Bitcoin mining difficulty has surged to unprecedented heights, marking a new all-time high (ATH) that has sent ripples throughout the cryptocurrency ecosystem. This milestone achievement represents both the robust security of the Bitcoin network and growing concerns about mining centralisation that could reshape the future of decentralised finance.

As Bitcoin mining difficulty continues its relentless climb, industry experts are raising critical questions about accessibility, energy consumption, and the long-term implications for individual miners. The latest adjustment has pushed the difficulty metric beyond previous records, creating a landscape where only the most efficient and well-funded operations can maintain profitability.

This unprecedented surge in Bitcoin mining difficulty reflects the network’s automatic adjustment mechanism working as designed, responding to increased computational power from mining operations worldwide. However, beneath this technical achievement lies a complex web of economic and technological challenges that could fundamentally alter Bitcoin’s mining ecosystem.

Bitcoin Mining Difficulty Mechanics

What Is Bitcoin Mining Difficulty?

Bitcoin mining difficulty represents a measure of how challenging it is to find a valid hash below the target threshold during the mining process. This algorithmic adjustment ensures that new blocks are mined approximately every 10 minutes, regardless of the total computational power dedicated to the network.

The Bitcoin protocol automatically adjusts mining difficulty every 2,016 blocks, roughly every two weeks, based on the time taken to mine the previous set of blocks. When miners add more computational power to the network, the Bitcoin mining difficulty increases proportionally to maintain the consistent block time interval.

This self-regulating mechanism serves as Bitcoin’s heartbeat, ensuring network stability while adapting to changing mining conditions. The recent ATH demonstrates the protocol’s responsiveness to the massive influx of mining hardware and institutional participation in Bitcoin mining operations.

Historical Context of Difficulty Adjustments

The evolution of Bitcoin mining difficulty tells the story of Bitcoin’s growth from an experimental digital currency to a trillion-dollar asset class. In Bitcoin’s early days, difficulty levels remained relatively low, allowing individual miners with basic computer equipment to participate meaningfully in the network.

Over the years, Bitcoin mining difficulty has experienced exponential growth, reflecting technological advances in mining hardware, increased network adoption, and substantial capital investment in mining infrastructure. Each significant difficulty increase has historically coincided with major developments in the Bitcoin ecosystem.

The current ATH represents a culmination of factors, including the deployment of next-generation ASIC miners, institutional mining operations, and renewed interest in Bitcoin following recent market developments. This perfect storm of circumstances has pushed Bitcoin mining difficulty into uncharted territory.

Factors Driving the New All-Time High

Advanced Mining Hardware Deployment

The latest surge in Bitcoin mining difficulty can be largely attributed to the widespread deployment of cutting-edge Application-Specific Integrated Circuits (ASICs). These specialised mining machines offer unprecedented hash rates and energy efficiency, enabling miners to contribute significantly more computational power to the network.

Major mining manufacturers have released new generations of ASIC miners featuring improved chip architectures and enhanced cooling systems. These technological advances have allowed large-scale mining operations to dramatically increase their hash rate contributions, directly impacting Bitcoin mining difficulty calculations.

The competitive race among mining hardware manufacturers has accelerated innovation cycles, resulting in frequent releases of more powerful and efficient mining equipment. This constant technological evolution continues to push Bitcoin mining difficulty to new heights as miners upgrade their operations.

Institutional Mining Investment

Institutional capital has flooded into Bitcoin mining operations, fundamentally changing the landscape that determines Bitcoin mining difficulty. Public companies, investment funds, and large-scale mining facilities have deployed billions of dollars in mining infrastructure, significantly increasing the network’s total hash rate.

These institutional players operate at scales previously unseen in Bitcoin mining, deploying thousands of mining machines in purpose-built facilities with optimised power arrangements and cooling systems. Their massive hash rate contributions have become a primary driver of Bitcoin mining difficulty increases.

The professionalisation of Bitcoin mining has introduced sophisticated operational strategies, including geographical diversification, renewable energy adoption, and advanced mining pool participation. These developments have created a more robust but increasingly competitive environment that continues to push Bitcoin mining difficulty upward.

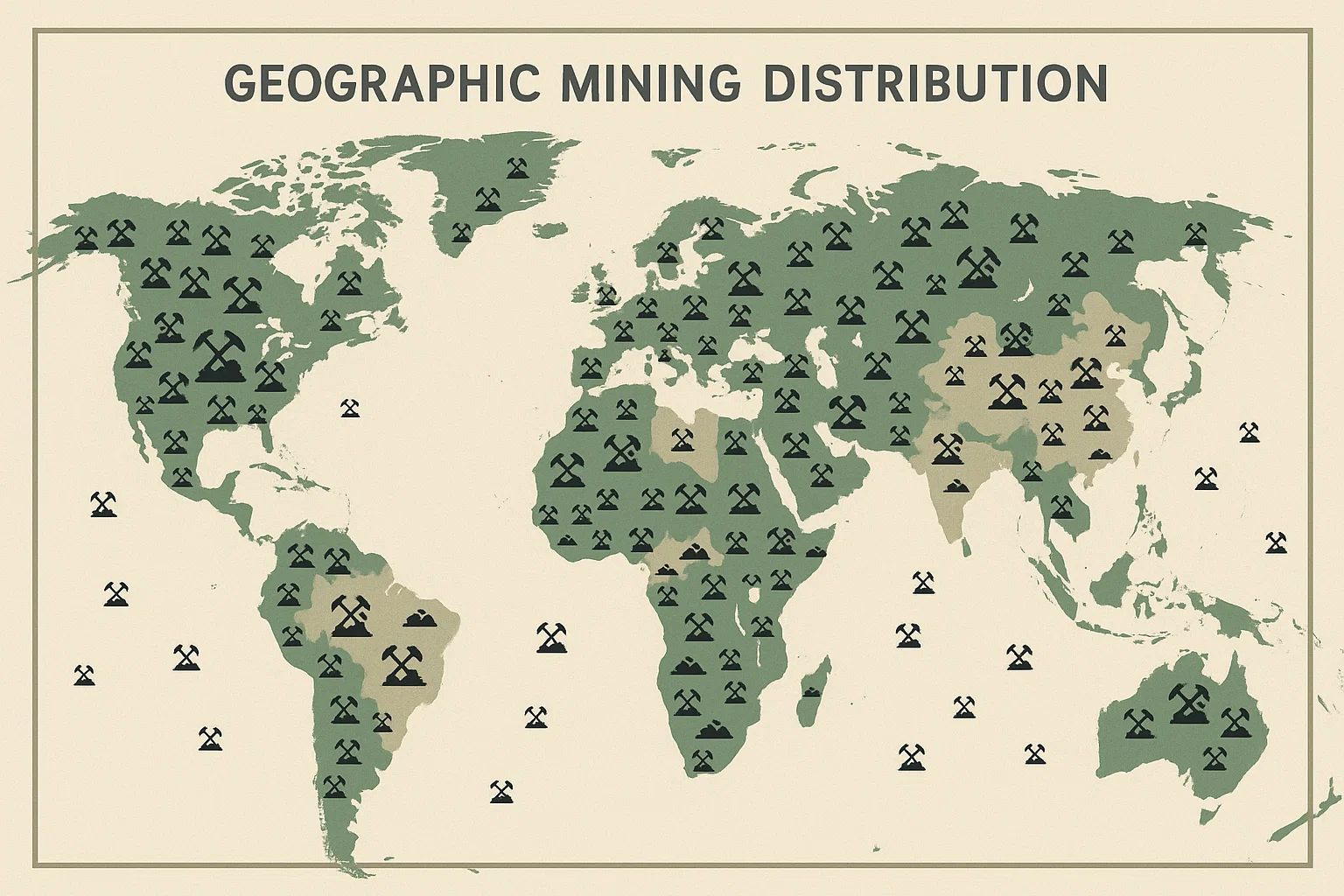

Geographic Mining Distribution

The global distribution of Bitcoin mining operations has evolved significantly, influencing Bitcoin mining difficulty patterns. Following regulatory changes in various jurisdictions, mining operations have relocated and expanded into regions offering favourable energy costs and regulatory environments.

North American mining operations have experienced substantial growth, with numerous facilities coming online in states with abundant renewable energy resources. This geographic shift has contributed to sustained increases in Bitcoin mining difficulty as new mining capacity comes online.

The diversification of mining locations has also introduced seasonal variations in Bitcoin mining difficulty as different regions experience varying energy costs and climate conditions.

Concerns and Network Implications

Mining Pool Concentration

The record-high Bitcoin mining difficulty has intensified concerns about mining centralization, particularly regarding the concentration of hash power among a limited number of mining pools. As individual miners find it increasingly challenging to compete, many join large mining pools to maintain consistent revenue streams.

Current data reveals that a small number of mining pools control significant portions of the network’s hash rate, raising questions about the decentralised nature of Bitcoin. This concentration becomes more pronounced as Bitcoin mining difficulty increases, potentially excluding smaller participants from meaningful network participation.

The economic pressures created by high Bitcoin mining difficulty may accelerate the trend toward mining pool consolidation, as smaller pools struggle to attract miners and maintain competitiveness. This dynamic could reshape Bitcoin’s mining landscape in ways that challenge its founding principles of decentralization.

Barriers to Entry for Individual Miners

Rising Bitcoin mining difficulty has created substantial barriers to entry for individual miners and small-scale operations. The significant capital requirements for competitive mining hardware, combined with increasing electricity costs and technical complexity, have made solo mining economically unfeasible for most participants.

The specialised knowledge required to operate modern mining equipment efficiently adds another layer of complexity that excludes casual participants. As Bitcoin mining difficulty continues climbing, these barriers may become insurmountable for individual miners seeking to participate in network validation.

This trend toward professionalisation and scale requirements fundamentally alters Bitcoin’s original vision of peer-to-peer participation, potentially concentrating mining power among fewer, larger entities with substantial resources and technical expertise.

Energy Consumption and Environmental Impact

The new ATH in Bitcoin mining difficulty directly correlates with increased energy consumption across the global mining network. Higher difficulty levels require more computational work to solve blocks, translating into greater electrical power consumption by mining operations worldwide.

Environmental concerns surrounding Bitcoin mining have intensified as Bitcoin mining difficulty reaches record levels, prompting discussions about sustainable mining practices and renewable energy adoption. The energy intensity required to maintain network security at current difficulty levels has drawn scrutiny from environmental advocates and regulators.

Mining operations are increasingly pursuing renewable energy sources and carbon-neutral practices to address environmental concerns while maintaining profitability despite rising Bitcoin mining difficulty. This shift toward sustainable mining could influence future difficulty trends and network participation patterns.

Economic Implications for Miners

Profitability Challenges

The record Bitcoin mining difficulty has significantly compressed profit margins for mining operations, forcing miners to optimise every aspect of their operations to maintain viability. Higher difficulty levels mean more computational work is required to earn the same Bitcoin rewards, directly impacting revenue streams.

Miners must now achieve greater operational efficiency, negotiate better electricity rates, and deploy more advanced hardware to remain profitable under the current Bitcoin mining difficulty regime. These economic pressures are driving consolidation within the mining industry as smaller operations struggle to compete.

The relationship between Bitcoin’s price, Bitcoin mining difficulty, and mining profitability creates a complex economic dynamic that influences miner behavior and network participation. Sustained high difficulty levels require correspondingly strong Bitcoin prices to maintain widespread mining activity.

Capital Expenditure Requirements

Maintaining competitiveness in the current Bitcoin mining difficulty environment requires substantial ongoing capital investment in hardware upgrades, facility improvements, and operational optimization. Mining operations must continually reinvest profits to stay ahead of difficulty increases and technological advances.

The rapid pace of mining hardware evolution means that equipment becomes obsolete quickly, forcing miners to regularly upgrade their operations to maintain efficiency ratios necessary for profitability. This constant upgrade cycle creates significant cash flow requirements that favour larger,well-capitalisedd operations.

Access to capital markets and financing arrangements has become crucial for mining operations seeking to scale their hash rate contributions in response to increasing Bitcoin mining difficulty. This financial requirement creates additional barriers for smaller miners and independent operations.

Network Security and Decentralisation Balance

Enhanced Network Security Benefits

The record-high Bitcoin mining difficulty represents unprecedented network security, making Bitcoin increasingly resistant to potential attacks or manipulation attempts. Higher difficulty levels require exponentially more computational resources to alter the blockchain, strengthening Bitcoin’s immutability guarantees.

This enhanced security comes from the massive amount of computational work required to mine blocks at current Bitcoin mining difficulty levels, creating an economic disincentive for malicious actors to attempt network disruption. The cost of mounting a successful attack increases proportionally with difficulty levels.

The robust security provided by high Bitcoin mining difficulty reinforces Bitcoin’s value proposition as a secure store of value and medium of exchange, potentially supporting long-term price appreciation and institutional adoption.

Decentralization Trade-offs

While high Bitcoin mining difficulty enhances network security, it simultaneously creates challenges for maintaining Bitcoin’s decentralised character. The economic barriers created by increased difficulty levels may concentrate mining power among fewer participants with sufficient resources.

This tension between security and decentralisation represents one of Bitcoin’s fundamental challenges as it scales and matures. The protocol must balance the benefits of increased security against the risks of mining centralisation that could undermine its decentralised principles.

Future protocol developments and community initiatives may need to address this balance, potentially introducing mechanisms that promote broader participation while maintaining the security benefits of high Bitcoin mining difficulty levels.

Future Outlook and Predictions

Difficulty Adjustment Projections

Analysts predict that Bitcoin mining difficulty will continue its upward trajectory in the near term, driven by ongoing hardware deployments and institutional mining expansion. The pipeline of new mining facilities and equipment orders suggests sustained difficulty increases over the coming months.

However, the rate of Bitcoin mining difficulty growth may moderate as the market approaches equilibrium between mining capacity and Bitcoin price levels. Economic pressures on less efficient operations could lead to periods of mining capacity reduction and corresponding difficulty adjustments.

Long-term Bitcoin mining difficulty trends will likely depend on technological breakthroughs in mining hardware, regulatory developments affecting mining operations, and Bitcoin’s price trajectory. These interconnected factors create a complex forecasting environment for difficulty predictions.

Technological Innovations Impact

Emerging technologies in mining hardware and operational optimisation could significantly influence future Bitcoin mining difficulty trends. Advances in chip design, cooling systems, and energy efficiency may enable continued hash rate growth even as economic pressures intensify.

The development of more energy-efficient mining technologies could help address environmental concerns while supporting continued growth in Bitcoin mining difficulty. These innovations may enable broader participation by reducing operational costs and environmental impact.

Integration of renewable energy sources and advanced energy management systems could reshape the economics of Bitcoin mining, potentially influencing Bitcoin mining difficulty adjustment patterns and geographic distribution of mining operations.

Regulatory and Policy Considerations

Government Response to Mining Growth

The surge in Bitcoin mining difficulty has attracted increased regulatory attention from governments worldwide, as policymakers grapple with the energy consumption and economic implications of large-scale mining operations. Regulatory frameworks are evolving to address the unique challenges posed by cryptocurrency mining.

Some jurisdictions have implemented specific regulations governing mining operations, including energy consumption limits, environmental impact assessments, and taxation frameworks. These regulatory developments could influence future Bitcoin mining difficulty trends by affecting the cost and feasibility of mining operations.

The global nature of Bitcoin mining creates challenges for coordinated regulatory responses, as mining operations can relocate to jurisdictions with more favourable regulatory environments. This regulatory arbitrage could influence the geographic distribution of hash power, contributing to Bitcoin mining difficulty.

Environmental Policy Impact

Environmental regulations and carbon emission targets are increasingly impacting Bitcoin mining operations, potentially influencing future Bitcoin mining difficulty trends. Policies promoting renewable energy adoption and carbon neutrality could reshape the economics of mining operations.

Mining operations are proactively adopting sustainable practices to address environmental concerns and comply with emerging regulations. These initiatives may influence the rate of Bitcoin mining difficulty growth as operations balance sustainability goals with competitive pressures.

The integration of mining operations with renewable energy projects and grid stabilisation services could create new economic models that support continued growth in Bitcoin mining difficulty while addressing environmental concerns.

Industry Response and Adaptations

Mining Pool Strategies

Mining pools are adapting their strategies in response to record Bitcoin mining difficulty levels, implementing new technologies and operational approaches to maintain competitiveness. These adaptations include advanced mining algorithms, improved reward distribution mechanisms, and enhanced participant services.

The competitive pressure created by high Bitcoin mining difficulty has driven innovation in mining pool operations, with pools offering differentiated services and features to attract miners. This competition benefits the broader mining ecosystem by improving efficiency and participant experiences.

Strategic partnerships between mining pools and hardware manufacturers, energy providers, and technology companies are emerging as responses to the challenges posed by increasing Bitcoin mining difficulty. These collaborations aim to optimise operations and maintain profitability.

Hardware Manufacturer Response

Mining hardware manufacturers are accelerating their development cycles in response to the competitive pressures created by rising Bitcoin mining difficulty. New products with improved performance and efficiency are being released more frequently to meet market demand.

The economic incentives created by high Bitcoin mining difficulty are driving substantial research and development investment in mining technology, potentially leading to breakthrough innovations that could reshape the industry landscape.

Manufacturers are also exploring new business models, including mining-as-a-service offerings and integrated solutions that combine hardware, software, and operational services. These innovations aim to address the complexity and capital requirements created by increasing Bitcoin mining difficulty.

Conclusion

The achievement of a new all-time high in Bitcoin mining difficulty represents a pivotal moment in Bitcoin’s evolution, showcasing the network’s growing strength while highlighting critical challenges for its decentralised future. As Bitcoin mining difficulty continues reaching unprecedented levels, the cryptocurrency community must carefully balance network security benefits against centralisation risks.

The record Bitcoin mining difficulty demonstrates Bitcoin’s remarkable resilience and growing institutional adoption, yet it also creates barriers that could fundamentally alter the network’s participatory nature. Success in navigating these challenges will require innovative solutions, regulatory clarity, and continued technological advancement.

Read more: Crypto Market News Live Updates Real-Time Bitcoin, Ethereum & Altcoin Analysis 2025