The cryptocurrency market is buzzing with anticipation as investors seek reliable insights into Bitcoin’s future trajectory. Our comprehensive bitcoin price prediction 2025 forecast combines institutional analysis, technical indicators, and market fundamentals to provide you with the most accurate outlook for BTC’s performance in the coming year. With Bitcoin currently trading above $117,000 and institutional adoption reaching unprecedented levels, understanding the factors that will drive price movements has never been more critical. This detailed forecast examines everything from ETF impacts to regulatory developments, giving you the complete picture of where Bitcoin might be headed in 2025.

Current Bitcoin Market Landscape

Bitcoin’s journey through 2025 has been marked by significant volatility and institutional interest. The cryptocurrency has demonstrated remarkable resilience, maintaining strong support levels above $75,000 while navigating through various market pressures. Current market dynamics show a complex interplay between institutional adoption, regulatory clarity, and macroeconomic factors that continue to shape Bitcoin’s price trajectory.

The introduction of spot Bitcoin ETFs has fundamentally altered the investment landscape, bringing billions of dollars in institutional capital to the cryptocurrency market. Major financial institutions like BlackRock, Fidelity, and VanEck have collectively attracted over $15 billion in net flows, representing approximately 7% of Bitcoin’s circulating supply. This institutional backing provides a solid foundation for our Bitcoin price prediction 2025 forecast analysis.

Market sentiment indicators, including the Fear and Greed Index, have shown periods of both extreme optimism and caution throughout the year. These fluctuations reflect the ongoing maturation of the cryptocurrency market as it transitions from purely speculative trading to more fundamental-based valuation methods.

Bitcoin Price Prediction 2025 Forecast Institutional Analysis

Leading financial institutions have released increasingly bullish projections for Bitcoin’s 2025 performance. Standard Chartered’s Head of Digital Assets Research, Geoff Kendrick, maintains a long-term target of $500,000 by the end of Donald Trump’s current presidential term, with intermediate targets of $200,000 by end-2025.

VanEck, one of the major ETF providers, predicts Bitcoin will peak at $180,000 by Q4 2025, with potential summer volatility before achieving new all-time highs in the year’s final quarter. This forecast aligns with historical patterns of Bitcoin’s cyclical behaviour and the ongoing halving cycle effects.

Bernstein analysts have revised their Bitcoin price targets upward, forecasting nearly $200,000 by the end of 2025. Their analysis emphasises the “Trojan Horse” effect of institutional basis trades, where traditional finance entities are gradually increasing their Bitcoin exposure through ETF mechanisms.

Technical Analysis Supporting 2025 Forecasts

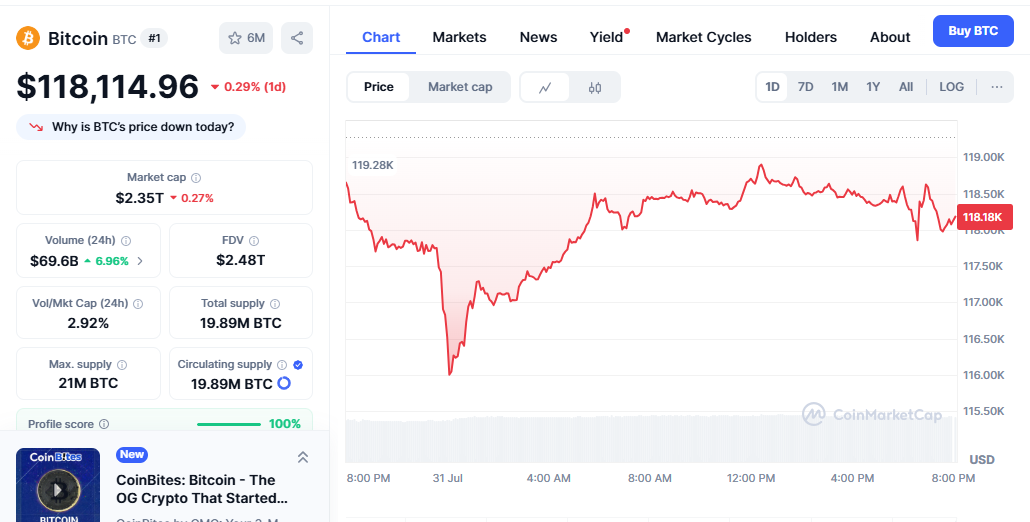

From a technical perspective, Bitcoin continues to trade within a broad ascending channel that has characterised much of its 2025 performance. Key resistance levels sit at $120,899, while critical support remains at $114,790. The 14-day RSI currently indicates neutral market conditions at 45.18, suggesting room for both upward and downward price movement.

Chart patterns reveal a potential descending triangle formation that typically compresses price action before significant breakouts. Historical analysis suggests that successful breaks above the triangle’s resistance could trigger substantial rallies toward the $150,000-$180,000 range predicted by major institutions.

Volume analysis shows increasing institutional participation during price dips, indicating strong accumulation patterns among long-term holders. This behaviour supports bullish bitcoin price prediction 2025 forecast scenarios where temporary volatility leads to higher prices over time.

Key Factors Driving Bitcoin’s 2025 Price Movement

ETF Impact and Institutional Adoption

The approval and success of spot Bitcoin ETFs represent the most significant development for cryptocurrency adoption in recent years. Current data shows that nearly 80% of ETF flows come from retail investors through broker platforms, while institutional integration is still in early stages. This suggests substantial room for growth as wirehouses and institutional platforms complete their integration processes.

Projected ETF assets under management could reach $190 billion by the market peak in 2025, with long-term forecasts suggesting $3 trillion by 2033. These projections form a cornerstone of optimistic bitcoin price prediction 2025 forecast models, as sustained capital inflows typically drive price appreciation.

Corporate treasury adoption continues expanding beyond early adopters like MicroStrategy and Tesla. Major corporations are increasingly viewing Bitcoin as a treasury asset and inflation hedge, contributing to steady demand pressure that supports higher price levels.

Regulatory Environment and Political Support

The regulatory landscape has shown marked improvement with more explicit guidance from financial authorities and political support from key figures. President Trump’s proposal for a national Bitcoin reserve has lifted investor confidence and provided regulatory clarity that institutional investors require for larger allocations.

Federal Reserve policies regarding interest rates and inflation continue to impact Bitcoin’s attractiveness relative to traditional assets. Lower interest rate environments typically favour risk assets like Bitcoin, while higher rates can create competitive pressure from yield-bearing instruments.

International regulatory developments, particularly in Europe and Asia, play crucial roles in global adoption patterns. Positive regulatory frameworks in major economies support institutional confidence and cross-border investment flows.

Price Target Analysis Conservative vs Bullish Scenarios

Conservative Forecast Scenarios

Conservative bitcoin price prediction 2025 forecast models suggest price ranges between $120,000 and $150,000 by year-end. These projections account for potential market corrections, regulatory uncertainties, and macroeconomic headwinds that could constrain price growth.

Factors supporting conservative scenarios include potential Federal Reserve policy changes, geopolitical tensions affecting risk asset preferences, and natural profit-taking activities as Bitcoin approaches previous psychological resistance levels.

Technical analysis supporting conservative projections points to natural resistance zones around $140,000-$150,000, where significant selling pressure might emerge from early institutional investors and long-term holders taking profits.

Bullish Forecast Scenarios

Bullish projections for Bitcoin in 2025 range from $180,000 to $200,000, with some extreme forecasts reaching $300,000 or higher. These scenarios assume continued institutional adoption acceleration, positive regulatory developments, and favourable macroeconomic conditions.

Key drivers for bullish outcomes include faster-than-expected ETF adoption, corporate treasury accumulation, and potential sovereign wealth fund allocations to Bitcoin. Additional catalysts might include major payment processor integrations and central bank digital currency developments that increase Bitcoin’s utility.

The Bitcoin halving cycle effects continue supporting long-term bullish scenarios, as reduced supply growth historically correlates with significant price appreciation over 12-18 month periods following halving events.

Market Dynamics and Supply-Demand Analysis

Supply Side Factors

Bitcoin’s fixed supply cap of 21 million coins creates inherent scarcity that becomes more pronounced as adoption increases. Current circulating supply approaches 19.8 million BTC, with mining rewards continuing to decrease through the halving mechanism.

Long-term holding behaviour shows strong accumulation patterns, with addresses holding Bitcoin for over one year maintaining elevated balances despite price volatility. This “hodling” behaviour effectively reduces the liquidity supply available for trading, potentially amplifying price movements.

Mining economics remain healthy despite increased network difficulty, with significant mining operations maintaining profitability at current price levels. Sustainable mining operations provide network security while limiting selling pressure from miners.

Also Read: Bitcoin Price Prediction 2025-2028 $50K Forecast by Standard

Demand Side Dynamics

Institutional demand through ETFs shows no signs of slowing, with regular inflows continuing even during periods of price consolidation. Retail demand remains strong, particularly in regions experiencing currency devaluation or economic uncertainty.

Corporate adoption extends beyond treasury allocation to include payment processing, employee compensation, and strategic partnerships. These use cases create ongoing demand that supports price stability and growth.

International demand patterns show increasing adoption in emerging markets, where Bitcoin serves as both an investment vehicle and a currency alternative. This geographic diversification strengthens overall demand resilience.

Technical Indicators and Chart Analysis

Moving average analysis reveals Bitcoin trading above key exponential moving averages, suggesting continued bullish momentum despite short-term volatility. The 50-day EMA provides immediate support around $110,000, while the 200-day EMA offers longer-term support near $95,000.

Relative Strength Index (RSI) readings across multiple timeframes indicate balanced conditions without extreme overbought or oversold signals. This technical balance supports projections for continued price appreciation without immediate correction requirements.

Volume-weighted average price (VWAP) analysis shows institutional accumulation during price dips, confirming strong demand at lower levels and supporting higher price targets in the bitcoin price prediction 2025 forecast scenarios.

Risk Factors and Potential Challenges

Market Risk Considerations

Cryptocurrency markets remain inherently volatile, with Bitcoin capable of experiencing 20-30% price swings within short timeframes. Investors should prepare for significant volatility even within bullish forecast scenarios.

Correlation with traditional risk assets during market stress events could limit Bitcoin’s safe-haven appeal during broader financial market downturns. This correlation risk affects the timing and magnitude of price movements predicted in various forecast models.

Liquidity risks during extreme market conditions could amplify price movements in both directions, potentially creating temporary disconnects from fundamental valuation metrics.

Regulatory and Political Risks

Changes in regulatory stance from major economies could significantly impact institutional adoption rates and price trajectories. Potential policy reversals or unexpected regulatory restrictions represent key risks to bullish forecasts.

Tax policy changes affecting cryptocurrency investments could influence demand patterns, particularly from institutional and high-net-worth investors who drive significant market volume.

International sanctions or restrictions on cryptocurrency usage could limit global adoption and reduce the addressable market size for Bitcoin investments.

Investment Strategies Based on 2025 Forecasts

Dollar-Cost Averaging Approaches

Regular investment strategies that average purchase prices over time can help investors benefit from Bitcoin’s volatility while building positions aligned with long-term Bitcoin price prediction 2025 forecast targets.

Systematic investment plans allow investors to participate in potential upside while managing timing risks associated with volatile cryptocurrency markets. These approaches work particularly well for retail investors without sophisticated market timing capabilities.

Institutional investors increasingly adopt dollar-cost averaging through ETF mechanisms, providing steady demand support that underpins bullish price forecasts.

Risk Management Strategies

Position sizing remains crucial for Bitcoin investments, with most financial advisors recommending 1-5% portfolio allocations to cryptocurrency assets. This sizing allows participation in potential gains while limiting portfolio impact from adverse price movements.

Stop-loss strategies require careful consideration in Bitcoin markets due to high volatility and potential for rapid price recovery after temporary declines. Many successful investors prefer longer-term holding periods over active trading approaches.

Diversification across multiple cryptocurrency assets can help manage specific risks to Bitcoin while maintaining exposure to the broader digital asset ecosystem growth trends.

Comparative Analysis with Traditional Assets

Bitcoin’s performance relative to traditional assets like gold and stocks provides context for investment allocation decisions. Historical data shows Bitcoin’s superior long-term returns despite higher volatility, supporting its inclusion in diversified portfolios.

Correlation analysis with major stock indices suggests Bitcoin increasingly behaves as a distinct asset class, offering portfolio diversification benefits during certain market conditions while maintaining growth potential.

Inflation hedge characteristics become more relevant as central banks navigate monetary policy challenges, with Bitcoin potentially outperforming traditional inflation hedges during periods of currency debasement.

Expert Opinions and Market Sentiment

Leading cryptocurrency analysts maintain predominantly bullish outlooks for Bitcoin’s 2025 performance, citing institutional adoption trends and supply-demand fundamentals. These professional assessments form essential components of a comprehensive Bitcoin price prediction 2025 forecast analysis.

Sentiment indicators from social media and trading platforms show sustained optimism,periodicc volatility, suggesting strong underlying confidence in Bitcoin’s long-term value proposition.

Academic research increasingly supports Bitcoin’s role as a legitimate asset class, with peer-reviewed studies validating portfolio allocation benefits and long-term growth potential.

Conclusion

Our comprehensive bitcoin price prediction 2025 forecast analysis reveals a predominantly bullish outlook supported by institutional adoption, regulatory clarity, and fundamental supply-demand dynamics. While price targets range from conservative $120,000-$150,000 to bullish $180,000-$200,000 scenarios, the consensus among major institutions points toward significant upside potential for Bitcoin in 2025.

The combination of ETF-driven institutional capital, corporate treasury adoption, and potential sovereign allocations creates a compelling investment thesis for Bitcoin’s continued price appreciation. However, investors must remain aware of inherent volatility and risk factors that could impact these projections.

Ready to position yourself for Bitcoin’s 2025 potential? Consider developing a systematic investment approach that aligns with your risk tolerance and takes advantage of the opportunities highlighted in this Bitcoin price prediction 2025 forecast. Remember to conduct thorough research and consider professional financial advice before making investment decisions.