The cryptocurrency investment landscape just witnessed a significant shake-up as Ethereum ETFs Just Had Their Worst day in recent weeks. This sent shockwaves through the digital asset market. On what turned out to be a turbulent trading session, spot Ethereum exchange-traded funds recorded their most substantial net outflows since mid-September, raising concerns among investors and market analysts alike. This dramatic reversal in investor sentiment highlights the volatile nature of cryptocurrency investment vehicles and poses important questions about the future trajectory of Ethereum ETFs. The substantial withdrawal of capital from these investment products reflects broader uncertainties within the crypto ecosystem, prompting investors to reassess their positions in digital asset funds. Understanding what triggered this massive exodus and its implications for the broader Ethereum ETF market is crucial for anyone invested in or considering cryptocurrency investment products.

Scale of Ethereum ETF Outflows

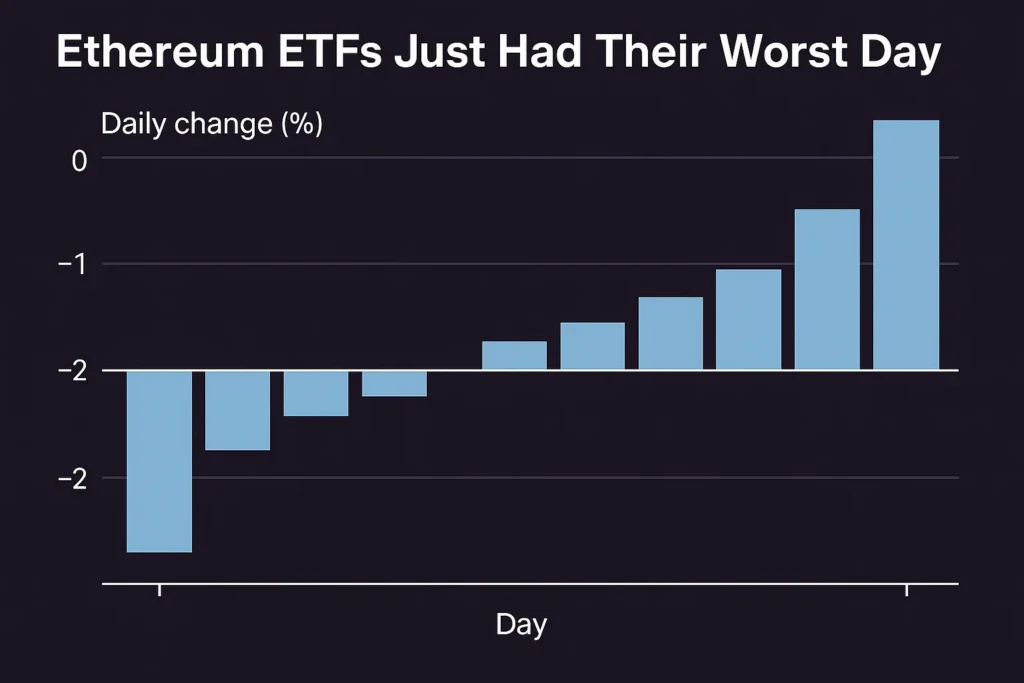

The magnitude of the recent Ethereum ETF’s worst day cannot be understated. According to preliminary data from industry tracking platforms, spot Ethereum exchange-traded funds experienced net outflows exceeding $15 million in a single trading session. This represented the most significant one-day capital withdrawal since September 23, 2024, marking a concerning milestone for these relatively new investment products. The outflows affected multiple Ethereum ETF providers simultaneously, suggesting that the selling pressure wasn’t isolated to a single fund but reflected a broader market sentiment shift.

Major institutional players contributed to these substantial withdrawals, with Grayscale’s Ethereum Trust and other prominent funds bearing the brunt of redemptions. The Ethereum ETF market, which had shown promising growth patterns throughout early 2025, suddenly faced a credibility test as investors rushed toward the exits. This coordinated movement of capital away from Ethereum ETFs raised essential questions about investor confidence in both the underlying asset and the investment vehicle itself.

What Triggered the Ethereum ETFs’ Worst Day?

Macroeconomic Pressures and Risk-Off Sentiment

Several converging factors contributed to the Ethereum ETF’s worst day of performance. The broader macroeconomic environment played a significant role, with mounting concerns about Federal Reserve monetary policy creating headwinds for risk assets across the board. As traditional equity markets experienced volatility, investors adopted a defensive posture, retreating from higher-risk investment vehicles, including cryptocurrency-focused Ethereum ETFs. The correlation between crypto assets and broader market sentiment became painfully evident as risk-averse capital allocation strategies dominated trading decisions.

Rising Treasury yields further complicated the investment landscape for Ethereum ETF holders. As safer, fixed-income alternatives offered increasingly attractive returns, the opportunity cost of maintaining exposure to volatile digital assets increased substantially. This shift in the risk-reward calculus prompted institutional investors to rebalance portfolios, often at the expense of cryptocurrency holdings, including Ethereum ETFs. The resulting capital reallocation created significant selling pressure that overwhelmed buying interest during the critical trading hours.

Ethereum Network Developments and Technical Concerns

Beyond macroeconomic factors, specific developments within the Ethereum ecosystem contributed to the Ethereum ETF’s worst day scenario. Technical concerns about network congestion and rising gas fees resurfaced as transaction volumes increased, reminding investors of persistent scalability challenges. Although Ethereum’s transition to proof-of-stake addressed energy consumption concerns, questions about the network’s ability to handle mainstream adoption levels continued to generate skepticism among conservative institutional investors.

Regulatory uncertainty also cast a shadow over Ethereum ETF performance. While the Securities and Exchange Commission had approved spot Ethereum exchange-traded funds, ongoing debates about the classification of specific tokens and potential regulatory changes created an atmosphere of uncertainty. This regulatory ambiguity prompted risk management professionals at institutional firms to recommend reducing exposure to Ethereum ETFs pending greater clarity from regulatory authorities.

Comparing Ethereum ETFs to Bitcoin ETF Performance

Diverging Trajectories in Crypto ETF Markets

TF’s worst for Ethereum ETFs ay stood in stark contrast to the relatively stable performance of Bitcoin exchange-traded funds during the same period. While Ethereum ETFs hemorrhaged capital, Bitcoin ETFs experienced modest inflows, highlighting a growing divergence in investor preferences within the cryptocurrency ETF space. This disparity suggested that institutional investors increasingly viewed Bitcoin as the preferred cryptocurrency investment vehicle, relegating Ethereum to a secondary position despite its technological innovations and innovative contract capabilities.

Bitcoin’s narrative as “digital gold” and a store of value resonated more strongly with conservative institutional investors than Ethereum’s positioning as a platform for decentralized applications. This philosophical difference manifested in capital allocation patterns, with Ethereum ETFs struggling to maintain parity with their Bitcoin counterparts. The performance gap widened significantly during periods of market stress, as evidenced by the worst day for the recent Ethereum ETFs while Bitcoin funds remained relatively resilient.

Market Share and Competition Dynamics

The competitive landscape among Ethereum ETF providers intensified following the mass outflow event. Established players like Grayscale, BlackRock, Fidelity, and VanEck competed aggressively for a shrinking pool of investor capital, implementing fee reductions and enhanced marketing campaigns to attract and retain assets. The Ethereum ETF’s worst day exposed vulnerabilities in specific fund structures, particularly those with higher expense ratios or less liquid trading characteristics.

Newer entrants to the Ethereum ETF market found themselves at a particular disadvantage, struggling to differentiate their offerings in an increasingly crowded field. The consolidation pressures accelerated as smaller funds with limited assets under management faced viability challenges. Industry observers predicted that only the strongest, most cost-efficient Ethereum ETFs would survive the current market turbulence, leading to potential industry consolidation in the coming months.

Impact on Ethereum Price and Market Sentiment

Immediate Price Repercussions

The worst day for Ethereum ETFs exerted downward pressure on Ethereum’s spot price, causing it to decline approximately 4.8% during the corresponding trading session. This price movement reflected both the direct selling pressure from ETF redemptions and the psychological impact on broader market participants. Technical analysts noted that Ethereum breached several key support levels, triggering automated selling from algorithmic trading systems and compounding the downward momentum.

The correlation between Ethereum ETF flows and spot price movements demonstrated the growing influence these investment vehicles exert on the underlying asset. As institutional participation in cryptocurrency markets increased through ETF structures, the capital flows into and out of Ethereum ETFs became significant market-moving events. The Ethereum ETF’s worst day illustrated this dynamic clearly, with ETF redemptions translating directly into spot market selling pressure.

Long-Term Sentiment Implications

Beyond immediate price impacts, the worst day for Ethereum ETFs raised questions about longer-term investor sentiment toward Ethereum as an institutional asset class. Skeptics pointed to the outflows as evidence that institutional appetite for Ethereum remained limited compared to Bitcoin, suggesting that widespread institutional adoption might be further away than optimistic projections indicated. This perspective gained traction among market commentators who questioned whether Ethereum could ever achieve Bitcoin’s status as a mainstream institutional holding.

However, contrarian investors viewed the Ethereum ETFs’ worst day as a potential buying opportunity rather than a fundamental repudiation of Ethereum’s investment thesis. These market participants argued that temporary capital flows shouldn’t overshadow Ethereum’s technological advantages, growing ecosystem, and increasing real-world utility. They contended that patient investors willing to weather short-term volatility would ultimately benefit from Ethereum’s long-term appreciation potential.

Analyzing Individual Ethereum ETF Performance

Grayscale Ethereum Trust: Leading the Outflows

Grayscale’s Ethereum Trust bore the largest share of redemptions during the Ethereum ETFs’s worst day, with net outflows exceeding $8 million. This substantial withdrawal reflected ongoing challenges the fund faced in converting skeptical investors who questioned its higher fee structure compared to newer, lower-cost alternatives. Despite Grayscale’s first-mover advantage and brand recognition in cryptocurrency investment products, the company struggled to retain assets as competition intensified and fee-sensitive investors sought cheaper alternatives.

The outflow pattern from Grayscale’s Ethereum ETF suggested that the initial conversion of the Grayscale Ethereum Trust to an ETF structure hadn’t fully resolved investor concerns. Many early holders who acquired shares at substantial premiums or discounts to net asset value during the trust structure period continued exiting positions, contributing to persistent redemption pressures. This ongoing conversion-related selling created a structural headwind that distinguished Grayscale’s Ethereum ETF experience from competitors without similar legacy issues.

Performance of Newer Ethereum ETF Entrants

Newer Ethereum ETF providers from BlackRock, Fidelity, and other prominent asset managers also experienced outflows during the worst day, though proportionally smaller than Grayscale’s losses. These funds, launched with competitive fee structures and robust liquidity provisions, had initially attracted significant investor interest. However, the worst day for Ethereum ETFs revealed that even well-structured, low-cost products weren’t immune to broader market sentiment shifts and macroeconomic pressures affecting cryptocurrency investments.

VanEck and Bitwise Ethereum ETFs demonstrated relative resilience during the downturn, with smaller outflows suggesting that specific investor cohorts remained committed to Ethereum exposure despite market turbulence. These funds benefited from targeted distribution strategies and investor bases that exhibited higher conviction about Ethereum’s long-term prospects. The differential performance across Ethereum ETF providers highlighted the importance of fund structure, fee competitiveness, and investor education in maintaining asset retention during challenging market conditions.

Institutional Investor Behavior and Portfolio Allocation

Risk Management Considerations

The worst day for Ethereum ETFs provided valuable insights into institutional investor risk management practices regarding cryptocurrency allocations. Many institutional investors maintain strict portfolio guidelines that trigger automatic rebalancing when asset classes exceed predetermined volatility thresholds or experience specified drawdown levels. The coordinated nature of outflows suggested that multiple institutions simultaneously reached risk management triggers, necessitating the reduction of Ethereum ETF positions regardless of longer-term investment convictions.

Regulatory capital requirements for confident institutional investors, particularly banks and insurance companies, further complicated Ethereum ETF holdings during periods of market stress. Regulatory frameworks often impose higher capital charges on volatile assets, making cryptocurrency investments increasingly expensive from a regulatory capital perspective during drawdown periods. These institutional constraints created additional selling pressure on Ethereum ETFs, extending beyond fundamental views about Ethereum’s long-term value proposition.

Evolving Institutional Adoption Patterns

Despite the Ethereum ETF’s worst day setback, underlying institutional adoption trends for cryptocurrency exposure continued to evolve. Sophisticated institutional investors increasingly implemented barbell strategies, maintaining core cryptocurrency exposure through Bitcoin while using Ethereum ETFs for tactical allocations tied to specific technological developments or ecosystem growth metrics. This strategic approach created more volatile flow patterns for Ethereum ETFs compared to the steadier accumulation patterns observed in Bitcoin ETF products.

Pension funds and endowments, which represent the most conservative institutional investor categories, maintained predominantly observational stances toward Ethereum ETFs following the recent outflows. These institutions typically require extended track records and demonstrated stability before committing significant capital to new asset classes. The worst day for Ethereum ETFs likely extended the evaluation period required by these conservative institutions before considering meaningful allocations to Ethereum investment products.

Regulatory Landscape and Its Influence on Ethereum ETFs

SEC Oversight and Approval Dynamics

The regulatory environment surrounding Ethereum ETFs remained complex and dynamic, with Securities and Exchange Commission oversight continuing to shape product development and market structure. While the SEC approved spot Ethereum ETF products, ongoing regulatory scrutiny regarding market manipulation, custody arrangements, and investor protection requirements created operational challenges for fund providers. The worst day for Ethereum ETFs intensified regulatory attention, with SEC staff likely analyzing whether market structure issues or trading irregularities contributed to the concentrated outflow event.

Regulatory uncertainty regarding Ethereum’s classification status periodically resurfaced, creating headline risk for Ethereum ETF investors. Although regulatory authorities generally treated Ethereum as a commodity rather than a security, definitive classification remained subject to ongoing legal interpretations and potential legislative developments. This ambiguity discouraged confident risk-averse institutional investors from establishing Ethereum ETF positions, contributing to the fragile capital base that proved vulnerable during the worst day outflows.

International Regulatory Comparisons

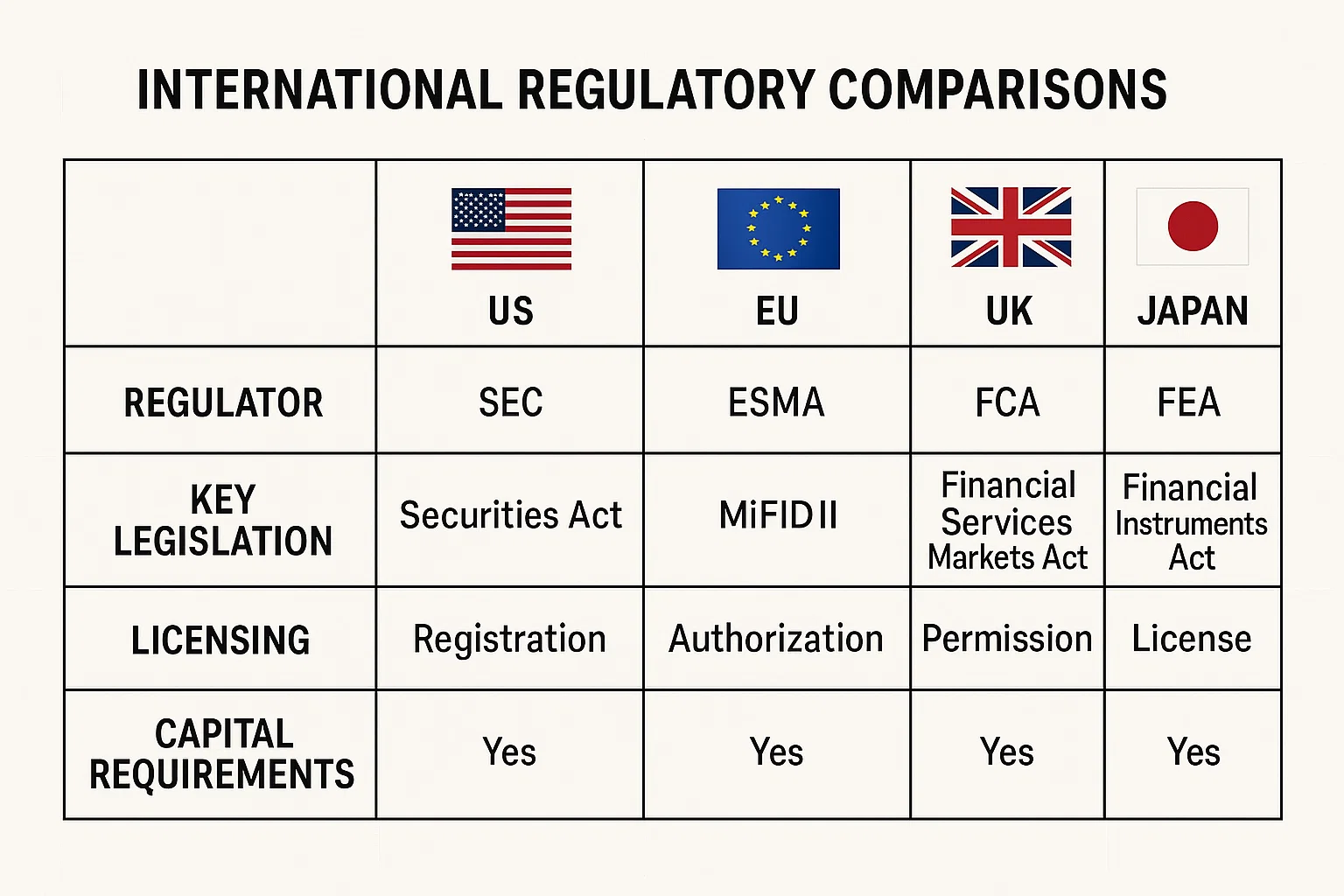

The worst day for Ethereum ETFs in the United States markets contrasted with more stable patterns observed in certain international jurisdictions with different regulatory approaches to cryptocurrency investment products. Canadian Ethereum ETFs, which benefited from earlier regulatory approval and longer operational track records, demonstrated greater resilience during the same period. European cryptocurrency investment products, operating under different regulatory frameworks, also exhibited distinct flow patterns that suggested regulatory structure significantly influenced investor behavior and product stability.

These international comparisons suggested that regulatory clarity and consistency might prove more critical for Ethereum ETF stability than specific regulatory requirements. Jurisdictions that provided clear, predictable regulatory frameworks—even if somewhat restrictive—enabled Ethereum ETFs to develop more stable investor bases compared to markets where regulatory uncertainty persisted. This observation carried implications for ongoing regulatory policy debates in the United States regarding cryptocurrency investment product oversight.

Technical Analysis and Market Indicators

Trading Volume and Liquidity Patterns

The worst day for Ethereum ETFs coincided with elevated trading volumes across spot Ethereum ETF products, indicating that the outflows occurred amid active market participation rather than illiquid conditions. This distinction was significant, as high-volume selling pressure suggested genuine changes in investor positioning rather than technical market disruptions. The liquidity profiles of major Ethereum ETFs generally functioned as designed, with market makers maintaining bid-ask spreads within normal ranges despite substantial redemption activity.

Options market activity surrounding Ethereum ETFs provided additional context for the outflow event. Put option volumes increased substantially in the days preceding the worst day, suggesting that sophisticated investors anticipated potential downside and positioned portfolios accordingly. This options market signal indicated that the worst day for Ethereum ETFs wasn’t entirely unexpected among professional traders who closely monitored technical indicators and market sentiment metrics.

Correlation With Broader Crypto Markets

The worst day for Ethereum ETFs occurred within a broader cryptocurrency market downturn that affected numerous digital assets beyond Ethereum. Bitcoin, while maintaining relative strength compared to altcoins, also experienced modest declines during the same period. This correlated movement across cryptocurrency assets suggested systemic factors affecting digital asset markets rather than Ethereum-specific concerns. Alternative layer-one blockchain tokens that compete with Ethereum showed even sharper declines, indicating that investor risk appetite for innovative contract platforms diminished across the board.

Traditional market correlations also influenced Ethereum ETF performance during the worst day. The positive correlation between cryptocurrency assets and technology growth stocks, which strengthened throughout 2024 and early 2025, meant that weakness in the Nasdaq and technology sector created additional headwinds for Ethereum ETFs. This correlation structure complicated diversification arguments for cryptocurrency investments, as Ethereum ETFs increasingly moved in tandem with existing portfolio risk factors rather than providing independent return sources.

Expert Opinions and Market Analysis

Bullish Perspectives on Ethereum ETFs

Despite the Ethereum ETF’s worst day setback, several prominent cryptocurrency analysts maintained constructive long-term views on Ethereum investment products. These experts emphasized that single-day outflow events, while noteworthy, shouldn’t overshadow the broader institutional adoption trend represented by Ethereum ETF availability. They argued that growing institutional infrastructure for cryptocurrency investing—including custody solutions, trading platforms, and regulatory frameworks—would ultimately support sustained Ethereum ETF growth regardless of short-term volatility.

Technological optimists highlighted Ethereum’s ongoing development roadmap, including scaling solutions and protocol improvements, as fundamental drivers that would eventually translate into renewed Ethereum ETF inflows. These analysts contended that the worst day for Ethereum ETFs represented a temporary disconnect between Ethereum’s technological progress and market sentiment rather than a fundamental reassessment of the platform’s long-term viability. They anticipated that as Ethereum upgrades demonstrated tangible improvements in transaction capacity and cost reduction, institutional interest in Ethereum ETFs would resume its upward trajectory.

Bearish Concerns and Skepticism

Skeptical analysts viewed the Ethereum ETFs’ worst day as confirmation of concerns about premature institutional enthusiasm for Ethereum investments. These critics argued that Ethereum’s technological complexity, ongoing scalability challenges, and intense competition from alternative blockchain platforms created fundamental uncertainties that justified cautious institutional positioning. They questioned whether Ethereum ETFs could sustain meaningful institutional allocations when the underlying asset faced such significant technological and competitive risks.

Valuation concerns also featured prominently in bearish analyses of Ethereum ETFs. Critics noted that Ethereum’s market capitalization, while substantial, reflected optimistic assumptions about future adoption and monetization of the platform’s capabilities. They argued that the worst day for the Ethereum ETF might represent the beginning of a valuation reassessment as investors applied more rigorous fundamental analysis to cryptocurrency investments. These skeptics anticipated continued volatility and potential additional outflows from Ethereum ETFs as market participants refined valuation frameworks for digital assets.

Strategies for Investors Following the Ethereum ETF’s Worst Day

Tactical Considerations for Current Holders

Investors maintaining Ethereum ETF positions following the worst day faced strategic decisions about whether to hold, reduce, or increase exposure. Financial advisors generally recommended that investors evaluate their original investment thesis and determine whether recent developments materially altered the fundamental case for Ethereum exposure. For investors whose rationale centered on long-term Ethereum adoption and ecosystem growth, temporary price volatility and Ethereum ETF outflows might not justify position changes.

Tax considerations also influenced the decision-making on the worst day for post-Ethereum ETFs for taxable accounts. Investors holding positions with unrealized gains faced trade-offs between locking in profits to reduce risk and maintaining exposure to potential recovery. Conversely, investors with unrealized losses could consider tax-loss harvesting strategies, particularly if they planned to maintain cryptocurrency exposure through alternative vehicles. These tax-aware strategies required coordination with qualified tax professionals to optimize after-tax investment outcomes.

Opportunities for New Investors

Contrarian investors viewed the Ethereum ETFs’ worst day as a potential entry opportunity, with prices and valuations potentially more attractive following the selloff. This perspective assumed that the outflow event represented excessive pessimism rather than accurate fundamental reassessment. New investors considering Ethereum ETF positions after the worst day need to carefully evaluate their risk tolerance, investment timeframe, and overall portfolio diversification to ensure appropriate position sizing.

Dollar-cost averaging strategies gained appeal for investors interested in establishing Ethereum ETF exposure without attempting to time market bottoms. This systematic investment approach reduced timing risk by spreading purchases across multiple periods, potentially capturing advantageous entry points if Ethereum ETF weakness persisted. Financial advisors frequently recommend this approach for volatile asset classes like cryptocurrency investments, particularly for retail investors without sophisticated market timing capabilities.

Future Outlook for Ethereum ETFs

Short-Term Market Expectations

The immediate aftermath of the Ethereum ETF’s worst day suggested continued volatility and uncertain capital flows in the near term. Technical analysts identified key support and resistance levels that would determine whether the selling pressure represented a temporary correction or the beginning of a more extended downtrend. Market participants monitored Ethereum ETF daily flow data closely for signs of stabilization or additional redemptions that would signal evolving investor sentiment.

Upcoming macroeconomic events, including Federal Reserve policy decisions and inflation data releases, would significantly influence short-term Ethereum ETF performance. Given the demonstrated sensitivity of cryptocurrency investments to broader risk sentiment and monetary policy expectations, these macroeconomic catalysts could drive substantial volatility in Ethereum ETFs regardless of Ethereum-specific developments. Prudent investors are prepared for continued turbulence while maintaining appropriate portfolio risk management practices.

Long-Term Growth Prospects

Looking beyond short-term volatility, the long-term trajectory for Ethereum ETFs remained subject to fundamental factors including technological development, regulatory clarity, and institutional adoption patterns. Optimistic scenarios envisioned growing institutional acceptance of cryptocurrency as a portfolio allocation, with Ethereum ETFs benefiting from this secular trend alongside Bitcoin products. These positive outcomes depended on continued Ethereum ecosystem growth, successful implementation of scaling solutions, and favorable regulatory developments.

Alternative scenarios acknowledged that Ethereum ETFs might struggle to achieve mainstream institutional adoption if technological limitations persisted or competitive threats from alternative blockchain platforms intensified. The worst day for Ethereum ETFs highlighted the fragility of institutional conviction about Ethereum investments, suggesting that sustained growth required demonstrable progress on key challenges rather than speculative enthusiasm. The outcome would depend on Ethereum’s ability to deliver on its technological roadmap while navigating an increasingly competitive blockchain ecosystem.

Conclusion

The Ethereum ETF’s worst day in over a month served as a stark reminder of the volatility inherent in cryptocurrency investments and the sensitivity of institutional capital to market conditions and sentiment shifts. With net outflows exceeding $15 million, the event highlighted both the growing influence of Ethereum ETF products on underlying market dynamics and the challenges these investment vehicles face in building stable, committed institutional investor bases. The convergence of macroeconomic pressures, regulatory uncertainty, and Ethereum-specific concerns created perfect conditions for coordinated redemptions that tested the resilience of the Ethereum ETF market structure.

For investors navigating the aftermath of this significant outflow event, disciplined adherence to investment principles and risk management frameworks remains essential. Whether viewing the Ethereum ETF’s worst day as a buying opportunity or a warning signal depends fundamentally on individual investment objectives, risk tolerance, and conviction about Ethereum’s long-term prospects. As the cryptocurrency investment landscape continues maturing, episodes like the recent Ethereum ETFs’ worst day will provide valuable lessons about market structure, investor behavior, and the path toward institutional adoption of digital assets.

Read more: Bitcoin Price Today Live Trends, Forecasts & Strategy for 2025