ETH price target discussions evolve amid changing market dynamics. While the initial euphoria surrounding Ethereum’s recent price movements has begun to subside, leading analysts maintain their bullish outlook, with a $5,000 ETH price target remaining firmly in sight for the end of 2025. This comprehensive analysis examines the factors behind the cooling enthusiasm, the technical indicators supporting continued growth, and why seasoned traders believe Ethereum’s journey toward five-figure territory is far from over.

Despite temporary market corrections and profit-taking activities, the fundamental strength of the Ethereum ecosystem remains a solid foundation for ambitious ETH price predictions. Market analysts emphasize that the current volatility represents a healthy consolidation phase rather than a bearish reversal, setting the stage for the next significant upward movement toward the coveted $ 5,000 ETH target.

Current ETH Price Analysis: Beyond the Euphoria

Market Sentiment Shift

The cryptocurrency landscape has undergone a noticeable shift in investor sentiment regarding the ETH price target expectations. After weeks of sustained bullish momentum, the market has entered what experts describe as a “cooling-off period.” This shift doesn’t necessarily indicate a bearish reversal but rather reflects a natural market cycle where early gains are consolidated before the next significant move.

Current Ethereum price analysis reveals several key factors contributing to this shift in sentiment. Profit-taking activities have intensified as traders who entered positions during lower price levels seek to secure gains. Additionally, broader market uncertainty related to regulatory developments and macroeconomic factors has contributed to a more cautious approach among institutional investors.

The ETH price target of $5,000 remains mathematically achievable, requiring approximately a 45-50% increase from current levels, depending on market entry points. Historical analysis shows that Ethereum has demonstrated the capability to achieve such percentage gains within relatively short timeframes, particularly during favorable market conditions.

Technical Indicators Supporting Bullish Outlook

Despite the fading euphoria, technical analysis continues to support the $5K ETH price target. Key indicators include:

Moving Average Convergence Divergence (MACD): The daily MACD remains in bullish territory, suggesting that upward momentum hasn’t been entirely exhausted. While the histogram shows some weakening, the overall trend direction supports continued price appreciation.

Relative Strength Index (RSI): Current RSI levels indicate that Ethereum isn’t significantly overbought, providing room for additional upward movement toward the ETH price target without triggering significant technical resistance.

Volume Analysis: Trading volume patterns suggest that while retail enthusiasm may have cooled, institutional accumulation continues at strategic support levels, indicating confidence in higher Ethereum price predictions.

Fundamental Factors Supporting the $5K ETH Price Target

Ethereum 2.0 and Staking Dynamics

The ongoing evolution of the Ethereum network through various upgrades continues to provide fundamental support for bullish ETH price target scenarios. The proof-of-stake consensus mechanism has fundamentally altered Ethereum’s supply dynamics, creating deflationary pressure that supports higher valuation targets.

Staking rewards have created a significant portion of the ETH supply that is locked away from immediate market circulation. Current staking statistics show that over 32 million ETH tokens are currently staked, representing approximately 25% of the total supply. This supply reduction mechanism creates natural upward pressure supporting the $5,000 ETH target.

The yield generation aspect of staking has attracted institutional investors seeking steady returns in the cryptocurrency space. This institutional interest provides a stable demand base that supports ambitious ETH price predictions and reduces volatility during market corrections.

DeFi and NFT Ecosystem Growth

The decentralized finance (DeFi) sector continues to expand, with Ethereum maintaining its position as the primary blockchain for innovative financial applications. The Total Value Locked (TVL) in Ethereum-based DeFi protocols remains substantial, creating consistent demand for ETH tokens to facilitate transactions and serve as collateral.

NFT marketplace activity on Ethereum, while experiencing periodic fluctuations, maintains significant transaction volumes that contribute to network utilization and fee generation. This activity supports the fundamental value proposition underlying the ETH price target of $5,000.

Layer 2 scaling solutions have enhanced Ethereum’s usability while maintaining security, attracting more users and applications to the ecosystem. This growth in utility and adoption provides a strong foundation for achieving ambitious Ethereum price analysis projections.

Market Dynamics and Institutional Adoption

Corporate Treasury Allocation

Institutional adoption of Ethereum has accelerated significantly, with several major corporations adding ETH to their treasury reserves. This trend provides substantial support for the $5K ETH price target by creating consistent buying pressure from entities with significant capital resources.

Investment fund flows into Ethereum-focused products have remained largely positive, despite short-term market volatility. These flows suggest that professional investors remain confident in the long-term trajectory toward higher ETH price target levels.

Regulatory clarity improvements in various jurisdictions have reduced institutional hesitation regarding cryptocurrency investments, potentially accelerating adoption rates that support bullish Ethereum price predictions.

Exchange-Traded Fund (ETF) Impact

The approval and launch of Ethereum ETFs in multiple jurisdictions have created new avenues for institutional and retail investment. These investment vehicles offer regulated exposure to ETH price movements, potentially amplifying demand during bullish phases, which could drive the price toward the $5,000 ETH target.

ETF inflows have demonstrated consistent positive trends, indicating sustained investor interest despite temporary market euphoria cooling. This institutional infrastructure supports the fundamental case for achieving ambitious ETH price target objectives.

Technical Analysis: Path to $5,000

Resistance and Support Levels

Key resistance levels on the path to the $5K ETH price target include psychological barriers at $4,000, $4,500, and $4,800. Historical analysis suggests that Ethereum typically experiences consolidation phases at these round-number levels before resuming upward momentum.

Support structures remain robust, with significant buying interest evident at key Fibonacci retracement levels. These support zones provide a foundation for renewed upward movement toward the $5,000 ETH target once market conditions improve.

Volume profile analysis indicates strong acceptance of current price levels, suggesting that any temporary retracements are likely to be met with renewed buying interest from both retail and institutional participants.

Chart Patterns and Projections

Elliott Wave analysis suggests that Ethereum may be completing a corrective phase before resuming its primary upward trend toward the ETH price target. Wave counting indicates potential for significant price appreciation in the coming months.

Flag and pennant patterns on various timeframes support continued bullish momentum toward the $ 5,000 ETH price target once consolidation phases are complete. These technical formations typically precede substantial price movements in the direction of the primary trend.

Fibonacci extension levels provide mathematical targets that align closely with the $5,000 ETH target, lending technical credibility to analyst projections.

Risk Factors and Considerations

Market Volatility Concerns

Cryptocurrency market volatility remains a significant factor that could impact the timeline for reaching the ETH price target. Sudden market corrections, although potentially temporary, may delay achieving the $5,000 target.

Regulatory developments in major markets could influence investor sentiment and trading patterns, affecting the trajectory toward ambitious Ethereum price predictions. Monitoring regulatory news remains crucial for timing market entries and exits.

Macroeconomic factors, including inflation rates, interest rate decisions, and global economic stability, continue to influence cryptocurrency markets and could impact the realization of the $ 5,000 ETH price target.

Competition and Technology Risks

Blockchain competition from alternative innovative contract platforms could potentially impact Ethereum’s market dominance, though current network effects and developer adoption suggest continued strength, supporting the ETH price target.

Technology risks, such as network upgrades, security vulnerabilities, or scalability challenges, could temporarily impact confidence in Ethereum price analysis projections.

Expert Opinions and Market Sentiment

Analyst Perspectives

Leading cryptocurrency analysts maintain an optimistic outlook regarding the $5,000 ETH target, despite a temporary cooling of sentiment. Technical analysts cite strong support levels and healthy consolidation patterns as evidence supporting continued upward momentum.

Fundamental analysts emphasize the growing utility and adoption of the Ethereum network as key factors supporting ambitious ETH price predictions. The combination of DeFi growth, NFT adoption, and institutional interest creates multiple demand drivers.

Quantitative analysis models incorporating network metrics, adoption rates, and market cycles continue to support scenarios where the ETH price target of $5,000 is achievable within the projected timeframe.

Community and Developer Sentiment

Developer activity metrics remain strong, with continued growth in GitHub commits, active repositories, and new project launches on the Ethereum network. This development activity supports long-term confidence in Ethereum price analysis projections.

Community engagement levels, although perhaps less euphoric than during peak market phases, remain substantially elevated compared to historical averages, indicating sustained interest in the $ 5,000 ETH price target.

Investment Strategies and Timing

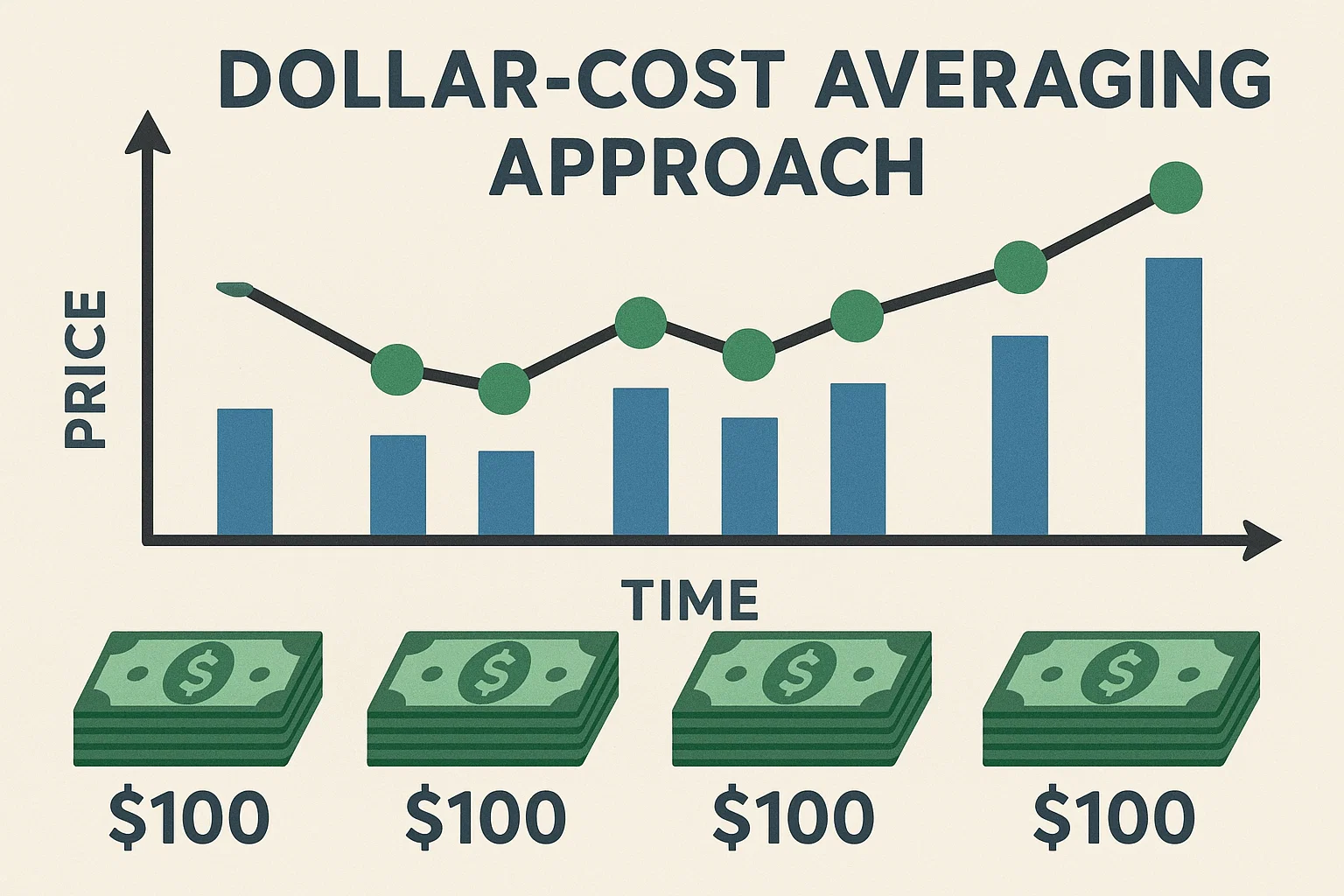

Dollar-Cost Averaging Approach

Systematic investment strategies, such as dollar-cost averaging, can help investors navigate volatility while positioning themselves for achieving their target TH pr. This approach reduces timing risk while maintaining exposure to potential upside.

Portfolio allocation strategies incorporating Ethereum alongside other cryptocurrencies and traditional assets can provide balanced exposure while targeting the $5,000 ETH target.

Risk Management Techniques

Stop-loss strategies and position sizing rules remain crucial for managing downside risk while maintaining exposure to the upside of the ETH price target. Proper risk management enables investors to participate in potential gains while limiting catastrophic losses.

Profit-taking ladders can help investors realize gains progressively as prices approach the $ 5,000 ETH price target, balancing the need to maximize returns and secure profits.

Future Outlook and Catalysts

Upcoming Network Upgrades

Planned Ethereum improvements continue to enhance network capabilities and efficiency, providing fundamental support for bullish Ethereum price predictions. These upgrades address scalability, security, and sustainability concerns that support long-term value appreciation.

Layer 2 development progress creates additional utility and reduces transaction costs, potentially accelerating adoption rates that support the achievement of the ETH price target.

Market Catalysts

Institutional product launches, regulatory approvals, and significant corporate adoptions could serve as catalysts for renewed momentum toward the $5,000 ETH target. These developments often trigger significant buying waves that can rapidly drive prices upward.

Macroeconomic conditions, including inflation hedge demand and concerns about currency debasement, may drive additional investment flows supporting ambitious ETH price target scenarios.

Conclusion

While the initial ETH price euphoria may have subsided, the fundamental case for achieving the $5,000 target by year-end remains compelling. The current consolidation phase represents a healthy pause in what remains a structurally bullish market for Ethereum. Technical indicators, fundamental developments, and institutional adoption trends all support the ambitious ETH price target, despite a temporary cooling of sentiment.

Investors should view the current market conditions as an opportunity to establish or add to positions before the next upward leg toward the $5K ETH price target. The combination of improved network utility, growing institutional adoption, and favorable supply dynamics creates a strong foundation for continued price appreciation.

Read more: Ethereum Hits Record 12 Million Daily Smart Contract Calls | $5200 Target