The cryptocurrency market continues to evolve at breakneck speed, with Ethereum standing as the second-largest digital asset by market capitalization. As we navigate through 2025, investors and traders are increasingly seeking comprehensive Ethereum price prediction 2025 analysis to make informed decisions about their digital asset portfolios. This detailed analysis examines current market conditions, technical indicators, institutional adoption trends, and expert forecasts to provide you with the most accurate picture of Ethereum’s potential price trajectory.

Ethereum has demonstrated remarkable resilience throughout various market cycles, establishing itself as the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and innovative contract applications. With the successful transition to Ethereum 2.0 and the implementation of proof-of-stake consensus, the network has positioned itself for sustainable growth. Our Ethereum price prediction 2025 analysis incorporates multiple data points, including on-chain metrics, institutional investment flows, regulatory developments, and technological advancements that could significantly impact ETH’s valuation in the coming months.

Current Ethereum Market Overview

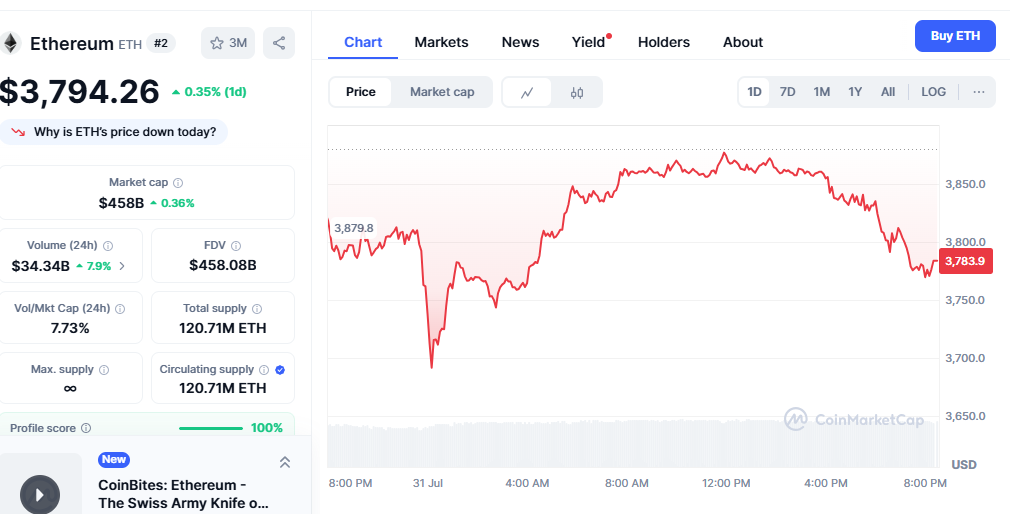

Ethereum’s current market position reflects both the opportunities and challenges facing the cryptocurrency ecosystem in 2025. Trading at approximately $3,800 as of July 2025, ETH has shown impressive recovery from earlier lows, demonstrating strong institutional support and retail investor confidence.

The network’s transition to proof-of-stake has fundamentally altered Ethereum’s economic model, introducing deflationary mechanisms through the burning of transaction fees. This structural change has created a supply-demand dynamic that many analysts believe will support higher prices over the long term. Additionally, the growing adoption of Layer 2 scaling solutions like Arbitrum and Optimism has addressed previous concerns about network congestion and high gas fees.

Recent data shows that Ethereum processes over 1.2 million transactions daily, with total value locked (TVL) in DeFi protocols exceeding $50 billion. These metrics indicate robust network activity and sustained demand for Ethereum’s infrastructure, providing fundamental support for price appreciation.

Ethereum Price Prediction 2025 Analysis: Technical Indicators

Technical analysis plays a crucial role in any comprehensive price prediction framework. Ethereum’s chart patterns and technical indicators provide valuable insights into potential price movements and key resistance levels.

Key Technical Levels to Watch

The $4,000 resistance level remains a critical psychological barrier for Ethereum, representing the gateway to new all-time highs. Historical trading data suggests that breaking above this level with significant volume could trigger a rally toward $5,000-$6,000. Conversely, support levels at $3,200 and $2,800 provide important downside protection.

Moving average indicators paint a bullish picture, with the 50-day moving average crossing above the 200-day moving average—a technical pattern known as a “golden cross.” This formation historically precedes significant upward price movements and suggests underlying strength in Ethereum’s price action.

The Relative Strength Index (RSI) currently sits at 62, indicating healthy momentum without being overbought. This positioning allows room for further upward movement while maintaining sustainable price action.

Volume Analysis and Market Structure

Trading volume patterns reveal increasing institutional participation in Ethereum markets. Average daily trading volumes have grown by 40% compared to the same period in 2024, suggesting growing market depth and liquidity. This increased participation from institutional investors provides price stability and reduces volatility, creating a more mature market environment.

The futures market shows a healthy balance between long and short positions, with no extreme positioning that might indicate an imminent reversal. Open interest in Ethereum futures contracts has reached record levels, reflecting growing sophisticated investor engagement.

Expert Forecasts and Price Targets

Leading cryptocurrency analysts and financial institutions have published various Ethereum price prediction 2025 analysis reports, offering diverse perspectives on ETH’s potential trajectory.

Institutional Predictions

Major cryptocurrency research firms project Ethereum could reach between $4,500 and $7,000 by the end of 2025. These forecasts are based on continued institutional adoption, regulatory clarity, and technological improvements. Several factors support these optimistic projections:

BlackRock and Traditional Finance Integration: The integration of Ethereum into traditional financial products, including spot ETFs and tokenized securities, has created new demand channels. BlackRock’s involvement in Ethereum-based financial products signals mainstream acceptance and could drive significant capital inflows.

Corporate Treasury Adoption: Following MicroStrategy’s Bitcoin treasury model, several companies are now considering Ethereum for their corporate treasuries. BitMine Immersion Technologies has already accumulated over $1 billion worth of ETH, demonstrating growing corporate confidence in Ethereum’s long-term value proposition.

Also Read: Ethereum Price Prediction News Today Expert Analysis & Market Forecast 2025

Conservative vs. Optimistic Scenarios

Conservative estimates place Ethereum’s 2025 price target between $3,000 and $5,000, accounting for potential market volatility and regulatory uncertainties. These projections assume steady growth without major market disruptions or significant regulatory setbacks.

Optimistic scenarios, supported by accelerated institutional adoption and technological breakthroughs, suggest Ethereum could reach $8,000-$12,000. These higher targets depend on factors such as widespread corporate adoption, successful implementation of sharding technology, and continued growth in the DeFi ecosystem.

Fundamental Analysis of Ethereum’s Value Drivers

Understanding Ethereum’s fundamental value drivers is essential for any comprehensive price prediction analysis. Unlike Bitcoin, which primarily serves as a store of value, Ethereum functions as a programmable money platform with diverse use cases.

Network Utility and Demand

Ethereum’s value proposition extends far beyond simple transactions. The network serves as the foundation for:

- Decentralized Finance (DeFi): With over $50 billion in total value locked, DeFi applications generate consistent demand for ETH as gas fees and collateral

- NFT Marketplace Activity: Digital art and collectibles markets continue driving network usage and ETH demand

- Brilliant Contract Execution: Thousands of applications require ETH for computation and storage

- Staking Rewards: Over 30 million ETH is currently staked, reducing the circulating supply

Tokenomics and Supply Dynamics

Ethereum’s transition to proof-of-stake introduced significant changes to its monetary policy. The implementation of EIP-1559 created a fee-burning mechanism that makes ETH deflationary during periods of high network activity. This deflationary pressure, combined with staking rewards and reduced issuance, creates favorable supply-demand dynamics.

Current staking yields of approximately 4-6% annually provide attractive returns for long-term holders, encouraging reduced selling pressure. With institutional staking services now widely available, more ETH is expected to be locked in staking contracts, further constraining supply.

Regulatory Environment and Market Impact

The regulatory landscape significantly influences cryptocurrency valuations, and Ethereum faces unique considerations as a platform token rather than a simple digital currency.

Current Regulatory Status

The SEC’s classification of Ethereum as a commodity rather than a security has provided important regulatory clarity. This designation allows for the development of various financial products, including futures contracts and potentially spot ETFs. The Trump administration’s generally crypto-friendly stance has created a more favorable regulatory environment for digital assets in 2025.

Recent legislation, including the GENIUS Act for stablecoins, has further legitimized the cryptocurrency ecosystem. These regulatory developments reduce uncertainty and encourage institutional participation, supporting higher Ethereum valuations.

Global Regulatory Trends

International regulatory frameworks continue evolving, with major economies developing comprehensive cryptocurrency regulations. The European Union’s Markets in Crypto-Assets (MiCA) regulation provides regulatory clarity while maintaining innovation-friendly policies. Similar frameworks in Asia and other regions create a more stable global environment for Ethereum adoption.

Ethereum 2025 Price Scenarios

Based on a comprehensive analysis of technical, fundamental, and market factors, we present three primary scenarios for Ethereum’s 2025 price.

Bullish Scenario ($6,000 – $8,000): This scenario assumes continued institutional adoption, successful technological implementations, and favorable regulatory developments. Key catalysts include:

- Approval and launch of Ethereum spot ETFs with significant inflows

- Major corporations are adding ETH to their treasury reserves

- Successful implementation of sharding and other scalability improvements

- Continued growth in DeFi and Web3 applications

- Favorable regulatory clarScenarioally

This scenario suggests Ethereum could reach $6,000-$8,000, representing a 50-100% increase from current levels.

Base Case Scenario ($4,500 – $6,000)

The base case assumes steady growth with moderate institutional adoption and technological scenarios. ThisScenarioo accounts for:

- Gradual institutional adoption without major catalysts

- Continued DeFi growth and Layer 2 scaling

- Stable regulatory environment without significant changes

- In moderate corporate treasury, Ethereum is expected to reach $4,500-$6,000 by the end of the year ($2,500 – $ 3,000). 3Scenario bullish scenario considers potential headwinds, including:

- Regulatory setbacks or unfavorable policy changes

- Major security breaches or technical issues

- Increased competition from alternative blockchains

- Macroeconomic recessions affect risk assessment. Given the reduced institutional interest in cryptocurrencies, Ethereum’s fundamental value proposition suggests prices will remain above $2,500-$3,500.

Investment Strategies Based on Price Analysis

Understanding potential price scenarios enables investors to develop appropriate strategies aligned with their risk tolerance and investment objectives.

Dollar-Cost Averaging Strategy

For long-term investors, dollar-cost averaging (DCA) remains a practical approach to Ethereum investment. This strategy involves making regular purchases regardless of price movements, reducing the impact of volatility while building positions over time.

Recommended DCA approach:

- Monthly purchases over 12-24 months

- Focus on accumulation during market downturns

- Consider increased allocation during significant dips below $3,000

Technical Trading Approach

Active traders can capitalize on Ethereum’s volatility using technical analysis and key support/resistance levels:

- Entry points: $3,200-$3,400 support zone

- Target levels: $4,200-$4,500 resistance

- Stop losses: Below $3,000 for risk management

- Profit-taking: Partial sales at key resistance levels

Staking and Yield Generation

Ethereum’s proof-of-stake mechanism enables investors to generate passive income through staking rewards. Current yields of 4-6% annually provide attractive returns while supporting network security.

Staking considerations:

- Minimum 32 ETH for solo staking

- Liquid staking services for smaller amounts

- Lock-up periods and slashing risks

- Tax implications of staking rewards

Risk Factors and Considerations

Any Ethereum price prediction 2025 analysis must acknowledge significant risks that could impact price performance.

Technology Risks

- Scalability challenges: Despite Layer 2 solutions, Ethereum still faces scalability limitations

- Competition: Alternative blockchains like Solana and Avalanche offer faster, cheaper transactions

- Security vulnerabilities: Smart contract bugs or protocol issues could undermine confidence

Market Risks

- Correlation with traditional markets: Cryptocurrency prices increasingly correlate with stock markets during stress periods

- Regulatory changes: Unfavorable regulations could significantly impact prices

- Institutional sentiment: Changes in institutional adoption could affect demand

Operational Risks

- Exchange risks: Centralized exchange failures could temporarily disrupt markets

- Custody risks: Self-custody challenges and institutional custody solutions

- Liquidity risks: Reduced liquidity during market stress could amplify volatility

Ethereum vs. Competitors Analysis

Evaluating Ethereum’s competitive position provides context for price predictions and long-term viability.

Ethereum’s Competitive Advantages

- First-mover advantage: Established ecosystem with an extensive developer community

- Network effects: Largest DeFi ecosystem and institutional adoption

- Brand recognition: Strong brand awareness and institutional trust

- Development activity: The most active development community in cryptocurrency

Competitive Challenges

- Transaction costs: Higher fees compared to newer blockchains

- Speed limitations: Slower transaction processing than some alternatives

- Energy consumption: Despite the proof-of-stake transition, perception issues remain

- Complexity: Technical complexity may limit mainstream adoption

Market Share Analysis

Ethereum maintains approximately 60% market share in DeFi total value locked, demonstrating strong competitive positioning. However, alternative blockchains have gained ground in specific niches like gaming and NFTs. Maintaining market leadership requires continued innovation and successful scaling of solutions.

Long-term Outlook Beyond 2025

While focusing on 2025 predictions, understanding Ethereum’s long-term trajectory provides valuable context for investment decisions.

Technology Roadmap

Ethereum’s development roadmap includes several significant upgrades:

- Sharding implementation: Dramatically increase transaction throughput

- State expiry: Reduce node storage requirements

- PBS (Proposer-Builder Separation): Improve decentralization and MEV protection

- Quantum resistance: Prepare for quantum computing threats

Institutional Adoption Trends

Growing institutional adoption suggests continued long-term demand:

- Traditional finance integration: Banks and asset managers developing Ethereum-based products

- Corporate treasuries: More companies considering ETH for cash reserves

- Government adoption: Some governments are exploring Ethereum for digital infrastructure

- Central bank digital currencies: Potential CBDC implementations on Ethereum

Conclusion

This comprehensive Ethereum price prediction 2025 analysis reveals a generally optimistic outlook for Ethereum’s price performance, supported by strong fundamentals, growing institutional adoption, and technological improvements. While various scenarios range from conservative targets of $4,500 to bullish projections exceeding $8,000, the base case suggests Ethereum could reach $5,000-$6,000 by the end of 2025.

Key factors supporting higher prices include continued DeFi growth, institutional adoption, regulatory clarity, and successful scaling solutions. However, investors must carefully consider risks, including competition, regulatory changes, and overall market volatility.