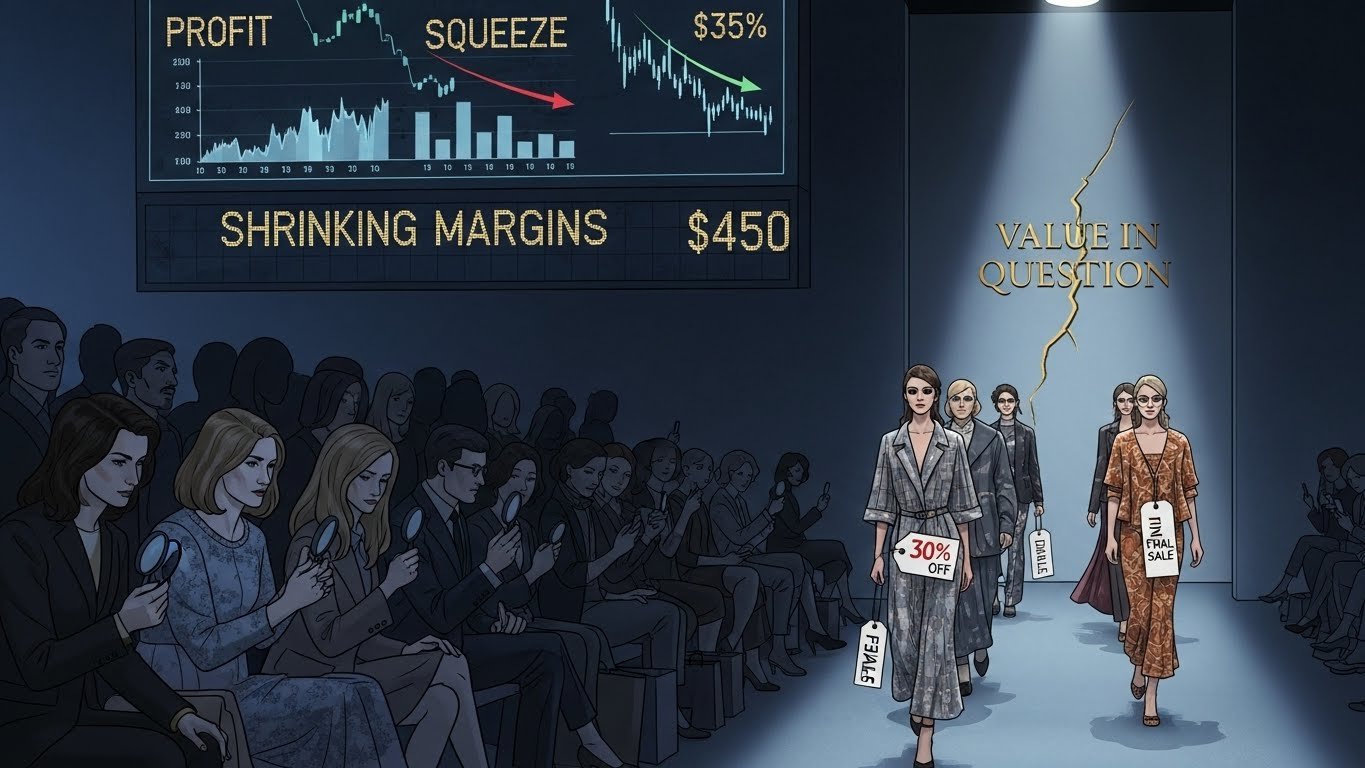

Luxury brands face profit squeeze as discounting soars and shoppers question value more openly than at any time in recent decades. Once defined by exclusivity, craftsmanship, and pricing power, the global luxury industry is now navigating a far more complex reality. Rising inflation, slower economic growth, shifting consumer psychology, and digital transparency have combined to challenge the traditional luxury business model. What was once a sector insulated from price sensitivity is now experiencing margin pressure as brands turn to discounts to maintain sales volumes, even at the risk of diluting brand equity.

The phrase luxury brands face profit squeeze as discounting soars and shoppers question value captures a structural shift rather than a temporary downturn. High-end consumers are no longer immune to macroeconomic stress, while aspirational buyers are reassessing whether premium prices truly reflect lasting value. As a result, luxury houses are forced to balance short-term revenue needs against long-term brand prestige, a delicate equation that is becoming increasingly difficult to solve.

Why luxury brands face profit squeeze as discounting soars and shoppers question value, how consumer behavior is evolving, and what this means for the future of the luxury industry. By examining pricing strategies, margin pressures, brand perception, and strategic responses, we gain a clearer picture of an industry at a critical crossroads.

The changing economics of the global luxury market

Slowing demand in key luxury regions

Luxury brands face profit squeeze as discounting soars and shoppers question value partly because demand growth has slowed across major markets. For years, strong consumption from China, the United States, and Europe supported consistent price increases. However, economic uncertainty, geopolitical tensions, and uneven post-pandemic recovery have weakened consumer confidence. Even high-net-worth individuals are becoming more selective, prioritizing experiences, investments, or savings over discretionary luxury purchases.

In emerging markets, currency volatility and rising living costs further reduce the appetite for premium goods. As luxury brands rely heavily on global tourism and cross-border spending, reduced international travel and cautious consumer sentiment amplify revenue challenges. This environment limits the ability of brands to push prices higher without facing resistance.

Rising costs and margin pressure

Another reason luxury brands face profit squeeze as discounting soars and shoppers question value lies in rising operational costs. Raw materials, skilled labor, logistics, and energy expenses have all increased. Luxury products are often handmade or produced in small batches, making cost absorption more difficult. When brands discount to stimulate demand, these higher input costs directly erode profit margins.

Historically, luxury houses relied on high gross margins to offset volatility. Today, that buffer is shrinking. Discounting compresses margins while fixed costs remain high, leaving brands with less financial flexibility. This creates a cycle where discounting becomes both a symptom and a cause of profitability challenges.

Discounting trends reshape luxury pricing power

The normalization of luxury discounts

Luxury brands face profit squeeze as discounting soars and shoppers question value because discounts are no longer rare exceptions. Seasonal sales, outlet stores, and online promotions have become common even among prestigious labels. While discounting was once limited to discreet channels, digital platforms now make price reductions highly visible, altering consumer expectations.

When shoppers know that luxury goods may be discounted, they delay purchases, waiting for better deals. This behavior undermines full-price sales and weakens pricing power. Over time, frequent discounting trains consumers to question whether luxury prices are justified or artificially inflated.

Digital transparency and resale markets

The rise of e-commerce and secondary resale platforms intensifies the problem. Luxury brands face profit squeeze as discounting soars and shoppers question value because consumers can easily compare prices across regions and platforms. Pre-owned luxury marketplaces also reveal how quickly products lose value, challenging the perception of luxury as a long-term investment.

This transparency shifts bargaining power toward consumers. When buyers see similar products available at lower prices, either new or pre-owned, they become less willing to pay full retail. As a result, luxury brands struggle to maintain consistent pricing strategies across channels.

Shoppers question value in a new consumer mindset

From status symbols to meaningful purchases

Luxury brands face profit squeeze as discounting soars and shoppers question value due to a profound shift in consumer psychology. Modern luxury consumers increasingly prioritize authenticity, sustainability, and emotional connection over overt status signaling. Younger generations, in particular, are less impressed by logos and more interested in craftsmanship, heritage, and ethical practices.

When these expectations are not met, premium prices feel harder to justify. Shoppers ask whether a luxury item delivers lasting quality or merely reflects branding and marketing costs. This scrutiny pushes brands to articulate clearer value propositions beyond exclusivity alone.

Inflation and everyday affordability pressures

Even affluent consumers are not immune to inflationary pressures. Luxury brands face profit squeeze as discounting soars and shoppers question value because rising costs of housing, healthcare, and education affect spending priorities. Discretionary purchases, including luxury goods, face closer evaluation.

As shoppers become more price-conscious, they seek reassurance that luxury products offer durability, resale value, or timeless design. Without this assurance, discounts become the primary incentive, reinforcing a cycle of reduced margins.

Brand equity at risk amid aggressive promotions

The long-term cost of short-term sales

Luxury brands face profit squeeze as discounting soars and shoppers question value, but the deeper risk lies in brand equity erosion. Excessive promotions can undermine the sense of rarity and prestige that defines luxury. Once consumers associate a brand with frequent discounts, restoring premium positioning becomes extremely challenging.

Brand equity is built over decades but can weaken quickly when pricing strategies appear inconsistent. Luxury houses that rely too heavily on discounting risk becoming perceived as premium rather than truly luxury, narrowing their competitive differentiation.

Managing exclusivity in a mass-market world

The expansion of luxury brands into broader markets has increased visibility but also vulnerability. Luxury brands face profit squeeze as discounting soars and shoppers question value because broader distribution exposes them to mass-market dynamics. Maintaining exclusivity while reaching new audiences requires careful control over supply, storytelling, and customer experience. When exclusivity erodes, price becomes the main differentiator. This shift forces brands into competition based on discounts rather than desirability, further compressing margins.

Strategic responses to the profit squeeze

Reframing value through craftsmanship and heritage

To address the reality that luxury brands face profit squeeze as discounting soars and shoppers question value, many brands are refocusing on storytelling. Emphasizing craftsmanship, heritage, and artisanal production helps justify premium pricing. By highlighting the human skill and cultural legacy behind products, brands can reconnect prices with perceived value.

This approach requires authenticity. Consumers quickly detect superficial narratives, making genuine investment in quality and transparency essential. Brands that successfully communicate their unique identity can reduce reliance on discounting.

Product innovation and category diversification

Luxury brands face profit squeeze as discounting soars and shoppers question value, prompting exploration of new product categories. Beauty, accessories, and entry-level items offer higher margins and broader appeal. These products allow brands to attract new customers without heavy discounting on core items. At the same time, innovation in materials, design, and functionality adds tangible value. Limited editions and bespoke offerings reinforce exclusivity while supporting higher price points.

Controlled pricing and supply discipline

Another response to the fact that luxury brands face profit squeeze as discounting soars and shoppers question value is tighter control over supply. Limiting production reduces the need for markdowns and preserves scarcity. While this may constrain short-term revenue, it supports long-term brand health. Some brands are also reassessing global pricing structures to minimize arbitrage and maintain consistency. A disciplined approach to pricing reinforces trust and reduces consumer skepticism.

The role of emerging markets and cultural shifts

New growth opportunities with cautious optimism

Luxury brands face profit squeeze as discounting soars and shoppers question value, yet emerging markets still offer growth potential. However, these markets are increasingly sophisticated. Consumers demand relevance to local culture and values, not just imported prestige. Adapting to regional preferences while maintaining global brand identity is critical. Success depends on understanding nuanced consumer motivations rather than relying solely on aspirational pricing.

Sustainability and ethical expectations

Sustainability is no longer optional. Luxury brands face profit squeeze as discounting soars and shoppers question value when ethical practices are unclear. Responsible sourcing, environmental stewardship, and fair labor practices contribute to perceived value, especially among younger consumers. Brands that align luxury with responsibility can strengthen loyalty and justify premium pricing without excessive discounting.

Conclusion

Luxury brands face profit squeeze as discounting soars and shoppers question value, signaling a transformative moment for the industry. The traditional model of continuous price increases supported by strong brand prestige is under pressure from economic realities and evolving consumer expectations. Discounting may provide temporary relief, but it risks undermining long-term profitability and brand equity.

The path forward requires a renewed focus on authentic value creation. By investing in craftsmanship, storytelling, sustainability, and disciplined pricing strategies, luxury brands can rebuild trust and relevance. Those that successfully adapt will emerge stronger, while those that rely heavily on discounts may struggle to maintain their luxury status in an increasingly discerning global market.

FAQs

Q: Why do luxury brands face profit squeeze as discounting soars and shoppers question value?

Luxury brands face profit squeeze as discounting soars and shoppers question value because rising costs, slower demand growth, and increased price transparency reduce pricing power. As brands discount to sustain sales, margins shrink and consumers become more skeptical about the true worth of luxury pricing.

Q: How does discounting affect long-term luxury brand value?

Frequent discounting can weaken brand equity by reducing perceptions of exclusivity and prestige. When consumers expect discounts, they delay purchases and associate luxury with promotions rather than timeless value, making it harder for brands to sustain premium positioning.

Q: Are younger consumers changing the luxury market dynamics?

Yes, younger consumers significantly influence why luxury brands face profit squeeze as discounting soars and shoppers question value. They prioritize authenticity, sustainability, and emotional connection over status symbols, forcing brands to redefine what luxury means in a modern context.

Q: Can sustainability help luxury brands justify higher prices?

Sustainability can enhance perceived value when it is genuine and transparent. Ethical sourcing, environmental responsibility, and social impact resonate with modern consumers, helping luxury brands justify premium prices without excessive discounting.

Q: What strategies can help luxury brands restore profitability?

Luxury brands can restore profitability by emphasizing craftsmanship and heritage, controlling supply, innovating in high-margin categories, and maintaining disciplined pricing. These strategies address the root causes of why luxury brands face profit squeeze as discounting soars and shoppers question value while protecting long-term brand strength.