The cryptocurrency market is abuzz with excitement as investors worldwide seek reliable Ethereum price prediction news today. With Ethereum trading at significant levels and institutional adoption reaching new heights, understanding the latest price forecasts has become crucial for both seasoned traders and newcomers to the digital asset space.

Today’s market analysis reveals compelling insights about Ethereum’s potential trajectory, driven by technological upgrades, regulatory developments, and increasing institutional interest. As we navigate 2025, the second-largest cryptocurrency by market capitalization continues to demonstrate remarkable resilience and growth potential, making Ethereum price prediction news one of the most sought-after topics in the crypto community today.

Current Ethereum Market Analysis

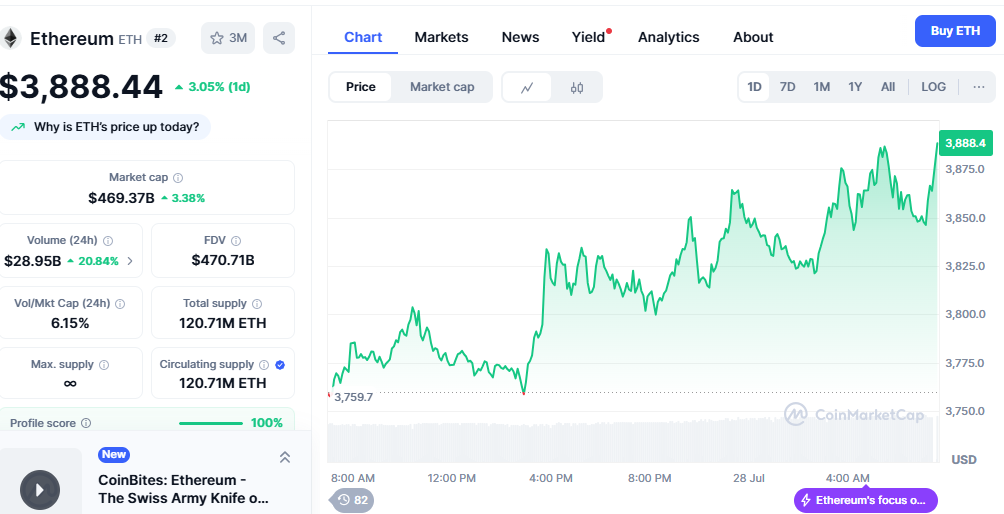

Real-Time Price Action and Market Sentiment

Ethereum’s current market performance reflects a complex interplay of technical indicators, fundamental developments, and broader market sentiment. Recent trading sessions have exhibited increased volatility, with institutional investors closely monitoring price movements to identify optimal entry points.

The cryptocurrency has demonstrated strong support levels around key technical benchmarks, while resistance zones continue to provide insights into potential breakout scenarios. Market makers and whale activity have significantly influenced short-term price movements, creating opportunities for both momentum and contrarian trading strategies.

Key Technical Indicators

Professional traders rely on multiple technical indicators to gauge the direction of Ethereum’s price. The Relative Strength Index (RSI) currently indicates whether the asset is overbought or oversold, while moving averages confirm the trend.

Bollinger Bands have shown expanding volatility patterns, suggesting potential significant price movements in the near term. Volume analysis reveals increasing participation from both retail and institutional investors, supporting the sustainability of current price levels.

Latest Ethereum Price Prediction News Today Expert Forecasts

Short-Term Price Projections (1-3 Months)

Leading cryptocurrency analysts have released their latest forecasts based on current market conditions and technical analysis. Several prominent firms project Ethereum could experience substantial price movements within the next quarter, driven by upcoming network upgrades and increased adoption.

The consensus among technical analysts suggests that Ethereum’s price could test higher resistance levels if current momentum continues. However, macroeconomic factors and regulatory developments remain crucial variables that could influence short-term price action.

Medium-Term Outlook (6-12 Months)

Industry experts are increasingly bullish on Ethereum’s medium-term prospects, citing the growing Layer 2 ecosystem and institutional adoption as primary catalysts. Major financial institutions have begun incorporating Ethereum into their digital asset strategies, providing fundamental support for higher valuations.

The implementation of ongoing network improvements continues to enhance Ethereum’s scalability and efficiency, addressing previous concerns about transaction costs and processing speeds. These technological advancements contribute to more optimistic price predictions from reputable analysts.

Long-Term Projections (1-5 Years)

Long-term Ethereum price predictions paint an auspicious picture for the leading innovative contract platform. Industry veterans project significant appreciation potential based on the expanding decentralized finance (DeFi) ecosystem and non-fungible token (NFT) markets.

The transition to the Proof-of-Stake consensus mechanism has reduced energy consumption while improving network security, attracting environmentally conscious institutional investors. These fundamental improvements support higher long-term valuation targets from major cryptocurrency research firms.

Factors Influencing Today’s Ethereum Price Predictions

Institutional Adoption and ETF Developments

The approval and growing success of Ethereum Exchange-Traded Funds (ETFs) have created new avenues for institutional investment. Major asset management companies have allocated billions of dollars to Ethereum-based investment products, providing sustained buying pressure.

Recent announcements from prominent financial institutions regarding Ethereum integration have boosted market confidence. These developments suggest continued institutional interest, which traditionally leads to price stability and long-term appreciation.

Network Upgrades and Technological Improvements

Ethereum’s ongoing development roadmap encompasses several significant upgrades designed to enhance scalability, security, and sustainability. The recent Pectra upgrade has introduced enhanced features that improve user experience and developer capabilities.

Layer 2 scaling solutions have gained significant traction, reducing transaction costs while maintaining security and stability. These technological improvements address previous scalability concerns and support higher network utilization, contributing to optimistic price predictions.

Regulatory Environment and Policy Changes

Global regulatory clarity continues to improve, with several major jurisdictions providing clearer frameworks for cryptocurrency operations. The United States and European Union have made significant progress in establishing comprehensive digital asset regulations.

Recent policy announcements from key regulatory bodies have reduced uncertainty around Ethereum’s legal status. This improved regulatory environment encourages institutional participation and supports more optimistic price forecasts.

Also Read: Ethereum Price Prediction Today Live Expert Analysis & 2025 Forecast

Market Trends Shaping Ethereum’s Future

DeFi Ecosystem Growth

The decentralized finance sector built on Ethereum continues expanding rapidly, with total value locked (TVL) reaching new milestones. Major DeFi protocols have demonstrated sustainable growth models, attracting both retail and institutional users.

Innovation in DeFi lending, borrowing, and yield farming continues driving demand for Ethereum. These applications require ETH for transaction fees and collateral, creating sustained demand pressure that supports higher price projections.

NFT Market Evolution

The non-fungible token market has matured significantly, with Ethereum remaining the dominant blockchain for high-value NFT transactions. Major brands and celebrities continue launching NFT projects on Ethereum, driving network utilization.

Utility-focused NFTs are gaining popularity, shifting from speculative trading to practical applications. This evolution suggests sustained demand for Ethereum’s NFT infrastructure, supporting long-term price appreciation.

Enterprise Blockchain Adoption

Fortune 500 companies are increasingly exploring Ethereum-based solutions for supply chain management, digital identity, and smart contracts. Enterprise adoption provides fundamental value beyond speculative trading activity.

Major consulting firms have developed Ethereum integration services for corporate clients, indicating growing business demand. This enterprise interest supports more conservative but sustainable price appreciation scenarios.

Expert Analysis What Drives Today’s Predictions

Technical Analysis Insights

Professional technical analysts utilize advanced charting techniques to identify potential price targets and support levels. Fibonacci retracements, Elliott Wave theory, and momentum indicators provide mathematical frameworks for price predictions.

Recent technical patterns indicate scenarios that could result in movements. However, technical analysis must be combined with fundamental analysis to achieve a comprehensive understanding of the market.

Fundamental Analysis Considerations

Ethereum’s fundamental value proposition continues strengthening through network effects, developer activity, and real-world utility. The platform’s dominance in smart contracts and decentralized applications provides sustainable competitive advantages.

Network metrics, including active addresses, transaction volume, and developer commits, indicate healthy ecosystem growth. These fundamental indicators support optimistic long-term price projections from industry analysts.

Macroeconomic Factors

Global monetary policy, inflation rates, and economic uncertainty influence the cryptocurrency market, including Ethereum. Central bank policies regarding digital currencies and traditional financial systems affect investor sentiment toward alternative assets.

Geopolitical events and economic crises often prompt investors to turn to digital assets as portfolio diversification tools. These macroeconomic trends contribute to institutional allocation decisions that impact Ethereum’s price trajectory.

Risk Factors and Market Considerations

Volatility and Market Risks

Cryptocurrency markets remain inherently volatile, with Ethereum experiencing significant price swings during both bull and bear market cycles. Investors must understand these risks when evaluating price predictions and investment strategies.

Leverage trading and derivatives markets can amplify price movements in both directions. Market manipulation by large holders and coordinated trading activities represent ongoing risks for individual investors.

Regulatory and Policy Risks

Despite improving regulatory clarity, potential policy changes could significantly impact Ethereum’s price trajectory. Government decisions regarding cryptocurrency taxation, trading restrictions, or technical requirements remain uncertain variables.

International coordination on cryptocurrency regulation could create new compliance requirements for Ethereum-based applications. These regulatory risks must be considered alongside technical and fundamental analysis.

Competition and Technology Risks

Alternative blockchain platforms continue developing competing solutions for smart contracts and decentralized applications. Ethereum must maintain technological leadership to preserve its market position and support price appreciation.

Technological failures, security vulnerabilities, or scalability limitations could negatively impact investor confidence. Ongoing development and security auditing remain crucial for maintaining market trust.

Investment Strategies Based on Current Predictions

Dollar-Cost Averaging Approach

Many financial advisors recommend dollar-cost averaging strategies for Ethereum investments, spreading purchases across multiple periods to reduce timing risk. This approach allows investors to benefit from price volatility while building long-term positions.

Systematic investment plans help investors avoid emotional decision-making during market volatility. Regular purchases, regardless of short-term price movements, can improve average entry prices over extended periods.

Portfolio Allocation Strategies

Professional portfolio managers suggest maintaining balanced cryptocurrency allocations within broader investment portfolios. Ethereum’s correlation with traditional assets varies over time, providing potential diversification benefits.

Risk management through position sizing and stop-loss strategies helps protect capital during adverse market conditions. Diversification across multiple cryptocurrencies and traditional assets reduces concentration risk.

Timing and Market Entry

While timing cryptocurrency markets perfectly is impossible, understanding market cycles and sentiment indicators can improve entry and exit decisions. Technical analysis combined with fundamental research provides frameworks for strategic positioning.

Market sentiment indicators, including fear and greed indices, help investors identify potential opportunities for contrarian investments. However, long-term investment approaches often outperform short-term trading strategies for most investors.

Future Outlook and Market Predictions

Short-Term Market Expectations

The immediate outlook for Ethereum remains influenced by broader cryptocurrency market trends, regulatory developments, and technical analysis indicators. Most analysts expect continued volatility with potential upward bias based on current fundamentals.

Network upgrade implementations and institutional adoption announcements could provide positive catalysts for near-term price movement. However, macroeconomic uncertainty and market sentiment remain essential variables.

Long-Term Growth Potential

Ethereum’s long-term prospects appear increasingly positive, driven by expanding use cases, technological advancements, and growing institutional adoption trends. The platform’s network effects and developer ecosystem provide sustainable competitive advantages.

Continued innovation in Layer 2 scaling, interoperability solutions, and enterprise applications supports optimistic long-term valuations. These developments suggest Ethereum could significantly outperform traditional investment alternatives over extended time horizons.

Conclusion

The latest Ethereum price prediction news today reveals a compelling investment landscape characterized by technological innovation, institutional adoption, and expanding real-world utility. While short-term volatility remains inevitable, the fundamental drivers supporting Ethereum’s long-term growth trajectory appear increasingly robust.

Investors seeking exposure to Ethereum should carefully consider current market conditions, understand the associated risks, and develop investment strategies aligned with their financial objectives. Staying informed about Ethereum price predictions today provides valuable insights for making informed investment decisions in this dynamic market.