On December 26, 2025, Bitcoin (BTC) maintained a strong position near $89,000, navigating a complex interplay of market factors. Holiday-thinned liquidity, ETF outflows, and a record-breaking options expiry converged to create a dynamic trading environment for the leading cryptocurrency. Investors and traders are carefully analyzing market flows, macroeconomic indicators, and technical levels as BTC continues to fluctuate around this critical zone.

The current market scenario underscores how seasonality, institutional activity, and derivatives expiration can collectively influence Bitcoin’s price. Holiday periods typically see reduced trading volumes, which can amplify price swings, while ETF outflows and options expiries introduce additional layers of volatility. Understanding these dynamics is crucial for investors seeking to interpret Bitcoin’s near-term trajectory and make informed decisions in a highly active market.

This article explores the factors influencing Bitcoin’s price today, examining holiday liquidity trends, ETF flows, options market dynamics, and technical analysis, providing a comprehensive view of BTC’s current position and potentialBitcoin Price Today

Holiday-Thinned Liquidity and Market Behavior

Impact of Reduced Trading Volumes

During holiday periods, global financial markets often experience significantly lower trading volumes. For Bitcoin, this reduced liquidity can magnify the impact of both buy and sell orders, resulting in wider price swings even with relatively small transaction sizes.

The thinning of market participation can create both risks and opportunities. While some investors may hesitate to engage due to unpredictability, others leverage the volatility for short-term trading strategies. The holiday environment on December 26 has contributed to BTC holding near $89,000, as small inflows and outflows exert amplified influence on the market.

Seasonal Investor Sentiment

Investor sentiment during holiday periods is often cautious, with traders and institutions balancing risk exposure while positioning for year-end portfolios. Reduced attention from retail traders and institutional investors can temporarily suppress momentum, making BTC’s price more sensitive to key catalysts such as ETF movements or large options expiries. The current stability near $89,000 reflects a balance between cautious optimism and underlying market demand, highlighting the importance of seasonal behavior in Bitcoin price dynamics.

ETF Outflows and Institutional Influence

Recent Trends in Bitcoin ETFs

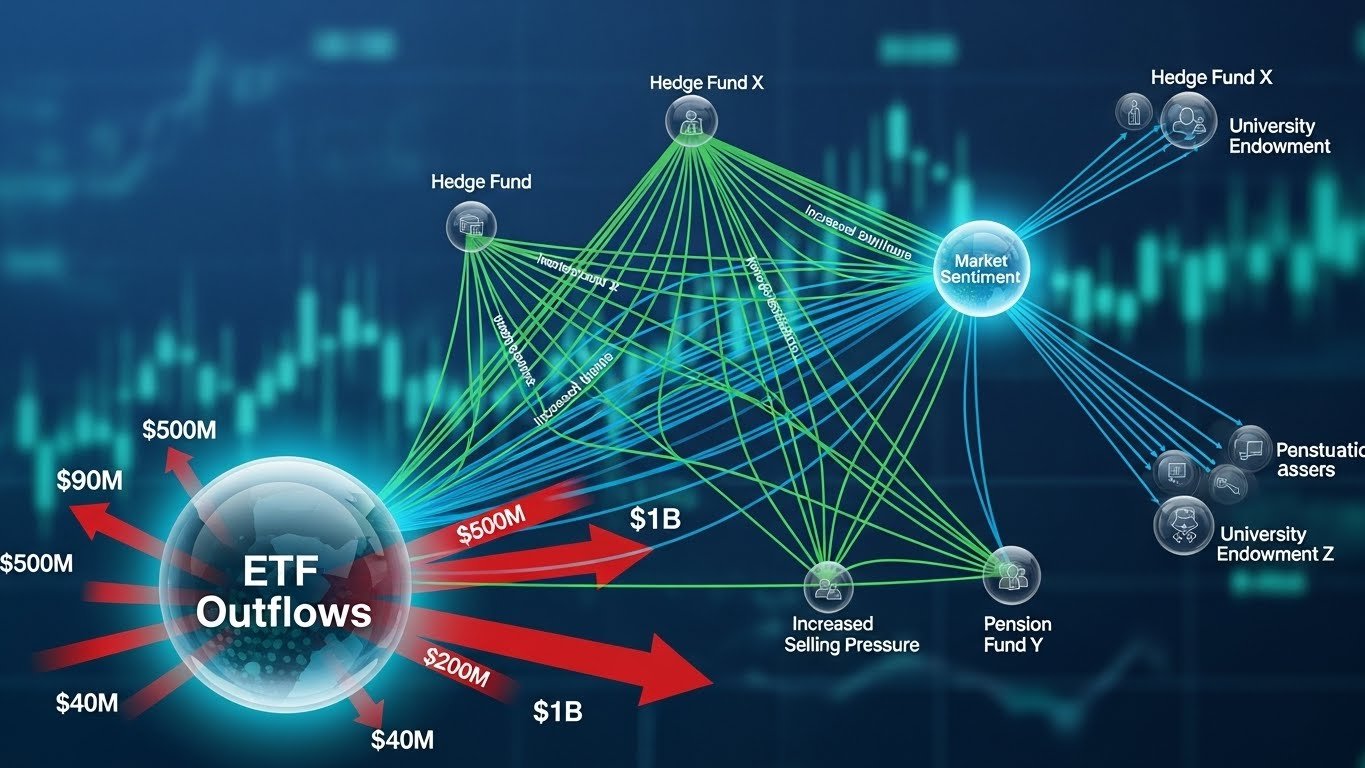

Exchange-traded funds (ETFs) linked to Bitcoin continue to play a significant role in price formation. Recent outflows from prominent Bitcoin ETFs have exerted downward pressure on BTC, as large-scale institutional participants adjust holdings based on portfolio needs, tax considerations, or profit-taking strategies.

The interaction of ETF flows with holiday-thinned liquidity creates a delicate balance, where outflows can influence short-term price trends despite broad market stability.

Institutional Sentiment and Market Positioning

Institutional investors often act as stabilizing or destabilizing forces, depending on market conditions and strategic objectives. Current ETF outflows reflect portfolio rebalancing rather than a shift in long-term bullish sentiment. The careful monitoring of these movements is essential, as institutional positioning can have amplified effects during periods of lower liquidity.

The confluence of ETF outflows and holiday trading patterns contributes to Bitcoin’s temporary range-bound behavior near $89,000, with both buying and selling pressures moderated by market depth.

Record Options Expiry and Derivatives Influence

Overview of Options Market Dynamics

Bitcoin derivatives markets, particularly options contracts, play a critical role in price behavior. On December 26, the market experienced a record options expiry, where numerous call and put contracts reached settlement. The closing of these positions often results in gamma hedging, volatility compression, and temporary price adjustments, influencing both spot and derivatives markets.

Price Impact of Expiring Contracts

The settlement of a high volume of options contracts introduces short-term pressure on BTC prices. Traders and market makers may adjust spot positions to hedge exposures, resulting in temporary price swings. The alignment of record options expiry with holiday liquidity has created a unique scenario where price movements are pronounced despite lower overall market participation.

This convergence explains Bitcoin’s relative stability near $89,000 while still experiencing intermittent volatility spikes tied to derivatives market activity.

Technical Analysis: BTC Near $89,000

Key Support and Resistance Levels

From a technical standpoint, BTC’s current price near $89,000 is approaching a critical support zone established by previous intraday highs and lows. Traders are closely watching these levels to gauge potential breakouts or corrective moves. Resistance levels near $90,500 to $91,000 serve as short-term barriers, while support near $87,500 provides a floor in case of downward pressure.

Technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands suggest that Bitcoin remains in a cautiously bullish phase, with potential for either consolidation or a breakout depending on market participation and liquidity dynamics.

Momentum and Trading Patterns

Price momentum is moderately positive, with short-term swings driven by derivatives hedging, ETF adjustments, and residual holiday trading flows. Momentum traders are balancing positions carefully, mindful of thin liquidity amplifying minor price movements. Historical patterns indicate that BTC often stabilizes after large options expiries, suggesting that current fluctuations may normalize in the coming days.

Macro Factors Influencing BTC Price

Global Market Correlations

Bitcoin’s behavior is increasingly linked to global financial markets, including equities, commodities, and foreign exchange trends. On December 26, correlations with risk assets were muted due to holiday-thinned activity, while safe-haven demand and macroeconomic indicators continued to influence investor sentiment.

The alignment of BTC with broader market trends highlights the importance of monitoring macro developments, including central bank announcements, currency strength, and geopolitical factors, which can amplify or dampen Bitcoin’s price movements.

Inflation and Monetary Policy Considerations

Inflation expectations and monetary policy decisions remain key drivers for BTC adoption as a digital store of value. The interplay between central bank policies and investor demand for hedge assets supports the narrative that Bitcoin retains a role as an alternative asset, particularly during periods of macroeconomic uncertainty.

Market Psychology and Investor Behavior

Holiday Trading and Risk Appetite

Investor psychology during holiday periods is characterized by reduced engagement and selective participation. Traders are often more conservative, leading to price ranges that reflect both caution and opportunism. The convergence of holiday trading with ETF outflows and options expiry has accentuated market sensitivity, influencing short-term BTC dynamics.

Speculative and Strategic Drivers

While some traders focus on short-term volatility created by options settlements, others adopt strategic positions based on year-end portfolio management, macroeconomic forecasts, and technical signals. This blend of speculative and strategic behavior underpins BTC’s current consolidation near $89,000.

Outlook for Bitcoin in the Near Term

Potential Scenarios Post-Holiday

As liquidity normalizes following the holiday period, BTC may experience either a continuation of bullish momentum or corrective consolidation, depending on institutional flows, options market adjustments, and investor sentiment. Analysts anticipate that post-expiry stabilization could set the stage for renewed upward movement toward $90,000 and beyond.

Strategic Considerations for Investors

Investors should monitor liquidity restoration, institutional ETF flows, and derivative market behavior to anticipate short-term volatility and price trajectories. Diversification, risk management, and close attention to technical levels are critical for navigating the post-holiday trading environment.

Conclusion

Bitcoin’s price on December 26, 2025, near $89,000, reflects a convergence of factors including holiday-thinned liquidity, ETF outflows, and record options expiry. The interaction of these elements has created a unique market environment where both stability and volatility coexist.

Understanding the influence of seasonal trading patterns, institutional positioning, and derivatives settlements is crucial for investors seeking to interpret BTC price movements. Technical indicators, macroeconomic trends, and investor psychology provide additional context, highlighting Bitcoin’s role as both a speculative and strategic asset in the evolving financial landscape.

The near-term outlook suggests that once normal trading volumes resume, Bitcoin may either consolidate within the $87,500–$90,500 range or experience renewed momentum depending on market flows and macro developments.

FAQs

Q: How has holiday-thinned liquidity influenced Bitcoin’s price near $89,000?

Holiday-thinned liquidity amplifies the effect of even small buy or sell orders, creating greater short-term volatility. On December 26, reduced participation contributed to BTC holding near $89,000 despite market fluctuations.

Q: What impact did ETF outflows have on BTC today?

ETF outflows exerted downward pressure on BTC, as institutional participants adjusted positions for portfolio rebalancing. However, the reduced liquidity moderated the impact, resulting in a relatively stable price range.

Q: How did the record options expiry affect Bitcoin’s market behavior?

The record options expiry triggered hedging adjustments and short-term volatility. Market makers and traders modified spot positions to mitigate risk, influencing BTC’s price swings near $89,000.

Q: What technical levels are critical for Bitcoin in the near term?

Key support is around $87,500, while resistance lies near $90,500 to $91,000. Technical indicators suggest cautious bullish momentum, with potential consolidation or breakout depending on liquidity and institutional flows.

Q: What should investors consider post-holiday for BTC trading?

Investors should monitor liquidity normalization, ETF and derivatives market activity, macroeconomic indicators, and technical signals. Strategic allocation, risk management, and attention to price levels are essential for navigating potential volatility.