Since its inception in 2009, Bitcoin has revolutionized how we think about money, financial systems, and technology. One of Bitcoin’s most unique aspects is its finite supply. Unlike traditional fiat currencies, which central banks can print at will, Bitcoin is capped at 21 million coins. This limit is hardcoded into its protocol; as of now, we are steadily approaching this maximum number. This begs the question: When will all Bitcoin be mined? Let’s dive deep into the timeline, the technical reasons behind the supply cap, and what this means for the future of Bitcoin.

The Basics of Bitcoin Mining and the 21 Million Supply Cap

It’s important to understand how the mining process works before we get into the timeline of when the last Bitcoin will be mined. Bitcoin is based on a decentralized, peer-to-peer network where transactions are recorded on a public ledger called the blockchain. The process of adding new transactions to this blockchain is called mining.

Miners use specialized hardware to solve complex mathematical puzzles, and the first one to solve the puzzle gets to add a block of transactions to the blockchain. Miners are rewarded with newly minted Bitcoin for their efforts. However, this reward is halved roughly every four years in an event known as the Bitcoin Halving. This is key to understanding why the total supply is capped at 21 million.

The halving mechanism ensures that the reward miners receive for mining a block decreases over time, and thus, fewer and fewer new Bitcoins enter circulation as time goes on. This continues until the reward becomes so small that no more Bitcoin will be issued, which brings us to the crux of our question: When will that be?

The Current State of Bitcoin Supply

As of October 2024, approximately 19.5 million Bitcoins have already been mined. This means over 92% of the total supply is already in circulation. The remaining 1.5 million Bitcoin will be mined over the next century, albeit at an increasingly slower rate due to the halving process.

Understanding the Bitcoin Halving

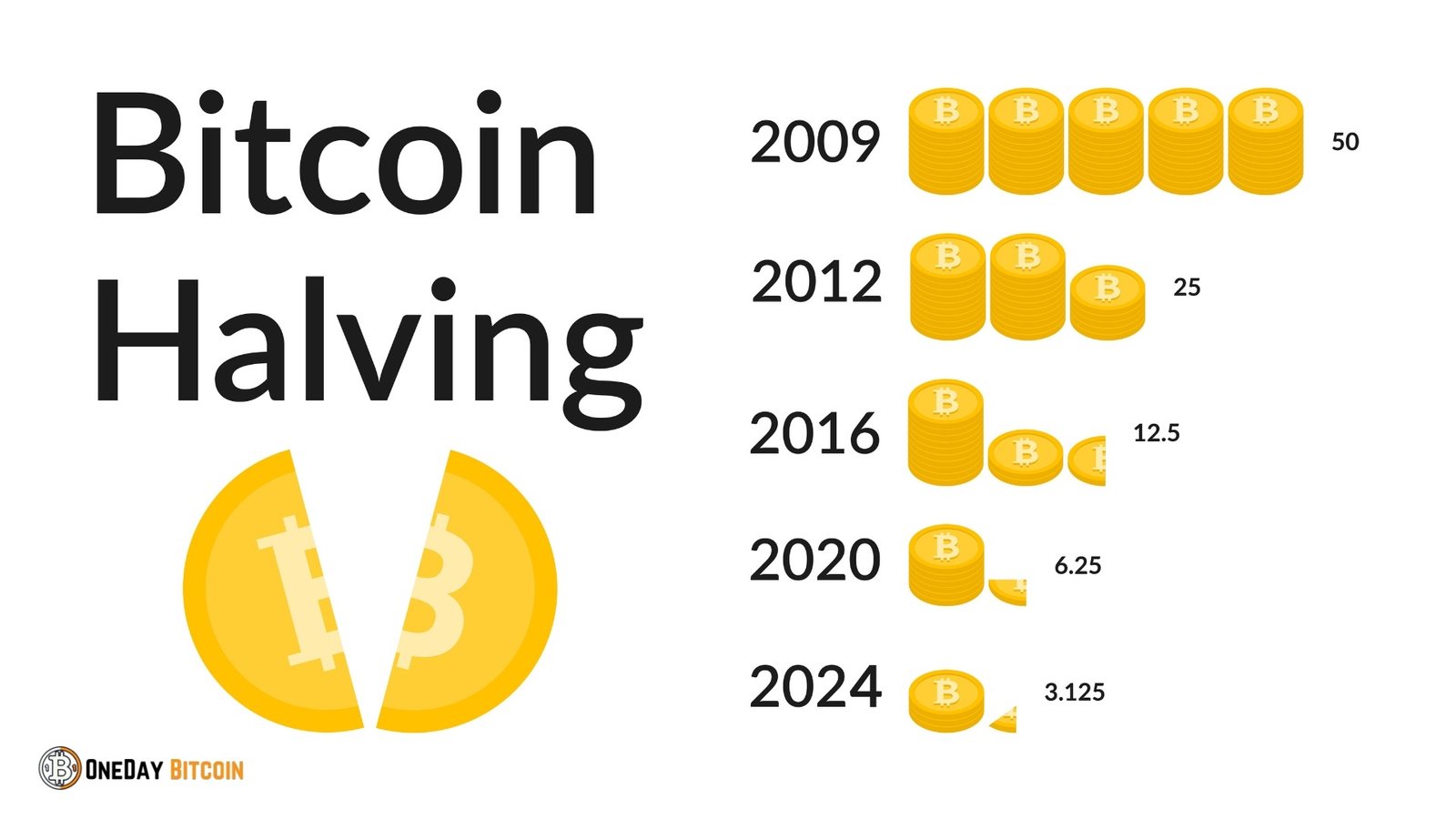

The Bitcoin Halving is one of the most critical events in the cryptocurrency’s lifecycle. When Bitcoin first launched, the reward for mining a block was 50 BTC. However, the reward is cut in half every 210,000 blocks, which occurs approximately every four years. Here’s a brief history of Bitcoin Halvings:

- 2009: 50 BTC per block

- 2012: 25 BTC per block

- 2016: 12.5 BTC per block

- 2020: 6.25 BTC per block

- 2024 (): 3.125 BTC per block

This halving process will continue until the block reward reaches zero, around 2140. At that point, no more Bitcoin will be created, and miners will only earn transaction fees as compensation for their work. However, due to the nature of the halving, the amount of Bitcoin being mined will become negligible long before 2140. For example, by 2030, over 98% of all Bitcoin will already have been mined.

The Timeline: When Will the Last Bitcoin Be Mined?

To calculate when the last Bitcoin will be mined, we must consider the halving schedule and the decreasing rate of Bitcoin production. The reward halves every four years, meaning that by 2040, the block reward will have dropped to around 0.0001 BTC or even less. At this point, even though new blocks will still be mined every 10 minutes, the amount of Bitcoin generated will be minuscule.

Given the current projections, the last Bitcoin is expected to be mined around 2140. This data is based on the consistent 10-minute block times and the ongoing halving cycles. Once we reach this point, no new Bitcoin will be circulated.

What Happens After All Bitcoin Is Mined?

The Bitcoin network will not simply cease to function once all Bitcoin is mined. Instead, miners will rely on transaction fees as their primary source of revenue. Every transaction on the Bitcoin network includes a small fee paid to miners for processing and confirming the transaction. Currently, miners earn most of their income from block rewards, but transaction fees will become increasingly important as those rewards dwindle.

There is some debate about whether transaction fees alone will be enough to incentivize miners to keep the network secure. Some worry that, as the block reward shrinks, there may not be enough incentive for miners to continue their work, leading to a decrease in security and a potential vulnerability to attacks. However, proponents of Bitcoin argue that, as the network grows and Bitcoin adoption increases, transaction fees will rise in proportion to the value of the network, ensuring that miners remain well-compensated.

Potential Risks and Concerns

While Bitcoin’s capped supply is often lauded as a key feature that sets it apart from inflationary fiat currencies, it also comes with potential risks.

- Network Security: As block rewards diminish, the reliance on transaction fees to maintain network security could pose a challenge. If transaction fees don’t rise sufficiently, miners may abandon the network, making it more vulnerable to attacks.

- Mining Centralization: Over time, the cost of mining has increased, requiring more specialized hardware and substantial electricity consumption. This has led to the centralization of mining in regions with access to cheap energy, potentially undermining Bitcoin’s decentralized ethos. As block rewards shrink, smaller miners may be driven out, further concentrating mining power.

- Deflationary Pressures: Bitcoin’s finite supply could lead to deflationary pressures, where the value of Bitcoin increases over time as its scarcity becomes more apparent. While this could benefit investors, it may discourage spending, leading to economic stagnation. If people hoard Bitcoin in anticipation of future price increases, it could reduce liquidity in the market.

What Could Delay or Accelerate the Timeline?

While 2140 is the widely accepted estimate for when the last Bitcoin will be mined, certain factors could accelerate or delay this timeline.

- Changes in Block Time: The Bitcoin network adjusts the difficulty of mining every 2,016 blocks to maintain a consistent 10-minute block time. However, if the hash rate—the total computational power being used to mine—increased significantly, it could shorten block times, leading to faster mining. Conversely, block times would increase if the hash rate were to drop, slowing the mining process.

- Technological Advances: Breakthroughs in hardware or mining algorithms could make mining more efficient, potentially speeding up the process. However, the Bitcoin protocol is designed to maintain its 10-minute block intervals, so an increase in mining difficulty would likely offset any gains in efficiency.

- Protocol Changes: Theoretically, the Bitcoin community could decide to change the 21 million supply cap or the halving schedule through a hard fork. However, such a change would be highly controversial and is unlikely to gain widespread support, as the fixed supply is a core tenet of Bitcoin’s value proposition.

Conclusion

The mining of the last Bitcoin is a monumental milestone that will mark the end of an era for cryptocurrency. While this won’t happen until 2140, the impact of Bitcoin’s capped supply is already being felt today as we approach the final stretch of mining. As we move closer to the 21 million mark, Bitcoin’s deflationary nature, mining incentives, and network security will come under increasing scrutiny. For now, the steady march toward 2140 continues, and Bitcoin remains a unique asset that offers both challenges and opportunities in the ever-evolving world of digital finance.