The Bitcoin price today continues to captivate investors worldwide as the leading cryptocurrency maintains its position as the most valuable digital asset. Whether you’re a seasoned trader or just starting your crypto journey, understanding the current Bitcoin price today is crucial for making informed investment decisions. With Bitcoin’s market cap exceeding $2 trillion and institutional adoption reaching new heights, tracking the live Bitcoin price today has become essential for anyone interested in the cryptocurrency market. In this comprehensive guide, we’ll explore everything you need to know about Bitcoin’s current valuation, market trends, and what factors are driving price movements in 2025.

Current Bitcoin Price Analysis: What’s Driving BTC Today

The Bitcoin price today reflects a complex interplay of market forces, institutional demand, and global economic conditions. As of the latest trading session, Bitcoin continues to demonstrate its resilience as a store of value, with price movements often correlating with broader financial markets and regulatory developments.

Real-Time Bitcoin Price Movements

Bitcoin’s price volatility remains one of its defining characteristics, with daily fluctuations often ranging from 2% to 8%. Several key factors influence the current Bitcoin price:

Market Sentiment Indicators:

- Trading volume across major exchanges

- Social media sentiment analysis

- Fear and Greed Index readings

- Institutional buying patterns

Technical Analysis Factors:

- Support and resistance levels

- Moving average convergences

- RSI and MACD indicators

- Chart pattern formations

The cryptocurrency market operates 24/7, unlike traditional stock markets, which means the Bitcoin price today can change dramatically within hours. This constant price discovery mechanism ensures that Bitcoin’s value reflects real-time market sentiment and global economic conditions.

Institutional Impact on Bitcoin Price Today

Institutional adoption has become a primary driver of Bitcoin’s price stability and long-term growth trajectory. Major corporations, pension funds, and investment firms have allocated significant portions of their portfolios to Bitcoin, creating a more mature market environment.

Key Institutional Players:

- MicroStrategy’s continued Bitcoin accumulation strategy

- Tesla’s Bitcoin holdings and payment integration

- El Salvador’s Bitcoin adoption as legal tender

- ETF inflows and outflows affect daily price movements

These institutional movements often create a substantial impact on the Bitcoin price today, as large-volume transactions can trigger significant price movements in either direction.

Bitcoin Price Today vs Historical Performance

Understanding Bitcoin’s price performance requires examining both short-term fluctuations and long-term trends. The Bitcoin price today represents years of technological development, regulatory clarity, and growing mainstream acceptance.

Yearly Performance Metrics

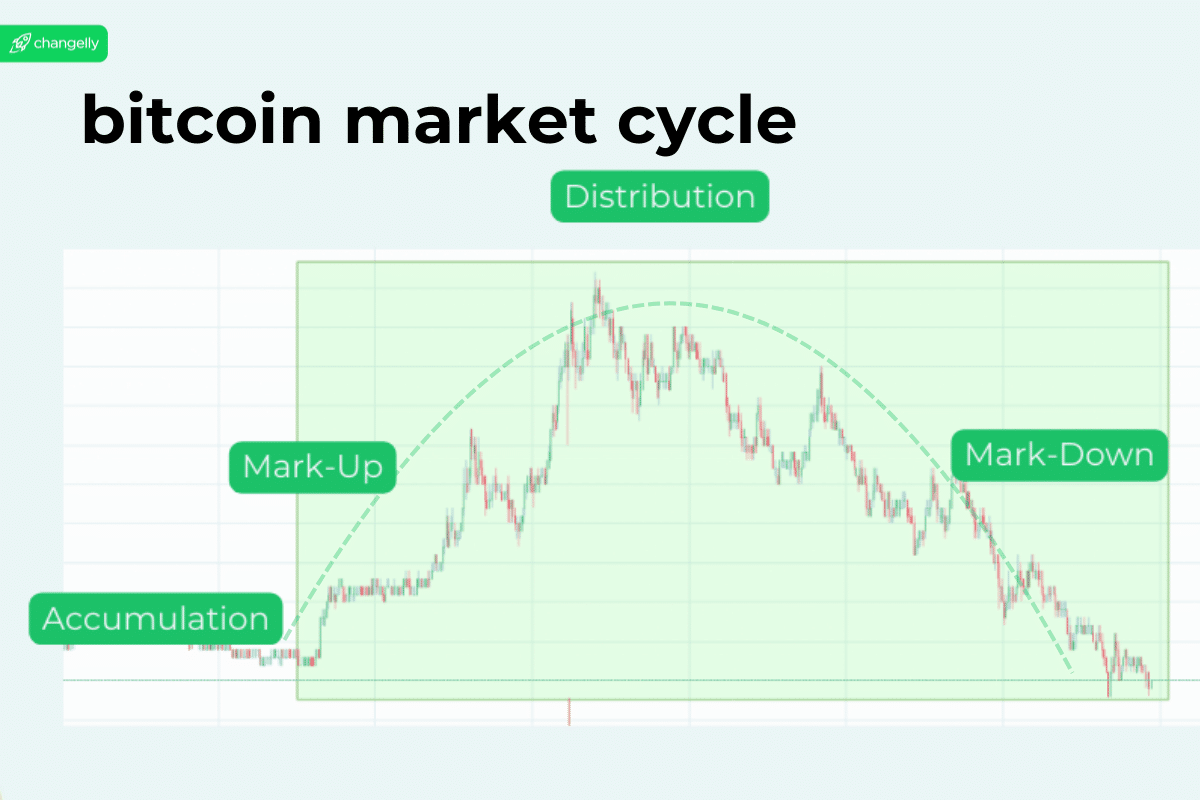

Bitcoin’s annual performance has shown remarkable growth over the past decade, despite periodic bear markets and corrections. When analyzing the Bitcoin price today against historical data, several patterns emerge:

Bull Market Cycles:

- 2017 surge to nearly $20,000

- 2021 peak at $69,000

- Current 2025 trading ranges

Market Recovery Patterns:

- Average recovery time from major corrections

- Correlation with halving events

- Impact of regulatory announcements

Comparing Today’s Price to Previous Highs

The current Bitcoin price must be viewed within the context of its historical volatility and long-term upward trajectory. Many analysts use various metrics to evaluate whether Bitcoin is undervalued or overvalued at current levels:

Valuation Metrics:

- Price-to-production cost ratios

- Network value to transactions (NVT) ratio

- Stock-to-flow model predictions

- On-chain analysis indicators

These metrics help investors determine whether the current Bitcoin price represents a buying opportunity or suggests caution in the current market environment.

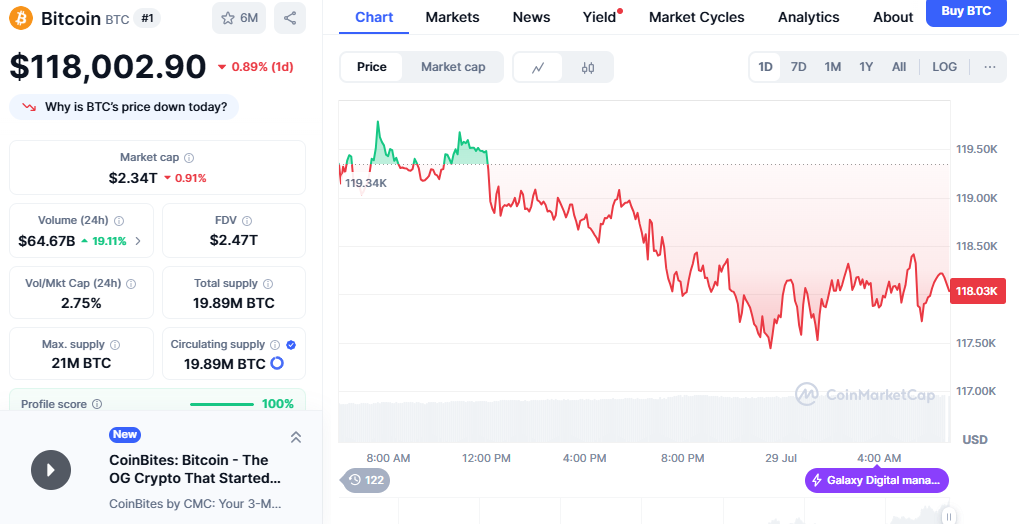

Live Bitcoin Price Tracking and Market Data

Monitoring the Bitcoin price today requires access to reliable, real-time data sources. The cryptocurrency market’s 24/7 nature means prices can change rapidly, making accurate tracking essential for traders and investors.

Best Sources for Real-Time Bitcoin Prices

Several platforms provide comprehensive Bitcoin price data, each offering unique features and analytical tools:

Major Cryptocurrency Exchanges:

- Coinbase Pro’s institutional-grade data

- Binance’s high-volume trading metrics

- Kraken’s detailed order book information

- Gemini’s regulated trading environment

Price Aggregation Platforms:

- CoinMarketCap’s comprehensive market data

- CoinGecko’s detailed analytics

- TradingView’s advanced charting tools

- Yahoo Finance’s mainstream accessibility

Understanding Price Variations Across Exchanges

The Bitcoin price today can vary slightly across different exchanges due to factors such as trading volume, geographic location, and market maker activities. These price differences, known as arbitrage opportunities, typically remain small due to automated trading systems that quickly exploit pricing inefficiencies.

Factors Affecting Price Variations:

- Exchange trading volumes

- Geographic regulatory differences

- Fiat currency pairs available

- Market maker presence and strategies

Also read: Ethereum Price Prediction News Today Expert Analysis & Market Forecast 2025

Market Factors Influencing Bitcoin Price Today

The Bitcoin price today is influenced by a complex ecosystem of factors ranging from technological developments to macroeconomic trends. Understanding these influences helps investors make more informed decisions about their cryptocurrency investments.

Regulatory Environment Impact

Government regulations and policy announcements continue to influence Bitcoin price movements significantly. The current regulatory landscape in 2025 shows increasing clarity and acceptance across major economies.

Positive Regulatory Developments:

- Bitcoin ETF approvals and institutional access

- Clear taxation guidelines in major markets

- Central bank digital currency (CBDC) discussions

- Cryptocurrency integration in traditional finance

Regulatory Challenges:

- Environmental concerns and mining regulations

- Anti-money laundering (AML) compliance requirements

- Cross-border transaction monitoring

- Stablecoin regulatory frameworks

Technological Advancements Affecting Price

Bitcoin’s underlying technology continues to evolve, with developments in the Lightning Network, Taproot implementation, and layer-2 solutions contributing to the network’s utility and, consequently, the current Bitcoin price.

Key Technological Improvements:

- Lightning Network adoption for instant payments

- Taproot upgrade enhancing privacy and efficiency

- Ordinals and BRC-20 token developments

- Mining efficiency improvements

These technological enhancements increase Bitcoin’s utility as both a store of value and a medium of exchange, supporting long-term price appreciation beyond speculative trading.

Bitcoin Price Predictions and Expert Analysis

Financial analysts and cryptocurrency experts regularly provide Bitcoin price forecasts based on technical analysis, fundamental metrics, and market trends. While the Bitcoin price today provides a snapshot of current market conditions, these predictions help investors understand potential future scenarios.

Short-Term Price Outlook (Next 30 Days)

Technical analysts examine chart patterns, trading volumes, and momentum indicators to predict short-term price movements of Bitcoin. The current Bitcoin price today suggests several possible scenarios for the coming month:

Bullish Scenarios:

- Break above key resistance levels

- Increased institutional buying pressure

- Positive regulatory developments

- Improved macroeconomic conditions

Bearish Scenarios:

- Failure to maintain support levels

- Profit-taking by long-term holders

- Negative regulatory news

- Broader market corrections

Long-Term Bitcoin Price Projections

Long-term Bitcoin price predictions often rely on fundamental analysis, including adoption rates, network effects, and macroeconomic factors. Many analysts remain bullish on Bitcoin’s long-term prospects despite short-term volatility.

Factors Supporting Long-Term Growth:

- Limited supply cap of 21 million bitcoins

- Increasing institutional adoption

- Growing acceptance as digital gold

- Technological improvements and scalability solutions

Potential Challenges:

- Regulatory uncertainty in some jurisdictions

- Environmental concerns related to mining

- Competition from other cryptocurrencies

- Macroeconomic headwinds

How to Track Bitcoin Price Today Effectively

Successfully monitoring the Bitcoin price today requires a combination of reliable data sources, analytical tools, and an understanding of market dynamics. Whether you’re a day trader or long-term investor, having access to accurate, real-time information is crucial.

Essential Tools for Price Monitoring

Mobile Applications:

- Coinbase for beginner-friendly tracking

- Binance for advanced trading features

- Delta for portfolio management

- CoinStats for comprehensive market data

Desktop Platforms:

- TradingView for professional charting

- CoinTracker for tax reporting

- Blockfolio for portfolio tracking

- Messari for fundamental analysis

Setting Up Price Alerts

Most cryptocurrency platforms allow users to set price alerts for the Bitcoin price, enabling investors to stay informed of significant market movements without needing to monitor charts constantly.

Alert Types:

- Price threshold notifications

- Percentage change alerts

- Volume spike notifications

- Technical indicator signals

These tools help investors react quickly to market opportunities while maintaining a balanced approach to cryptocurrency investing.

Bitcoin Trading Strategies Based on Today’s Price

The current Bitcoin price provides opportunities for various trading strategies, from short-term scalping to long-term dollar-cost averaging. Understanding these approaches enables investors to select methods that align with their risk tolerance and investment objectives.

Day Trading Bitcoin

Day trading involves buying and selling Bitcoin within the same trading day, capitalizing on short-term price movements. The Bitcoin price today’s volatility creates opportunities for experienced traders to profit from intraday fluctuations.

Day Trading Considerations:

- High risk and potential for significant losses

- Requires constant market monitoring

- Transaction fees can erode profits

- Emotional discipline is essential for success

Long-Term Investment Approaches

Many investors prefer long-term Bitcoin investment strategies, viewing the cryptocurrency as digital gold or a hedge against inflation. These approaches focus less on the Bitcoin price today and more on long-term value creation.

Long-Term Strategies:

- Dollar-cost averaging (DCA) for regular purchases

- Buy and hold for multi-year positions

- Portfolio rebalancing with other assets

- Tax-efficient investment structures

Global Bitcoin Market Trends

The Bitcoin price today reflects global market conditions and trends in international adoption. Understanding these broader patterns helps investors contextualize current price movements within the larger cryptocurrency ecosystem.

Regional Market Differences

Bitcoin adoption and pricing can vary significantly across different geographic regions due to regulatory environments, economic conditions, and cultural factors.

High Adoption Regions:

- North America’s institutional investment growth

- Europe’s regulatory clarity and innovation

- Asia-Pacific’s technological advancement

- Latin America’s inflation hedge adoption

Emerging Markets:

- Africa’s peer-to-peer trading growth

- Southeast Asia’s mobile-first adoption

- Middle East’s wealth preservation strategies

- Eastern Europe’s financial inclusion initiatives

Impact of Global Economic Conditions

The Bitcoin price today often correlates with broader economic indicators, including inflation rates, currency devaluations, and monetary policy decisions by major central banks.

Economic Factors:

- Federal Reserve interest rate decisions

- Global inflation trends

- Currency devaluation concerns

- Geopolitical tensions and safe-haven demand

Bitcoin Price Today Technical Analysis

Technical analysis provides valuable insights into potential Bitcoin price movements by examining historical price patterns, trading volumes, and market indicators. The Bitcoin price today can be analyzed using various technical tools and methodologies.

Key Technical Indicators

Moving Averages:

- 50-day and 200-day moving average crossovers

- Exponential moving averages for trend identification

- Moving average convergence divergence (MACD)

- Bollinger Bands for volatility measurement

Momentum Indicators:

- Relative Strength Index (RSI) for overbought/oversold conditions

- Stochastic oscillators for momentum shifts

- Commodity Channel Index (CCI) for cyclical analysis

- Williams %R for short-term reversals

Chart Pattern Recognition

Professional traders frequently utilize chart patterns to forecast future Bitcoin price movements, drawing on historical market behavior.

Common Patterns:

- Head and shoulders formations

- Triangle consolidations

- Support and resistance levels

- Flag and pennant continuations

Understanding these technical patterns helps investors make more informed decisions about entry and exit points based on the current Bitcoin price.

Security Considerations When Trading Bitcoin

As the Bitcoin price today attracts more investors, security becomes increasingly important. Protecting your cryptocurrency investments requires understanding various security measures and best practices.

Wallet Security Best Practices

Cold Storage Solutions:

- Hardware wallets for long-term storage

- Paper wallets for offline security

- Multi-signature requirements

- Regular backup procedures

Hot Wallet Precautions:

- Two-factor authentication (2FA)

- Strong password requirements

- Regular software updates

- Limited funds for daily trading

Exchange Security Measures

When monitoring the Bitcoin price today and executing trades, choosing secure exchanges is crucial for protecting your investments.

Security Features to Look For:

- Insurance coverage for digital assets

- Cold storage for customer funds

- Regular security audits

- Compliance with regulatory standards

Future Outlook for Bitcoin Price

The Bitcoin price today represents just one point in the cryptocurrency’s ongoing evolution. Understanding future trends and potential developments helps investors prepare for various market scenarios.

Technological Developments

Upcoming Improvements:

- Lightning Network scaling solutions

- Privacy enhancement protocols

- Quantum resistance preparations

- Energy efficiency improvements

Market Maturation Trends

Institutional Infrastructure:

- Custody solutions development

- Derivatives market expansion

- Integration with traditional finance

- Regulatory framework establishment

These developments suggest that the Bitcoin price today may represent early stages of a more mature and stable cryptocurrency market.

Conclusion

Understanding the current Bitcoin price requires more than simply checking market values. Successful cryptocurrency investing involves analyzing market trends, understanding technological developments, and staying informed about regulatory changes that impact Bitcoin’s long-term value proposition.

The current Bitcoin price today represents years of innovation, growing institutional acceptance, and increasing mainstream adoption. While short-term volatility remains a characteristic of the cryptocurrency market, Bitcoin’s fundamental value propositions—digital gold and a decentralized store of value — continue to attract investors worldwide.