The Bitcoin price prediction 2025 expert analysis landscape has never been more compelling, with leading financial institutions, cryptocurrency analysts, and blockchain experts converging on bullish forecasts that could reshape the digital asset market. As Bitcoin continues to establish itself as “digital gold,” institutional adoption accelerates, and regulatory clarity improves, professional analysts are painting an increasingly optimistic picture for 2025.

Recent expert analyses from Standard Chartered, ARK Invest, VanEck, and other prestigious institutions suggest Bitcoin could reach unprecedented heights in 2025. These predictions are based on comprehensive fundamental analysis, technical indicators, and macroeconomic factors, which professional traders and institutional investors rely upon. Understanding these expert perspectives becomes crucial for anyone considering Bitcoin investment strategies in the coming year.

This comprehensive analysis compiles the most credible Bitcoin price predictions from verified industry experts, examining the methodologies behind their forecasts and the key factors driving their optimistic outlook for 2025.

Current Bitcoin Market Landscape in 2025

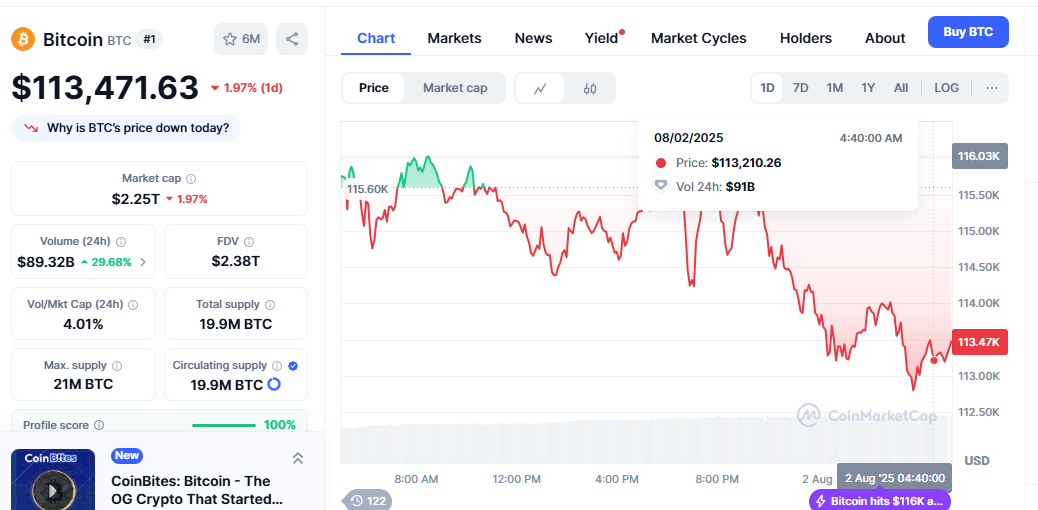

Bitcoin’s position in early 2025 reflects remarkable institutional maturation and mainstream acceptance. Trading at approximately $115,000 as of August 2025, Bitcoin has already demonstrated significant price appreciation from its previous cycle lows, establishing a foundation for further growth according to expert analysis.

The cryptocurrency market has witnessed unprecedented institutional inflows through Bitcoin ETFs, with BlackRock’s iShares Bitcoin ETF alone holding over 625,000 BTC. This institutional accumulation has fundamentally altered Bitcoin’s supply dynamics, creating the scarcity conditions that many experts believe will drive substantial price appreciation throughout 2025.

Professional analysts note that Bitcoin’s correlation with traditional financial markets has decreased, suggesting the digital asset is developing independent value propositions that could support higher valuations. The combination of limited supply, increasing institutional demand, and improving regulatory frameworks creates what many experts describe as a “perfect storm” for Bitcoin price appreciation.

Market volatility remains a characteristic feature, but expert analysis indicates that volatility has been decreasing over longer timeframes, suggesting market maturation that could support more stable price appreciation patterns throughout 2025.

Bitcoin Price Prediction 2025 Expert Analysis

Standard Chartered’s Aggressive $200,000 Target

Standard Chartered’s Head of Digital Assets Research, Geoff Kendrick, presents one of the most bullish expert analyses for Bitcoin in 2025. His research methodology incorporates institutional adoption rates, regulatory developments, and macroeconomic factors to project Bitcoin reaching $200,000 by the end of 2025.

Kendrick’s analysis emphasizes the role of institutional demand as the primary price driver. His team’s models suggest that continued ETF inflows, corporate treasury adoption, and sovereign wealth fund allocations could create sustained buying pressure throughout 2025. The bank’s expert analysis particularly focuses on the supply shock effects created by institutional accumulation strategies.

The Standard Chartered forecast incorporates geopolitical factors, including potential currency debasement and inflation hedging demand that could accelerate Bitcoin adoption among institutional investors. Their expert analysis suggests that even conservative institutional allocation targets of 1-2% could generate demand far exceeding available supply.

ARK Invest’s Million-Dollar Vision

Cathie Wood’s ARK Invest provides perhaps the most aggressive long-term expert analysis, with Bitcoin price predictions extending beyond 2025. While their base case for 2025 centers around $150,000-$200,000, ARK’s expert analysis methodology incorporates network effects, technological developments, and adoption curves that suggest exponential growth potential.

ARK’s expert analysis framework examines Bitcoin through multiple lenses: store of value adoption, payment system development, and digital asset integration into traditional finance. Their models suggest that if Bitcoin captures even a small percentage of global store-of-value markets, current price levels represent significant undervaluation.

The investment firm’s expert analysis particularly emphasizes Bitcoin’s role as a hedge against monetary debasement, with their models suggesting that continued central bank money printing could drive substantial institutional allocation to Bitcoin as a portfolio hedge.

VanEck’s Conservative-Bullish Approach

VanEck’s expert analysis takes a more measured approach while remaining fundamentally bullish on Bitcoin’s 2025 prospects. Their research team projects Bitcoin trading in the $120,000-$180,000 range throughout 2025, based on historical cycle analysis and current market fundamentals.

VanEck’s methodology incorporates Bitcoin’s four-year halving cycles, institutional adoption curves, and regulatory development timelines. Their expert analysis suggests that 2025 represents the optimal period within the current cycle for significant price appreciation, as institutional infrastructure matures and regulatory clarity improves.

The firm’s expert analysis particularly emphasizes risk-adjusted returns, suggesting that Bitcoin’s risk-reward profile remains attractive even at current price levels, with potential for substantial appreciation through 2025.

Technical Analysis from Professional Traders

Chart Pattern Recognition and Price Targets

Professional technical analysts have identified several bullish chart patterns supporting optimistic Bitcoin price predictions for 2025. The formation of a multi-year cup and handle pattern, according to expert analysis, suggests potential price targets well above current levels.

Expert analysis of Bitcoin’s weekly and monthly charts reveals strong support levels around $75,000-$80,000, with resistance levels that, once broken, could trigger rapid price advancement toward $150,000-$200,000. These technical formations align with fundamental analysis from institutional experts.

On-chain analysis experts have identified accumulation patterns among long-term holders that historically precede significant price appreciation phases. The combination of decreasing exchange balances and increasing whale accumulation suggests strong hands are preparing for substantial price movements.

Volume Analysis and Market Structure

Expert analysis of Bitcoin’s trading volume patterns reveals institutional-grade accumulation occurring at current price levels. Professional traders note that volume profiles suggest limited selling pressure above $120,000, potentially creating conditions for rapid price advancement once key resistance levels are breached.

The market structure analysis from trading experts indicates that Bitcoin’s price discovery mechanism has evolved to incorporate longer-term institutional demand rather than retail speculation. This structural change supports more sustained price appreciation scenarios rather than boom-bust cycles.

Expert analysis of futures markets and options positioning reveals institutional investors positioning for significant upside price movements throughout 2025, with substantial call option interest at $150,000-$200,000 strike prices.

Macroeconomic Factors Driving Expert Predictions

Monetary Policy and Inflation Hedging

Expert analysis consistently identifies monetary policy as a primary driver of Bitcoin price predictions for 2025. With central banks maintaining accommodative policies and inflation concerns persisting, financial experts increasingly view Bitcoin as a necessary portfolio hedge.

Professional economic analysts note that Bitcoin’s fixed supply schedule provides a predictable monetary policy in contrast to fiat currencies. This characteristic becomes increasingly valuable as governments worldwide grapple with debt sustainability and currency debasement pressures.

Expert analysis of institutional allocation models suggests that even conservative 1-2% portfolio allocations to Bitcoin could generate demand far exceeding current supply, creating the scarcity conditions that drive expert price predictions for 2025.

Regulatory Clarity and Institutional Infrastructure

The regulatory landscape for Bitcoin has improved significantly, according to expert analysis from legal and compliance professionals. Clear regulatory frameworks in major jurisdictions are removing institutional adoption barriers that previously limited Bitcoin investment.

Expert analysis indicates that regulatory approval of Bitcoin ETFs represents just the beginning of institutional infrastructure development. Additional products, including Bitcoin futures, options, and structured products, are expected to expand institutional access throughout 2025.

Professional regulatory experts suggest that clear tax treatment and accounting standards for Bitcoin will eliminate remaining institutional hesitation, potentially accelerating adoption beyond current expert predictions.

Risk Factors and Potential Challenges

Market Volatility and Correction Risks

Despite optimistic expert analysis, professional risk managers emphasize that Bitcoin remains subject to significant volatility. Expert analysis suggests that even within a bullish 2025 scenario, corrections of 20-40% are possible and should be expected.

Professional traders’ expert analysis indicates that reaching price targets of $150,000-$200,000 would likely involve multiple correction phases that test investor resolve. Understanding these volatility patterns becomes crucial for long-term investment success.

Expert analysis of historical price cycles suggests that the magnitude of corrections tends to decrease as market capitalization increases, potentially making 2025 corrections less severe than previous cycles.

Regulatory and Political Risks

Expert analysis acknowledges that regulatory changes could impact Bitcoin price trajectories, despite current positive trends. Professional political analysts monitor potential policy shifts that could affect institutional adoption patterns.

International regulatory coordination efforts, according to expert analysis, could either accelerate or hinder Bitcoin adoption depending on implementation approaches. Professional analysts emphasize the importance of monitoring regulatory developments across major jurisdictions.

Expert analysis suggests that political changes in key markets could create temporary volatility but are unlikely to derail long-term institutional adoption trends supporting 2025 price predictions.

Institutional Adoption Trends Supporting Price Predictions

Corporate Treasury Adoption

Expert analysis of corporate adoption trends reveals accelerating interest in Bitcoin treasury strategies. Professional corporate finance analysts are identifying a growing acceptance of Bitcoin as a legitimate treasury asset among Fortune 500 companies.

MicroStrategy’s continued accumulation strategy, according to expert analysis, has demonstrated successful corporate Bitcoin adoption that other companies are beginning to emulate. This trend could significantly impact the available Bitcoin supply throughout 2025.

Professional treasury management experts suggest that corporate adoption could create sustained buying pressure that supports expert price predictions, as companies implement systematic accumulation strategies similar to traditional reserve assets.

Sovereign Wealth Fund Interest

Expert analysis indicates increasing interest from sovereign wealth funds in Bitcoin allocation strategies. Professional institutional analysts note that even small allocations from these massive funds could significantly impact Bitcoin’s price trajectory.

Government adoption trends, according to expert analysis, suggest that Bitcoin’s role as a strategic reserve asset is gaining acceptance among nation-states. This development could provide substantial price support throughout 2025.

Professional geopolitical analysts suggest that Bitcoin adoption by smaller nations could accelerate as digital asset infrastructure improves and regulatory frameworks solidify.

Also Read: Ethereum Price Prediction 2025 Analysis Expert Forecasts & Market Trends

Technology Developments Impacting Price Predictions

Lightning Network and Scalability Solutions

Expert analysis of Bitcoin’s technological development reveals significant improvements in transaction capacity and user experience. Professional blockchain analysts suggest that Lightning Network adoption could expand Bitcoin’s utility beyond store-of-value applications.

Scalability improvements, according to expert analysis, could address previous concerns about Bitcoin’s transaction throughput, potentially expanding adoption and supporting higher valuations throughout 2025.

Professional technology analysts note that Bitcoin’s layer-2 solutions are maturing rapidly, potentially enabling new use cases that could drive additional demand and support expert price predictions.

Smart Contract and DeFi Integration

Expert analysis indicates that Bitcoin’s integration with decentralized finance protocols could expand its utility and value proposition. Professional blockchain analysts suggest that wrapped Bitcoin and cross-chain solutions are increasing Bitcoin’s functionality.

The development of Bitcoin-native smart contract capabilities, according to expert analysis, could position Bitcoin to capture value from the growing DeFi ecosystem while maintaining its security and decentralization characteristics.

Professional cryptocurrency analysts suggest that technological developments could support Bitcoin adoption beyond traditional store-of-value use cases, potentially exceeding current expert price predictions for 2025.

Global Economic Context and Bitcoin’s Role

Currency Debasement and Store of Value Demand

Expert analysis consistently identifies currency debasement concerns as a primary driver of Bitcoin adoption. Professional economists note that fiscal and monetary policies worldwide are creating conditions favorable for alternative store-of-value assets.

The global debt situation, according to expert analysis, suggests that traditional monetary systems face sustainability challenges that could accelerate Bitcoin adoption among institutional and sovereign investors.

Professional macroeconomic analysts suggest that Bitcoin’s fixed supply schedule provides a hedge against monetary uncertainty that could drive substantial demand throughout 2025.

International Trade and Payment Systems

Expert analysis indicates that Bitcoin’s role in international trade could expand significantly, particularly as traditional payment systems face geopolitical pressures. Professional trade finance analysts note growing interest in Bitcoin for cross-border transactions.

The development of Bitcoin-based trade settlement systems, according to expert analysis, could create new demand sources that support optimistic price predictions for 2025.

Professional international finance experts suggest that Bitcoin’s neutral monetary properties could make it attractive for global trade as geopolitical tensions affect traditional payment systems.

Investment Strategy Implications

Dollar-Cost Averaging and Systematic Accumulation

Expert analysis consistently recommends systematic accumulation strategies for Bitcoin investment. Professional wealth managers suggest that dollar-cost averaging approaches can help investors benefit from price volatility while building long-term positions.

The volatility inherent in Bitcoin markets, according to expert analysis, creates opportunities for systematic investors to accumulate positions at favorable average prices throughout 2025.

Professional investment advisors suggest that systematic accumulation strategies align well with institutional adoption trends that support expert price predictions for 2025.

Portfolio Allocation and Risk Management

Expert analysis indicates that Bitcoin allocation within diversified portfolios continues to make sense despite current price levels. Professional portfolio managers suggest that allocation targets of 1-5% remain appropriate for most investors.

Risk management strategies, according to expert analysis, should account for Bitcoin’s volatility while recognizing its potential for substantial appreciation throughout 2025.

Professional financial planners suggest that Bitcoin’s correlation characteristics and return potential support its inclusion in well-diversified investment portfolios.

Market Sentiment and Investor Psychology

Institutional vs. Retail Sentiment

Expert analysis reveals significant differences between institutional and retail investor sentiment regarding Bitcoin. Professional sentiment analysts note that institutional investors remain systematically bullish while retail sentiment fluctuates with short-term price movements.

The maturation of institutional sentiment, according to expert analysis, provides stability that could support sustained price appreciation throughout 2025.

Professional behavioral analysts suggest that institutional sentiment is based on fundamental analysis rather than speculation, providing a more stable foundation for expert price predictions.

Fear and Greed Cycles

Expert analysis of market psychology indicates that Bitcoin markets continue to experience fear and greed cycles, but with decreasing amplitude as institutional participation increases.

Professional psychological analysts note that understanding sentiment cycles can help investors optimize entry and exit strategies while maintaining long-term positions aligned with expert predictions.

The evolution of market sentiment, according to expert analysis, suggests that Bitcoin markets are maturing in ways that support more stable price appreciation patterns.

Conclusion

The convergence of Bitcoin price prediction 2025 expert analysis from leading institutions creates a compelling case for significant price appreciation throughout the year. Professional analysts from Standard Chartered, ARK Invest, VanEck, and other prestigious institutions base their optimistic forecasts on concrete fundamental factors: institutional adoption acceleration, regulatory clarity improvements, and macroeconomic conditions favoring alternative store-of-value assets.

Expert analysis consistently identifies the current period as potentially pivotal for Bitcoin’s evolution from speculative asset to institutional-grade investment vehicle. The combination of limited supply, increasing institutional demand, and improving infrastructure creates conditions that professional analysts believe could drive Bitcoin toward $150,000-$200,000 targets throughout 2025.

However, expert analysis also emphasizes the importance of understanding risks and maintaining appropriate investment strategies. Professional recommendations consistently favor systematic accumulation approaches and proper portfolio allocation rather than speculative trading based on price predictions alone.