying for investor capital and market dominance. However, when a new cryptocurrency surpasses significant funding milestones, such as $17.8 million in its early stages, it signals a fundamentally different value proposition and market appeal.

Revolutionary Tokenomics Driving Investment Interest

One of the primary reasons this new cryptocurrency surpasses comparable projects is its innovative tokenomics. The development team has carefully engineered a token distribution model that balances early investor rewards with long-term sustainability. Unlike many cryptocurrency projects that allocate disproportionate percentages to team members and early insiders, this project demonstrates transparency and fairness in its allocation strategy.

The crypto coin features deflationary mechanisms, staking rewards, and liquidity provisions that create multiple value accrual pathways for holders. These economic incentives encourage long-term holding rather than speculative trading, which contributes to price stability and sustained growth potential. Investors recognise that projects with sound tokenomics typically outperform those with poorly designed economic models.

Solving Real-World Problems With Blockchain Technology

What truly sets this project apart is its commitment to addressing genuine market inefficiencies through blockchain innovation. The new crypto coin surpasses mere speculation by providing tangible utility within its ecosystem. The platform focuses on solving specific pain points in decentralised finance, cross-border payments, or other verticals that experience significant friction under current systems.

By delivering practical applications rather than vague promises, the project attracts investors who seek meaningful exposure to cryptocurrency beyond pure price speculation. This utility-driven approach creates intrinsic value that supports long-term price appreciation and ecosystem development.

Market Analysis: How the New Crypto Coin Surpasses Competitors

The cryptocurrency landscape remains intensely crowded, with new projects launching weekly across various blockchain networks. Understanding how this particular new cryptocurrency surpasses its competitors requires examining several critical differentiators that have resonated with the investment community.

Superior Technology Infrastructure and Scalability

Technical excellence forms the foundation of any successful blockchain project. This crypto coin leverages cutting-edge consensus mechanisms, layer-2 scaling solutions, or innovative architectural approaches that address the scalability trilemma—balancing decentralisation, security, and throughput.

The development team comprises experienced blockchain engineers and cryptography experts who have previously contributed to established protocols. Their technical expertise instils confidence among investors who recognise that solid engineering practices are essential to long-term viability. The project’s testnet performance demonstrates transaction speeds and cost efficiency that rival or exceed industry leaders.

Strategic Partnerships and Ecosystem Development

Another factor explaining why this new cryptocurrency has surpassed $17.8 million in early funding is its strategic partnership announcements. The project has secured collaborations with established blockchain platforms, payment processors, enterprise technology companies, and financial institutions, providing immediate credibility and market access.

These partnerships aren’t superficial marketing arrangements but represent genuine integrations that expand the token’s utility and adoption potential. When investors see that reputable organisations are willing to associate their brands with a new project, it significantly reduces perceived risk and validates the team’s vision.

Community Engagement and Marketing Momentum

The cryptocurrency sector thrives on community enthusiasm and grassroots marketing. This crypto coin has cultivated an exceptionally engaged community across social media platforms, forums, and messaging applications. The project’s marketing strategy balances professional campaigns with authentic community building, creating organic momentum that drives awareness and investment.

Community members actively participate in governance proposals, content creation, and ecosystem development initiatives. This level of engagement indicates genuine belief in the project’s long-term potential rather than mercenary interest in quick profits. Strong communities provide resilience during market downturns and accelerate growth during bullish periods.

Investment Opportunities: Why Investors Choose This Crypto Coin

Understanding investor motivations provides crucial insights into why this new cryptocurrency surpasses funding expectations while many other projects struggle to gain traction. Several compelling factors drive capital allocation decisions in the current market environment.

Early-Stage Entry Points and Potential Returns

Savvy cryptocurrency investors recognise that the most substantial returns typically accrue to those who identify promising projects during presale or early launch phases. By the time a crypto coin lists on major exchanges, much of the early appreciation has already occurred, leaving late entrants with diminished profit potential.

This project offers investors favourable entry pricing through its presale structure, with tiered bonuses that reward early commitment. Historical analysis of successful cryptocurrency projects shows that early participants often realise returns of hundreds or thousands of percentage points. While past performance never guarantees future results, the pattern of outsized returns for early believers remains consistent across successful projects.

Diversification Strategy for Cryptocurrency Portfolios

Professional investors and retail participants alike understand the importance of portfolio diversification within the cryptocurrency asset class. While established coins like Bitcoin and Ethereum provide stability and liquidity, emerging projects offer asymmetric return profiles that can dramatically enhance overall portfolio performance.

This new cryptocurrency surpasses traditional diversification options by occupying a unique niche within the broader cryptocurrency ecosystem. Its specific use case, technological approach, or market positioning provides exposure that isn’t perfectly correlated with major cryptocurrencies, thereby reducing overall portfolio volatility while maintaining upside potential.

Favourable Risk-Reward Ratio Compared to Alternatives

Risk assessment forms a critical component of any investment decision, particularly in the volatile cryptocurrency markets. Investors gravitate toward this project because the new cryptocurrency surpasses many alternatives in terms of risk-adjusted return potential.

The project’s transparent roadmap, experienced team, working product demonstrations, and audited smart contracts reduce technical and execution risks that plague many cryptocurrency launches. While all cryptocurrency investments carry substantial risk, diligent investors distinguish between calculated risks with asymmetric upside and reckless speculation on fundamentally flawed projects.

Technical Analysis and Price Predictions

As this new cryptocurrency surpasses key funding milestones, analysts and investors naturally turn their attention to price projections and technical indicators that might signal its future trajectory.

Presale Performance Metrics and Momentum Indicators

The pace at which this cryptocurrency accumulated $17.8 million in funding provides necessary momentum signals. Projects that rapidly achieve funding targets typically continue that momentum post-launch, as strong presale performance generates media coverage, social proof, and FOMO (fear of missing out) among investors who missed early opportunities.

Tracking daily funding velocity, wallet address growth, and social media engagement metrics offers quantitative evidence of building momentum. These indicators suggest that demand for the token significantly exceeds current supply, creating favourable conditions for price appreciation upon broader market access.

Comparable Project Analysis and Valuation Frameworks

Cryptocurrency valuation remains more art than science, but comparing this project against similar tokens that have completed their launch cycles provides valid reference points. When a new crypto coin surpasses significant presale milestones, analysts examine the market capitalisations, tokensupply,y and utility metrics of comparable projects to establish reasonable valuation ranges.

Based on these comparisons, many analysts project that this cryptocurrency could achieve a market capitalisation of $100 million to $500 million within its first year post-launch, depending on overall market conditions and execution against the roadmap objectives. These projections translate to potential multiples of 5x to 30x for early presale participants.

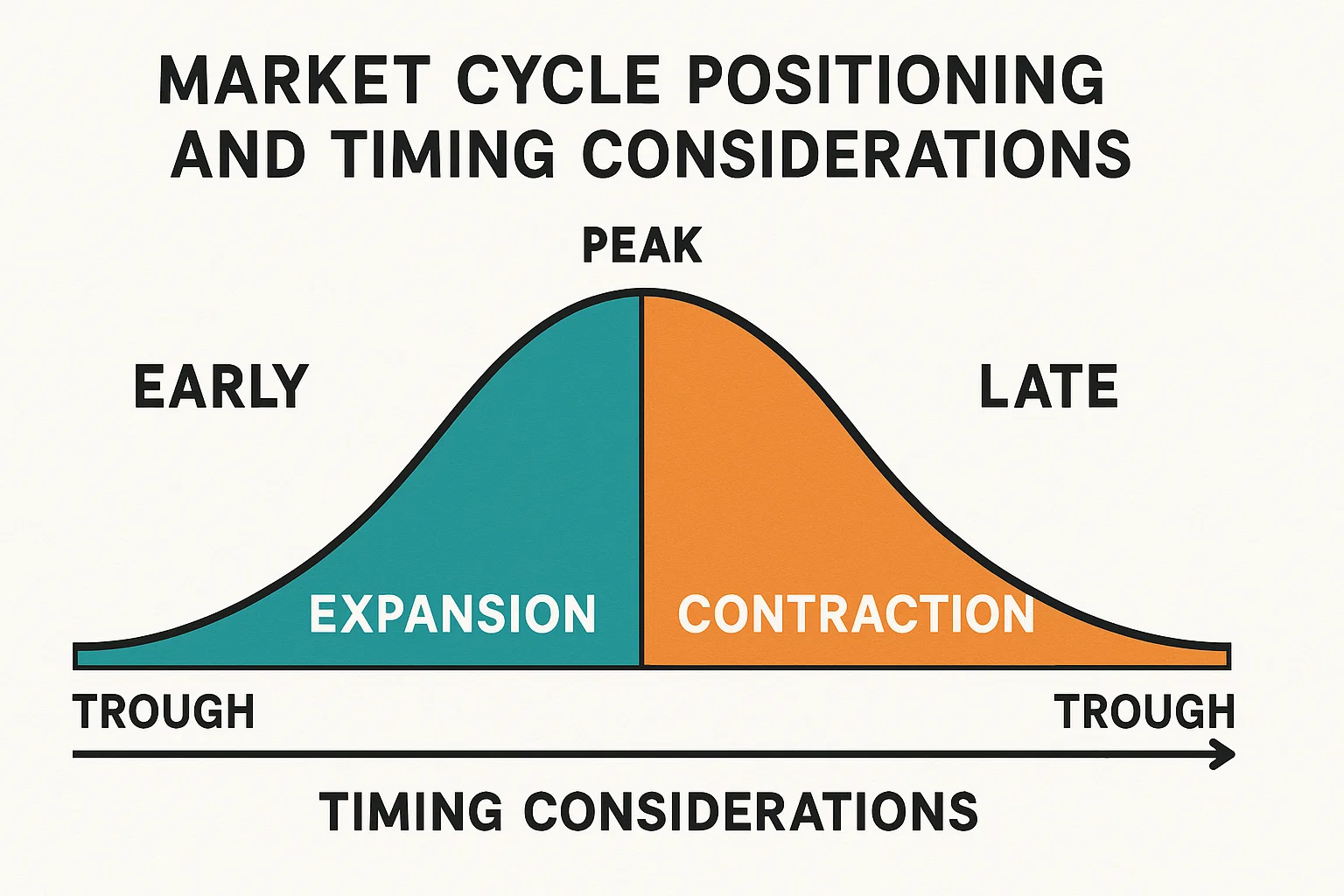

Market Cycle Positioning and Timing Considerations

Timing significantly influences cryptocurrency investment outcomes. This project’s presale phase coincides with improving macroeconomic conditions, increasing institutional adoption of digital assets, and growing retail interest in alternative investments. The new cryptocurrency surpasses many competitors simply by launching during a favourable market window.

Cryptocurrency markets operate in cyclical patterns, with periods of explosive growth followed by consolidation phases. Investors who position themselves in promising projects before broader market rallies often realise the most significant gains. Current market indicators suggest an emerging bullish cycle that could provide significant tailwinds for new project launches.

Risk Factors and Investment Considerations

While the fact that this new cryptocurrency surpasses $17.8 million in funding demonstrates strong market interest, responsible investors must carefully consider potential risks before allocating capital to any cryptocurrency project.

Regulatory Uncertainty in Cryptocurrency Markets

The regulatory landscape for digital assets continues evolving globally, with different jurisdictions adopting varying approaches to cryptocurrency oversight. Projects must navigate complex legal frameworks regarding securities classifications, taxation, anti-money laundering compliance, and consumer protection.

This crypto coin addresses regulatory concerns through legal compliance measures, transparent operations, and proactive engagement with regulatory authorities where appropriate. However, investors must recognise that regulatory changes could impact the project’s operations, token utility, or market access in certain jurisdictions.

Technology Risks and Smart Contract Vulnerabilities

Blockchain projects inherently entail technical risks, including smart contract bugs, protocol vulnerabilities, and unforeseen edge cases that could compromise security or functionality. Even thoroughly audited code occasionally contains exploitable weaknesses that malicious actors may discover.

The development team mitigates these risks through multiple independent security audits, bug bounty programs, and phased rollout strategies that limit exposure during initial deployment. Nevertheless, investors should allocate only capital they can afford to lose recognising thatt technicalfailuress are realrisks inn emerging technology sectors.

Market Volatility and Liquidity Concerns

Cryptocurrency markets exhibit extreme volatility, with double-digit percentage price swings occurring regularly even for established assets. New projects with smaller market capitalisations often experience even greater volatility, creating both opportunities and risks for investors.

After this new crypto coin surpasses its presale phase and begins trading on exchanges, initial price discovery may involve significant volatility as market participants establish equilibrium pricing. Patient investors who maintain long-term perspectives typically navigate this volatility more successfully than those seeking immediate returns.

How to Participate in the Presale Opportunity

For investors interested in capitalising on the momentum as this new crypto coin surpasses funding milestones, understanding the participation process ensures a smooth onboarding experience and optimal position sizing.

Step-by-Step Presale Participation Guide

Participating in cryptocurrency presales requires basic technical competence and appropriate wallet infrastructure. Investors typically need a compatible Web3 wallet, such as MetaMask, Trust Wallet, or a WalletConnect-enabled alternative, that supports the blockchain network hosting the presale.

The process generally involves visiting the official project website, connecting the wallet, selecting the desired purchase amount, and completing the transaction using accepted cryptocurrencies like Ethereum, BNB, or stablecoins. Crypto coin tokens are typically distributed either immediately or upon the conclusion of the presale, depending on the project’s structure.

Security Best Practices for Cryptocurrency Investments

Security represents paramount importance when participating in cryptocurrency presales. Investors must verify they’re accessing the legitimate project website rather than phishing sites that mimic authentic platforms to steal funds. Official communication channels, including verified social media accounts, provide authoritative links.

Using hardware wallets for significant cryptocurrency holdings, enabling two-factor authentication, and never sharing private keys or seed phrases protects against the most common attack vectors. As this new cryptocurrency surpasses visibility thresholds, scammers inevitably create fraudulent versions attempting to exploit investor enthusiasm.

Future Roadmap and Development Milestones

The trajectory of any cryptocurrency depends significantly on the team’s ability to execute against stated objectives and deliver progressive improvements to the ecosystem. This project’s roadmap outlines ambitious yet achievable milestones that serve as markers for progress.

Short-Term Development Priorities (0-6 Months)

Immediate post-presale priorities focus on exchange listings, liquidity provision, and initial platform feature launches. The team plans to secure listings on decentralised exchanges immediately upon the conclusion of the presale, followed by tier-2 centralised exchange partnerships to provide broader accessibility.

Platform features scheduled for initial release include core utility functions that demonstrate the token’s practical applications. These early deliverables establish credibility and provide tangible value to holders beyond speculative price appreciation. As the new crypto coin surpasses early-adopter thresholds, network effects begin to amplify utility and demand.

Medium-Term Ecosystem Expansion (6-18 Months)

Medium-term development emphasises ecosystem expansion, strategic partnerships, and enhanced platform capabilities. The roadmap includes additional exchange listings on tier-1 platforms, integration with major DeFi protocols, and feature enhancements based on community feedback.

This phase also involves expanding the team, securing additional funding through strategic investment rounds if necessary, and establishing partnerships that drive real-world adoption. The crypto coin transitions from a purely speculative asset to a functional ecosystem component as these integrations materialise.

Long-Term Vision and Sustainability (18+ Months)

Long-term vision encompasses ambitious objectives, including mainstream adoption, cross-chain interoperability, enterprise partnerships, and the potential launch of complementary products or services that expand the ecosystem’s value proposition.

Sustainable projects distinguish themselves through continuous innovation rather than resting on initial success. The team’s commitment to ongoing development, community governance implementation, and adaptive strategy ensures the crypto coin remains competitive as the broader cryptocurrency landscape evolves.

Community Testimonials and Investor Sentiment

The fact that this new cryptocurrency surpasses $17.8 million in funding reflects strong investor sentiment and community enthusiasm. Understanding what attracts participants provides insights into the project’s appeal.

Early Investor Perspectives and Motivations

Early investors consistently cite the project’s transparent communication, strong fundamentals, and experienced team as primary factors influencing their participation decisions—many express appreciation for the detailed technical documentation and regular development updates that demonstrate accountability.

Community members frequently highlight the token’s practical utility and clear use case as distinguishing factors compared to purely speculative projects. This focus on fundamentals rather than hype attracts more sophisticated investors seeking sustainable long-term holdings rather than pump-and-dump opportunities.

Social Media Buzz and Organic Growth Signals

Social media analytics reveal an exponentially growing interest across platforms such as Twitter, Telegram, Reddit, and Discord. The crypto coin generates organic discussion and content creation without relying exclusively on paid marketing—a positive indicator of genuine community interest.

Hashtag tracking, mention frequency, and sentiment analysis all demonstrate increasingly positive sentiment trajectories. This organic growth provides more sustainable momentum than artificial hype campaigns that characterise many failed projects.

Comparing This Project to Recent Successful Launches

Context for understanding how this new cryptocurrency surpasses expectations comes from examining recent successful cryptocurrency launches and identifying common success patterns.

Success Factors from Top-Performing Presales

Analysis of top-performing cryptocurrency presales from recent years reveals consistent patterns, including strong technical foundations, clear utility propositions, experienced teams, active communities, and favourable market timing. This project exhibits all these characteristics.

Successful projects also demonstrate transparent communication, realistic roadmaps, and appropriate tokenomics that balance various stakeholder interests. The crypto code draws lessons from both successful projects and cautionary tales of failed launches, positioning itself favourably in a historical context.

Differentiation Strategies in a Crowded Market

Standing out in today’s crowded cryptocurrency market requires genuine innovation rather than minor iterations on existing concepts. This project differentiates through its specific technological approach, target market focus, or unique value proposition that addresses underserved needs.

The new crypto coin surpasses mere imitation by offering distinctive features that create defensible competitive advantages. These differentiators provide reasons for adoption beyond mere speculative interest, establishing a foundation for sustained relevance.

Expert Opinions and Analyst Coverage

As this new cryptocurrency surpasses funding milestones, it increasingly attracts attention from cryptocurrency analysts, influencers, and industry commentators who shape market narratives.

Cryptocurrency Analyst Perspectives

Independent cryptocurrency analysts who have examined the project generally express cautiously optimistic outlooks based on fundamental analysis. Many highlight the strong tokenomics, practical utility, and experienced team as positive factors supporting long-term viability.

Analysts typically recommend that investors conduct thorough due diligence, understand the risks, and allocate only appropriate portfolio percentages to any single cryptocurrency investment, including this coin. Their coverage provides valuable third-party validation, enhancing project credibility.

Influencer Commentary and Social Proof

Cryptocurrency influencers with substantial followings have begun discussing the project across various platforms. While influencer endorsements should never constitute the sole investment rationale, they significantly amplify awareness and help build social proof.

Discerning investors verify that influencer commentary discloses any compensation relationships and represents genuine analysis rather than paid promotion. Authentic influencer interest as this new crypto coin surpasses visibility thresholds indicates organic momentum rather than artificial hype.

Tax Implications and Legal Considerations

Cryptocurrency investors must understand tax obligations and legal considerations associated with participating in presales and holding digital assets.

Cryptocurrency Taxation Fundamentals

Most jurisdictions classify cryptocurrency as property for tax purposes, meaning transactions trigger capital gains or losses. Purchasing tokens during the presale establishes a cost basis, with subsequent sales creating taxable events based on the difference between the sale price and purchase price.

The crypto coin itself doesn’t create tax implications merely from holding. Still, investors should maintain detailed records of all transactions,, including purchase dates, amounts, and prices,, to facilitate accurate tax reporting. Consulting qualified tax professionals ensures compliance with jurisdiction-specific requirements.

Regulatory Compliance for International Investors

Cryptocurrency regulations vary significantly across jurisdictions, with some countries embracing digital assets while others impose restrictions or outright bans. Investors must understand their local legal framework and ensure their participation complies with applicable regulations.

The project implements KYC (Know Your Customer) procedures where legally required and restricts participation from jurisdictions where offering the crypto coin would violate local regulations. These compliance measures protect both the project and participants from legal complications.

Conclusion

The remarkable achievement of this new cryptocurrency, surpassing $17.8 million in funding during its presale phase, demonstrates robust market validation and investor confidence. This milestone reflects the project’s strong fundamentals, including innovative tokenomics, practical utility, experienced leadership, and an engaged community that distinguish it from countless competitors.

For investors seeking exposure to promising early-stage cryptocurrency opportunities, this coin presents a compelling risk-reward profile. The combination of favourable entry pricing, clear development roadmap, strategic partnerships, and strong momentum creates conditions historically associated with substantial returns for early participants.

Read more: Cryptocurrency Tax Enforcement Ramps Up: What Traders Must Know.