The Bitcoin market finds itself at a fascinating crossroads as we navigate through one of the most volatile periods in cryptocurrency history. With Bitcoin price movements capturing global attention, market participants are deeply divided on where the world’s leading digital asset is heading next. Current market sentiment reveals a stark polarization among Bitcoin speculators, with some predicting an imminent 7% correction while others maintain bullish outlooks targeting astronomical highs of $141,000.

This dramatic split in market opinion reflects the inherent complexity of cryptocurrency trading and the numerous factors influencing Bitcoin news today. From institutional adoption patterns to regulatory developments, macroeconomic pressures to technical analysis signals, the BTC price trajectory remains one of the most closely watched financial stories of our time.

Understanding these conflicting perspectives requires a deep dive into current market dynamics, examining both the bearish arguments supporting a potential correction and the bullish case for continued upward momentum. As Bitcoin investors navigate this uncertain landscape, the decisions made by large-scale speculators and institutional players continue to shape price discovery mechanisms across global exchanges.

The stakes have never been higher for the Bitcoin ecosystem, with trillions of dollars in market capitalization hanging in the balance. Whether we’re witnessing a temporary pause before another meteoric rise or the beginning of a more substantial pullback, the current market environment demands careful analysis of all available data points.

Current Bitcoin Market Overview

Bitcoin Price Analysis and Recent Performance

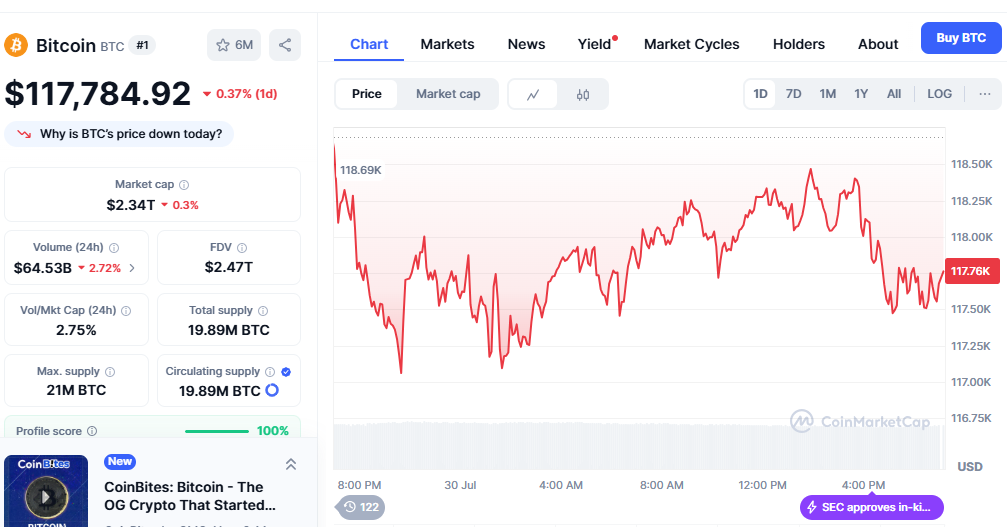

The Bitcoin market has experienced remarkable volatility in recent trading sessions, with price action reflecting the ongoing uncertainty among market participants. Current BTC price levels continue to test key resistance and support zones, creating an environment where both bulls and bears find technical justification for their respective positions.

Bitcoin trading volume has surged significantly, indicating heightened interest from both retail and institutional investors. This increased activity suggests that major market moves may be imminent, as prominent positions are being established across various price levels. The cryptocurrency market as a whole has been responding to Bitcoin’s price movements, demonstrating the continued dominance of BTC in digital asset markets.

Recent Bitcoin news has highlighted several critical developments affecting market sentiment. Regulatory clarity in major jurisdictions, institutional adoption announcements, and macroeconomic factors have all contributed to the current state of market uncertainty. Bitcoin investors are carefully weighing these factors against technical indicators to position themselves for potential upcoming volatility.

Market Sentiment and Trading Patterns

Professional Bitcoin speculators have been particularly active in options markets, with unusual volumes in both put and call options suggesting preparation for significant price movements. The options flow data reveals a fascinating dichotomy, with substantial bets placed on both dramatic upside moves and meaningful corrections.

Cryptocurrency trading patterns indicate that market makers are positioning for increased volatility, with wider bid-ask spreads and reduced liquidity at certain price levels. This market structure often precedes major breakouts or breakdowns, making the current environment particularly critical for Bitcoin price discovery.

Case for a 7% Bitcoin Correction

Technical Analysis Supporting Bearish Outlook

Several technical indicators are flashing warning signals that suggest a potential Bitcoin price correction may be overdue. Chart patterns, momentum oscillators, and volume analysis all point toward possible downside pressure in the near term.

The BTC price has been testing overhead resistance multiple times without achieving a decisive breakout, creating what technical analysts call a “multiple rejection pattern.” This formation often precedes corrective moves as buyers exhaust themselves attempting to push through significant resistance levels.

Bitcoin market leverage ratios have reached concerning levels, with futures markets showing excessive long positioning. Historically, such imbalances have led to forced liquidations and cascading price declines as overleveraged positions are unwound.

Fundamental Factors Supporting the Correction Thesis

Macroeconomic headwinds continue to create challenges for risk assets, including Bitcoin. Rising interest rates, inflation concerns, and global economic uncertainty have historically pressured speculative investments, and cryptocurrency markets are not immune to these forces.

Recent Bitcoin news regarding regulatory developments in key markets has introduced additional uncertainty. While long-term regulatory clarity may benefit the cryptocurrency market, short-term uncertainty often leads to risk-off behavior among institutional investors.

Bitcoin trading data shows that long-term holders have been taking profits at current levels, suggesting that even committed believers in the technology are being cautious about near-term price action. This distribution by strong hands often precedes corrective phases in bull markets.

Also Read: Bitcoin Hits $104K as Ethereum Surges. Will the Crypto Rally Last?

Bullish Case Path to $141K

Institutional Adoption and Demand Drivers

The bullish case for Bitcoin reaching $141,000 is built on several compelling fundamental arguments. Institutional adoption continues to accelerate, with major corporations, pension funds, and sovereign wealth funds allocating significant portions of their portfolios to Bitcoin and other digital assets.

Bitcoin news regularly features announcements of new institutional adoption, creating a consistent demand floor that supports higher price levels. The limited supply of 21 million Bitcoin, combined with increasing institutional demand, creates a supply-demand imbalance that could drive dramatic price appreciation.

Corporate treasury adoption represents another significant driver for Bitcoin price appreciation. As more companies follow the lead of early adopters, the potential for increased corporate demand could substantially impact market dynamics.

Technical Arguments for Continued Bull Market

From a technical perspective, Bitcoin remains in a long-term uptrend despite short-term volatility. Key moving averages continue to provide support, and the overall trend structure remains intact for those maintaining longer time horizon perspectives.

BTC price patterns on weekly and monthly charts suggest that current consolidation may be building energy for the next significant or upward move. Historical analysis of previous bull markets shows similar consolidation phases before significant breakouts to new all-time highs.

Bitcoin market cycles have historically produced price targets that initially seem impossible but eventually materialize over multi-year time frames. The $141,000 target, while ambitious, falls within the range of historical cycle analysis and logarithmic growth projections.

Speculation Impact on Bitcoin Price Discovery

How Large Speculators Influence Market Direction

Bitcoin speculators with substantial capital resources have an outsized impact on short-term price movements. Their trading decisions often trigger algorithmic trading systems and create momentum that smaller market participants follow.

The concentration of Bitcoin holdings among large addresses means that relatively few entities can significantly impact market liquidity and price discovery. When these “whales” decide to buy or sell, their actions often create the volatility that defines cryptocurrency trading.

Bitcoin price movements are frequently amplified by derivative markets, where speculators can take leveraged positions that exceed the underlying spot market size. This dynamic creates feedback loops that can drive prices well beyond what fundamental factors alone might justify.

Market Psychology and Crowd Behavior

Bitcoin investors are heavily influenced by social media sentiment, news cycles, and the actions of high-profile market participants. This psychological component adds complexity to Bitcoin market analysis and makes price prediction particularly challenging.

Fear and greed cycles play a significant role in cryptocurrency market dynamics. Current market conditions suggest we may be at a critical psychological inflection point where sentiment could shift dramatically in either direction.

The role of retail versus institutional psychology in Bitcoin trading continues to evolve as the market matures. Understanding these different participant groups and their behavioral patterns is crucial for anticipating future price movements.

Expert Predictions and Market Analysis

Professional Analyst Perspectives

Leading Bitcoin analysts remain divided on near-term price direction, with respected voices on both sides of the current debate. Technical analysts point to chart patterns and momentum indicators, while fundamental analysts focus on adoption metrics and macroeconomic factors.

Cryptocurrency market research firms have published conflicting reports, with some maintaining extremely bullish long-term targets while others warn of potential near-term corrections. This divergence in professional opinion reflects the genuine uncertainty in current market conditions.

Bitcoin news coverage of analyst predictions often focuses on the most extreme scenarios. Still, the reality is that most professionals acknowledge the high degree of uncertainty in current market conditions and emphasize risk management over directional predictions.

Historical Context and Precedent Analysis

Previous Bitcoin bull markets have featured similar periods of uncertainty and conflicting predictions. Historical analysis shows that major price movements often occur when market consensus is most divided, suggesting that current conditions may indeed precede significant volatility.

BTC price behavior during previous cycles provides some guidance, but the increasing institutional participation and changing market structure mean that historical patterns may not repeat exactly. The Bitcoin market continues to evolve in ways that make past performance an imperfect predictor of future results.

Risk Management in the Current Market Environment

Strategies for Bitcoin Investors

Given the current uncertainty in Bitcoin price direction, risk management becomes paramount for market participants. Diversification, position sizing, and clear exit strategies are essential components of any investment approach in current market conditions.

Bitcoin investors should consider their risk tolerance and investment timeline when making decisions in the current environment. Short-term speculation requires different risk management approaches than long-term accumulation strategies.

Cryptocurrency trading in volatile markets demands strict discipline and predetermined rules for both profit-taking and loss limitation. The current environment, with its potential for dramatic moves in either direction, makes these principles particularly important.

Portfolio Allocation Considerations

Professional portfolio managers recommend treating Bitcoin allocation as part of an alternative investment strategy, with position sizes appropriate to individual risk tolerance and overall portfolio objectives.

The correlation between Bitcoin and traditional financial markets has been increasing, which affects its role as a portfolio diversifier. Bitcoin market participants should consider these changing correlations when making allocation decisions.

Conclusion

The current Bitcoin market environment presents one of the most intriguing setups in the cryptocurrency’s history. With Bitcoin speculators firmly divided between expectations of a 7% correction and ambitious targets of $141,000, market participants face genuine uncertainty about near-term price direction.