The cryptocurrency market has been gripped by overwhelming pessimism as the Crypto Fear and Greed Index plummeted a staggering 42 points within a single week, signaling one of the most dramatic sentiment shifts in recent months. This sharp decline has left investors questioning whether another devastating price crash is on the horizon. The Fear and Greed Index, a widely respected barometer of cryptocurrency market sentiment, now sits firmly in “extreme fear” territory, raising concerns about the stability of Bitcoin, Ethereum, and other significant digital assets. As trading volumes decline and panic selling intensifies, understanding what this dramatic shift means for your portfolio has never been more critical.

Crypto Fear and Greed Index

The Crypto Fear and Greed Index serves as a comprehensive sentiment analysis tool that measures the emotions and sentiments driving the cryptocurrency market. Developed to provide traders and investors with actionable insights, this index operates on a scale from 0 to 100, where values below 25 indicate “extreme fear” and values above 75 suggest “extreme greed.”

How the Fear and Greed Indicator Works

This sophisticated cryptocurrency market sentiment gauge analyzes multiple data points to generate its readings. The index incorporates volatility measurements, comparing current market fluctuations with average levels over the past 30 and 90 days. Market momentum and volume play crucial roles, with unusual buying or selling activity triggering significant index movements. Social media sentiment, survey results, Bitcoin dominance ratios, and Google Trends data all contribute to creating a holistic view of market psychology.

When the Crypto Fear and Greed Index registers extreme fear, it typically indicates that investors are overly worried about market conditions, potentially creating buying opportunities for contrarian traders. Conversely, extreme greed often precedes market corrections as irrational exuberance drives prices to unsustainable levels.

Historical Significance of 42-Point Drops

A 42-point decline in the Fear and Greed Index within seven days represents an extraordinary shift in market psychology. Historical data reveal that such dramatic movements have preceded significant market events. During the May 2021 crash, the index fell from 75 to 10 within two weeks as Bitcoin plummeted from $64,000 to $30,000. Similarly, the June 2022 collapse saw the index drop 38 points in just five days, coinciding with Bitcoin’s fall below $20,000.

These precedents suggest that the current 42-point drop shouldn’t be dismissed as mere statistical noise. Instead, it represents genuine panic spreading throughout the cryptocurrency ecosystem, potentially foreshadowing more turbulent times ahead.

Current State of Cryptocurrency Market Sentiment

The current bearish crypto market conditions have created a perfect storm of negative sentiment. The Crypto Fear and Greed Index reading indicates that fear has reached levels not seen since the aftermath of major exchange collapses and regulatory crackdowns. This extreme pessimism manifests across multiple metrics that paint a concerning picture for short-term price action.

Factors Driving the Sentiment Collapse

Several interconnected factors have contributed to this dramatic shift in the cryptocurrency market sentiment. Macroeconomic headwinds continue to buffet digital assets, with persistent inflation concerns and restrictive monetary policies from central banks worldwide creating an unfavorable environment for risk assets. The Bitcoin fear index component reflects growing anxiety about regulatory developments, particularly increased scrutiny from the Securities and Exchange Commission and other global regulatory bodies.

Technical breakdowns across major cryptocurrencies have amplified selling pressure. Bitcoin’s failure to maintain support at critical levels triggered algorithmic selling and forced liquidations across leveraged positions. Ethereum and altcoins have suffered even steeper declines, with many projects losing 60-80% of their value from recent highs. This cascading effect has intensified the fear captured by the Crypto Fear and Greed Index.

Market Behavior During Extreme Fear Periods

Historical analysis of the fear and greed indicator reveals fascinating patterns about market behavior during extreme fear periods. Contrary to popular belief, extreme fear doesn’t always immediately precede crashes. In fact, many of the most profitable buying opportunities have occurred when the index bottomed out in extreme fear territory. The March 2020 COVID-19 crash saw the index hit 10, yet those who bought Bitcoin at $3,800 enjoyed returns exceeding 1,500% over the following 18 months.

However, extreme fear can also persist for extended periods during bear markets. Throughout late 2018 and early 2019, the Crypto Fear and Greed Index remained below 30 for months as Bitcoin gradually declined from $6,000 to $3,200. This demonstrates that while fear can signal opportunity, it doesn’t guarantee immediate reversals.

Is Another Bitcoin Price Crash Imminent?

The question dominating investor discussions centers on whether this dramatic shift in the Crypto Fear and Greed Index foreshadows another catastrophic Bitcoin price crash. Multiple indicators suggest heightened vulnerability, though the situation remains complex and multifaceted.

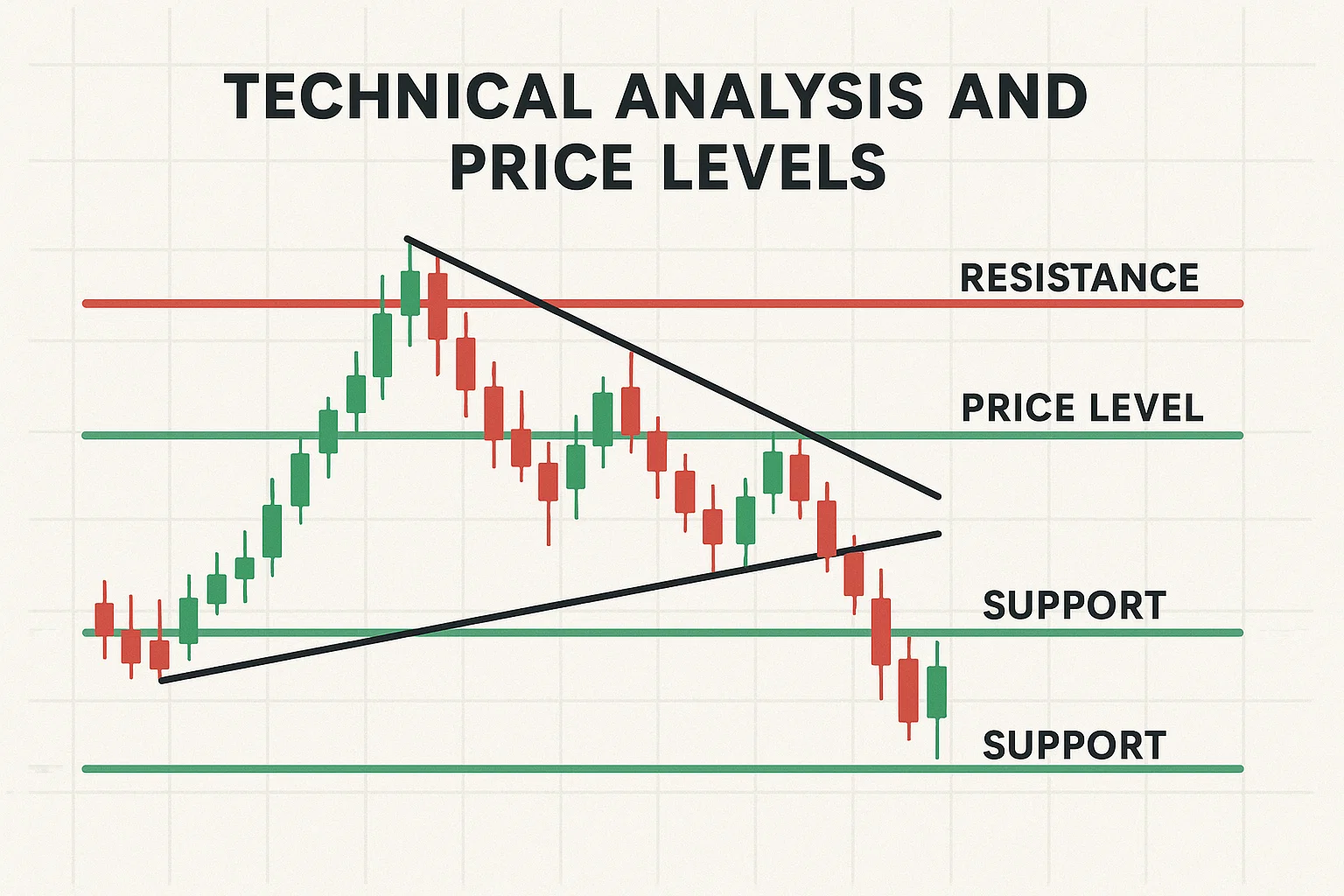

Technical Analysis and Price Levels

Bitcoin’s current technical structure presents concerning signals that align with the bearish sentiment reflected in the fear and greed indicator. The leading cryptocurrency has broken below several key support levels that previously held during minor corrections. The 200-day moving average, a closely watched long-term trend indicator, has been decisively breached, a pattern that historically preceded extended downtrends.

On-chain metrics provide additional context for potential cryptocurrency volatility. The number of addresses holding Bitcoin has plateaued, suggesting new adoption has stalled. Exchange inflows have increased significantly, indicating that holders are moving coins to platforms in preparation for selling. Meanwhile, mining profitability has decreased substantially, potentially forcing some miners to liquidate holdings to cover operational costs.

The realized price—representing the average cost basis of all Bitcoin holders—sits approximately 15% above current prices, meaning a significant portion of the market holds unrealized losses. This creates psychological pressure for capitulation selling if prices decline further, potentially triggering the cascading liquidations that characterize major crashes.

Comparing Current Conditions to Previous Crashes

Examining previous market cycles provides a valuable perspective on whether current conditions truly indicate an imminent Bitcoin price crash. The 2018 bear market saw Bitcoin decline 83% from its all-time high, with the Crypto Fear and Greed Index remaining depressed for over a year. The 2021-2022 bear market resulted in a 77% decline, accompanied by similar prolonged fear readings.

Currently, Bitcoin has declined approximately 45-50% from recent highs, depending on the measurement period, suggesting either that significant downside remains or that this correction may prove less severe than previous bear markets. The cryptocurrency market sentiment reflected in the index suggests that market participants are pricing in additional downside. However, our actual price action will depend on numerous external factors, including regulatory developments, macroeconomic conditions, and institutional adoption trends.

One critical difference distinguishes current conditions from previous crashes: institutional involvement. Major corporations, investment funds, and even nation-states now hold substantial Bitcoin positions, potentially providing support levels that didn’t exist in previous cycles. This could limit downside even as the Crypto Fear and Greed Index signals extreme fear.

Cryptocurrency Volatility and Risk Management

Understanding and managing cryptocurrency volatility becomes paramount when the fear and greed indicator signals extreme conditions. The inherent volatility of digital assets amplifies both gains and losses, making strategic risk management essential for portfolio preservation.

Strategies for Navigating Extreme Fear Markets

Successful navigation of bearish crypto market conditions requires disciplined approaches that counteract emotional decision-making. Dollar-cost averaging remains one of the most effective strategies during extreme fear periods, allowing investors to accumulate positions at lower average prices without attempting to time the exact bottom. Historical data from previous extreme readings of the Crypto Fear and Greed Index shows that systematic buying during periods of fear outperforms both lump-sum investing and waiting for confirmations of trend reversals.

Portfolio rebalancing deserves special attention when market sentiment reaches extremes. As the cryptocurrency market sentiment turns bearish and prices decline, cryptocurrency positions shrink as a percentage of total portfolio value. Rebalancing back to target allocations forces buying during fear and selling during greed, systematically implementing the contrarian approach that has proven successful throughout financial market history.

Risk-appropriate position sizing protects capital during extended downtrends. Even if the current fear and greed indicator reading suggests a potential bottom, maintaining reasonable exposure limits downside if conditions deteriorate further. Financial advisors typically recommend limiting cryptocurrency exposure to 5-10% of investment portfolios for most investors, with higher allocations only appropriate for those with high risk tolerance and long investment horizons.

Tools and Indicators Beyond the Fear and Greed Index

While the Crypto Fear and Greed Index provides valuable sentiment data, comprehensive market sentiment analysis requires multiple complementary indicators. On-chain metrics, including active addresses, transaction volumes, and exchange flows, offer insights into actual blockchain activity rather than just sentiment. These fundamental indicators can diverge from sentiment readings, sometimes providing early signals of trend changes.

Technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands help identify oversold conditions that frequently coincide with extreme Bitcoin fear index readings. When multiple technical indicators confirm oversold conditions alongside extreme fear sentiment, the probability of a trend reversal increases substantially.

Funding rates in perpetual futures markets provide real-time sentiment data from leveraged traders. Negative funding rates indicate that short positions dominate, with traders paying to hold bearish bets. These conditions often precede short squeezes that can trigger rapid price reversals, even when the Crypto Fear and Greed Index remains depressed.

Expert Analysis and Crypto Price Prediction

Professional analysts and institutional researchers offer diverse perspectives on the current cryptocurrency market sentiment and potential future trajectories. Understanding these viewpoints helps investors contextualize the dramatic decline in the Crypto Fear and Greed Index and make informed decisions.

Bullish Perspectives on Current Fear Levels

Contrarian analysts view the current extreme fear reflected in the fear and greed indicator as a potentially powerful buy signal. These experts note that the most profitable cryptocurrency investments have historically occurred when sentiment reached its darkest points. They argue that widespread panic creates irrational selling pressure that drives prices below fundamental value, eventually setting the stage for powerful rebounds.

Some institutional analysts point to improving fundamentals that contradict the bearish cryptocurrency market sentiment. Bitcoin’s network security continues to strengthen as the hash rate reaches new all-time highs despite price declines. Lightning Network capacity and adoption grow steadily, enhancing Bitcoin’s utility for payments. Ethereum’s successful transition to proof-of-stake and ongoing scaling solutions position it for increased institutional adoption regardless of short-term price action.

From a macroeconomic perspective, some analysts are confident that cryptocurrencies will ultimately benefit from the same conditions currently driving fear. Concerns about fiat currency debasement, geopolitical instability, and financial system fragility—the very issues Bitcoin was designed to address—remain valid despite current price weakness. These fundamentals may eventually override short-term sentiment captured by the Crypto Fear and Greed Index.

Bearish Warnings and Downside Scenarios

Bearish analysts interpret the decline in the Crypto Fear and Greed Index as a justified response to deteriorating conditions that may worsen before improving. These experts highlight several scenarios that could drive additional downside and extend the period of extreme fear in cryptocurrency markets.

Regulatory risks remain a primary concern for bearish analysts. Potential classification of major cryptocurrencies as securities, restrictions on decentralized finance (DeFi) protocols, or outright bans in major economies could trigger another leg down in the current correction. The feared Bitcoin price crash scenario, which many investors worry about, might materialize if multiple jurisdictions simultaneously implement restrictive policies.

Systemic risks within the cryptocurrency ecosystem also worry cautious analysts. The collapse of major lending platforms, exchanges, or algorithmic stablecoins during previous downturns demonstrated that interconnected risks can cascade through the market. With the fear and greed indicator already at extreme levels, any major platform failure could trigger panic selling that overwhelms support levels and forces additional liquidations.

Macroeconomic headwinds may persist longer than optimists expect. If central banks maintain restrictive monetary policies to combat inflation, risk assets, including cryptocurrencies, may face continued pressure. Historical patterns show that cryptocurrencies tend to underperform during periods of monetary tightening, suggesting that the bearish sentiment reflected in current cryptocurrency readings may prove prescient rather than excessive.

Long-Term Investment Perspective on Cryptocurrency

While short-term cryptocurrency volatility and the current Crypto Fear and Greed Index reading dominate headlines, long-term investors maintain focus on fundamental developments and adoption trends that transcend temporary sentiment shifts.

Building Positions During Fear Cycles

History demonstrates that patient accumulation during periods of extreme fear—when fear and greed indicators signal maximum pessimism—has rewarded long-term cryptocurrency investors. Those who systematically purchased Bitcoin during the 2018-2019 bear market, when the Crypto Fear and Greed Index remained depressed for months, enjoyed substantial returns during the subsequent 2020-2021 bull market.

The current sentiment collapse presents similar potential opportunities for investors with multi-year time horizons. Rather than attempting to time the exact bottom, successful long-term investors focus on accumulating quality assets at prices substantially below previous peaks. Dollar-cost averaging during extreme Bitcoin fear index readings allows investors to build positions while minimizing the risk of poorly timed lump-sum investments.

Quality selection becomes crucial during bearish markets when many projects fail to survive extended downturns. Bitcoin and Ethereum have demonstrated resilience through multiple cycles, while numerous altcoins that dominated previous bull markets have faded into obscurity. The current extreme fear environment will likely separate sustainable projects from speculative ventures, with survivors emerging stronger when sentiment eventually recovers.

Fundamental Developments Contradicting Current Sentiment

Despite the bearish cryptocurrency market sentiment reflected in the Crypto Fear and Greed Index, fundamental developments continue advancing. Institutional infrastructure for cryptocurrency custody, trading, and investment management expands steadily. Major financial institutions launch cryptocurrency services, providing regulated access for clients who previously lacked exposure options.

Technological improvements enhance cryptocurrency utility regardless of price action. Layer-2 scaling solutions reduce transaction costs and increase throughput for Ethereum. Bitcoin’s Lightning Network processes growing payment volumes with near-instant settlement and minimal fees. These developments build a foundation for future adoption that transcends current sentiment cycles.

Global adoption metrics tell a story that contradicts the panic implied by the fear and greed indicator. Emerging market adoption accelerates as citizens seek alternatives to unstable local currencies. El Salvador’s Bitcoin adoption, despite criticism and implementation challenges, inspired similar explorations by other nations. Central bank digital currency (CBDC) projects advance worldwide, validating blockchain technology even as they compete with cryptocurrencies.

Protecting Your Cryptocurrency Portfolio

Practical risk management strategies become essential when the Crypto Fear and Greed Index signals extreme conditions and cryptocurrency volatility increases. Implementing protective measures helps preserve capital while maintaining exposure to potential upside.

Stop Losses and Position Management

Strategic stop-loss placement protects against catastrophic losses during potential Bitcoin price crash scenarios without forcing premature exits during normal volatility. Rather than tight stops that trigger during routine fluctuations, consider wider stops below primary support levels that only activate during genuine trend breakdowns. Some investors prefer mental stops over automated orders to avoid triggering liquidations during flash crashes that quickly reverse.

Position sizing relative to portfolio value and risk tolerance determines maximum loss exposure regardless of stop-loss placement. If a position represents 5% of portfolio value with a stop-loss 30% below current prices, the maximum loss equals 1.5% of the total portfolio value. This mathematical approach to risk management prevents emotional decision-making when the cryptocurrency market sentiment turns extremely harmful.

Trailing stops allow locking in profits during rebounds while maintaining upside exposure. As prices recover from extreme Bitcoin fear index readings, trailing stops protect gains while allowing continued participation if the rally extends. This approach balances the goals of protecting capital and maximizing returns during the volatile transitions between fear and greed cycles.

Diversification and Alternative Strategies

Diversification beyond cryptocurrencies provides portfolio stability when digital assets experience extreme volatility. Maintaining allocations to traditional assets—such as stocks, bonds, real estate, and commodities—ensures that cryptocurrency-specific risks don’t dominate total portfolio performance. Even investors who are highly optimistic about long-term cryptocurrency prospects benefit from diversification, which smooths volatility during periods like the current Crypto Fear and Greed Index collapse.

Within cryptocurrency allocations, diversification across different assets and strategies reduces concentration risk. While Bitcoin and Ethereum dominate most portfolios, smaller allocations to selected altcoins, DeFi protocols, or blockchain infrastructure projects provide exposure to different growth drivers. Some of these alternatives may outperform during recoveries from extreme fear conditions.

Yield-generating strategies, including staking, liquidity provision, and lending programs, can partially offset price declines during bearish markets. These approaches carry their own risks and complexities, but for knowledgeable investors, they provide alternative sources of returns less dependent on short-term price appreciation. Income generation becomes particularly valuable during extended periods of depressed sentiment reflected in the fear and greed indicator.

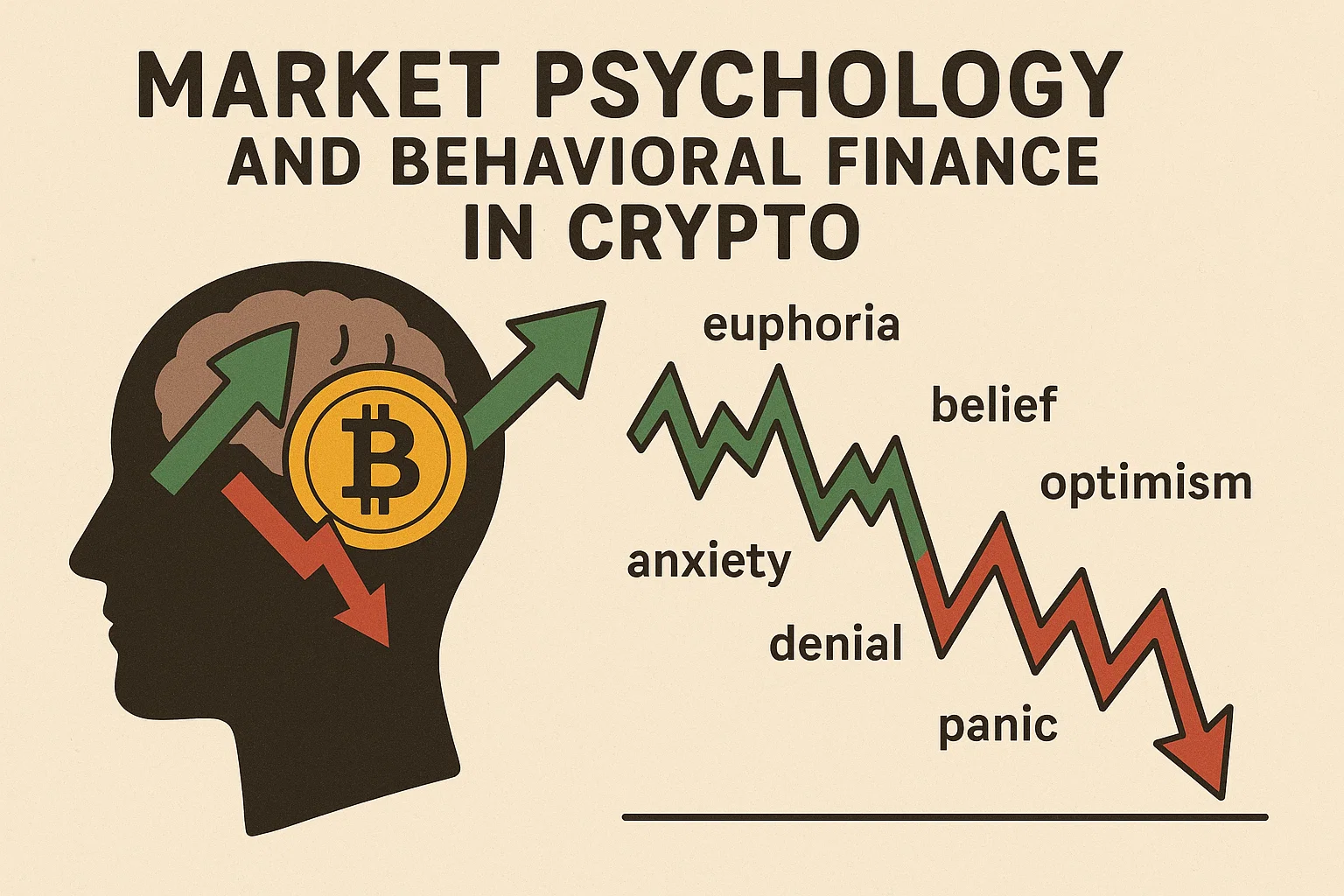

Market Psychology and Behavioral Finance in Crypto

Understanding psychological factors driving the Crypto Fear and Greed Index helps investors recognize and counteract cognitive biases that impair decision-making during extreme market conditions.

Fear-Driven Decision Making

Extreme fear triggers psychological responses that frequently lead to suboptimal investment decisions. Loss aversion—the tendency to feel losses more intensely than equivalent gains—becomes overwhelming when the Bitcoin fear index reaches extreme levels. Investors often capitulate near bottoms, selling at precisely the wrong moment to eliminate the psychological discomfort of watching further declines.

Recency bias amplifies fear during downtrends. Recent adverse price action dominates thinking, causing investors to project current conditions indefinitely into the future. When the Crypto Fear and Greed Index plummets, many investors struggle to remember that cryptocurrency markets are cyclical and that extreme fear has historically preceded recovery periods.

Herd behavior intensifies during panic selling. As more investors capitulate and prices decline, the pressure to follow the crowd becomes overwhelming. Social media and news coverage amplify this effect, creating feedback loops where falling prices generate negative sentiment, driving additional selling and further decreasing prices. Breaking free from herd mentality during extreme cryptocurrency market sentiment shifts requires discipline and predetermined investment plans.

Contrarian Investing Principles

Successful contrarian investors view extreme fear and greed indicator readings as opportunities rather than confirmations of prevailing trends. Warren Buffett’s famous advice to “be fearful when others are greedy and greedy when others are fearful” applies directly to cryptocurrency markets experiencing the current sentiment collapse.

Contrarian approaches require distinguishing between justified fear based on fundamental deterioration and excessive fear driven by temporary factors. The current decline in the Crypto Fear and Greed Index may reflect both elements—legitimate concerns about macroeconomic conditions and regulatory risks, combined with excessive panic about near-term price action. Careful analysis helps identify whether current fear levels appropriately price risks or represent opportunities.

Systematic contrarian strategies eliminate emotional decision-making. Predetermined rules for increasing cryptocurrency exposure when the Bitcoin fear index reaches specific thresholds provide structure that counteracts psychological pressure. These mechanical approaches have proven effective throughout financial market history, generating superior returns by forcing buying during panic and selling during euphoria.

Conclusion

The dramatic 42-point decline in the Crypto Fear and Greed Index signals a critical juncture for cryptocurrency markets. While extreme fear often precedes significant opportunities, it can also persist during extended bear markets or lead to further downside. Historical analysis suggests that both possibilities remain viable, making risk management and strategic positioning essential.

Whether the current collapse in cryptocurrency market sentiment foreshadows an imminent Bitcoin price crash or represents a generational buying opportunity depends on numerous factors, including macroeconomic developments, regulatory actions, and the evolution of market structure. Investors should focus on controllable factors—position sizing, diversification, systematic accumulation strategies—rather than attempting to predict unpredictable short-term price movements.

Read more: Bitcoin Price Today Expert Analysis and 2025 Market Predictions