Arthur Hayes’ Bitcoin surge predictions. In a comprehensive analysis that has captured the attention of investors globally, Hayes argues that ongoing monetary policies and unprecedented money printing by central banks worldwide will inevitably drive Bitcoin prices to new heights. His latest insights suggest that the Arthur Hayes Bitcoin surge thesis is not merely speculative but grounded in fundamental economic principles that have historically favoured alternative assets during periods of monetary expansion.

As traditional financial systems grapple with concerns about inflation and economic uncertainty, Hayes’ perspective on how money printing affects Bitcoin has resonated strongly with both institutional and retail investors. His track record of accurate market predictions, combined with his deep understanding of cryptocurrency mechanics and macroeconomic trends, lends significant credibility to his latest Bitcoin price predictions.

Arthur Hayes’ Economic Philosophy

Arthur Hayes, the former CEO of BitMEX, a controversial yet insightful figure, has consistently positioned himself as one of the most vocal advocates for Bitcoin’s role as a hedge against monetary debasement. His economic philosophy centres around the belief that central banks’ continued reliance on quantitative easing and expansionary monetary policies creates an environment where Bitcoin benefits from money printing.

Hayes argues that the fundamental properties of Bitcoin – its fixed supply cap of 21 million coins, decentralised nature, and resistance to manipulation – make it an ideal store of value when fiat currencies face devaluation pressures. This perspective has shaped his approach to cryptocurrency market analysis and formed the backbone of his predictions about the Bitcoin surge of Arthur Hayes.

The Foundation of Hayes’ Bitcoin Thesis

The core of Hayes’ argument rests on several key economic principles:

Monetary Policy Impact: Hayes contends that when central banks print money to stimulate economic growth or address financial crises, they inadvertently create conditions that favour scarce assets like Bitcoin. This phenomenon of money printing and Bitcoin has been observed during previous periods of quantitative easing, where Bitcoin prices often experienced significant appreciation.

Inflation Hedge Properties: Unlike traditional assets that may lose purchasing power during inflationary periods, Bitcoin’s algorithmic scarcity makes it an attractive alternative for investors seeking to preserve wealth. Hayes’ Bitcoin surge analysis highlights this characteristic as a key driver of future price appreciation.

Institutional Adoption Trends: The growing acceptance of Bitcoin by major corporations, financial institutions, and even governments creates a positive feedback loop that supports Hayes’ Bitcoin price forecast. As more entities recognise Bitcoin’s utility as a treasury asset, demand increases while supply remains fixed.

Current Global Money Printing Landscape

To understand the context behind Arthur Hayes’ Bitcoin surge predictions, it’s essential to examine the current state of global monetary policies. Central banks across major economies have maintained accommodative stances, with many continuing to expand their balance sheets through various forms of quantitative easing.

Federal Reserve Policies and Bitcoin

The Federal Reserve’s approach to monetary policy has been a significant factor in Hayes’ analysis. Despite recent attempts to tighten financial conditions, the Fed’s balance sheet remains substantially larger than pre-2020 levels. Hayes argues that any sustained tightening would likely prove unsustainable given the current debt levels in the U.S. economy, ultimately forcing a return to more accommodative policies that would benefit Bitcoin during money printing periods.

European Central Bank Actions: The ECB’s continued commitment to supportive monetary policies, including negative interest rates and asset purchase programs, creates conditions that Hayes believes will drive European investors toward Bitcoin as an alternative store of value.

Bank of Japan Strategies: Japan’s ultra-loose monetary policy stance, maintained for over a decade, serves as a case study for Hayes’ thesis about how prolonged money printing impacts Bitcoin adoption and pricing.

Emerging Market Dynamics

Hayes’ analysis extends beyond developed economies to include emerging markets, where currency devaluation and capital controls often prompt citizens to turn to Bitcoin as a means of preserving their wealth. Countries such as Turkey, Argentina, and Nigeria have seen significant increases in Bitcoin adoption as their local currencies face pressure from inflationary policies.

Technical Analysis Supporting Hayes’ Predictions

Beyond macroeconomic factors, Arthur Hayes’ Bitcoin surge predictions are supported by various technical indicators and market dynamics that suggest favourable conditions for cryptocurrency appreciation.

On-Chain Metrics and Market Structure

Bitcoin Supply Dynamics: Current on-chain data shows that long-term holders continue to accumulate Bitcoin, reducing the available supply for trading. This trend aligns witHayes’s thesis that Bitcoin benefits from money printing as investors seek alternatives to depreciating fiat currencies.

Exchange Reserves: The continued decline in Bitcoin reserves on centralised exchanges suggests strong holding behaviour among investors, creating a supply scarcity that could amplify price movements when demand increases.

Institutional Holdings: Corporate treasury holdings of Bitcoin have grown substantially, with companies like MicroStrategy and Tesla leading the way. Hayes argues that this trend will accelerate as the correlations between money printing and Bitcoin become more apparent to corporate decision-makers.

Market Cycle Analysis

Hayes’ Bitcoin price predictions incorporate cyclical patterns observed in previous market cycles, adjusted for current macroeconomic conditions. He suggests that the combination of reduced supply availability due to mining halving events and increased demand from money printing policies creates optimal conditions for significant price appreciation.

Historical Precedents: Money Printing and Asset Prices

Arthur Hayes’ Bitcoin surge thesis draws heavily from historical examples of how asset prices respond to expansionary monetary policies. These precedents provide context for understanding why Hayes believes current conditions favour Bitcoin appreciation.

The 1970s Gold Rally

During the 1970s, when the U.S. abandoned the gold standard and pursued inflationary policies, gold prices experienced a dramatic surge from $35 to over $800 per ounce. Hayes argues that Bitcoin could experience a similar trajectory as it serves as “digital gold” in the current monetary environment.

Quantitative Easing Era (2008-2020): The period following the 2008 financial crisis saw unprecedented money printing by central banks worldwide. During this time, Bitcoin emerged and experienced multiple bull cycles, with its price appreciating from less than $1 to over $60,000. Hayes contends that this relationship between money-printing and Bitcoin demonstrates the cryptocurrency’s potential during periods of monetary expansion.

Comparing Traditional Assets to Bitcoin

Hayes’ analysis includes comparisons between Bitcoin and traditional inflation hedges:

Real Estate Markets: While real estate has historically benefited from inflationary policies, Hayes argues that Bitcoin offers superior portability, divisibility, and resistance to government interference.

Stock Market Performance: Although stocks have generally performed well during periods of monetary expansion, Hayes suggests that Bitcoin’s uncorrelated nature and superior scarcity make it a more attractive investment in the current environment.

Precious Metals: While gold and silver have served as stores of value for millennia, Hayes contends that Bitcoin’s digital nature and programmable scarcity make it better suited for the modern economy.

Potential Risks and Challenges to Hayes’ Thesis

Despite his bullish outlook, Hayes acknowledges several risks that could impact his Arthur Hayes Bitcoin surge predictions. Understanding these challenges provides a more balanced perspective on potential investment outcomes.

Regulatory Uncertainties

Government Intervention: Increased regulatory scrutiny and potential restrictions on Bitcoin trading or ownership could dampen adoption and price appreciation. Hayes monitors regulatory developments closely, as they could significantly impact his Bitcoin price forecast.

Tax Policy Changes: Modifications to cryptocurrency taxation policies could affect investor behaviour and market dynamics, potentially influencing the relationship between money printing and Bitcoin that Hayes emphasises.

Technical and Operational Risks

Network Security: While Bitcoin’s network has proven remarkably resilient, potential security vulnerabilities or successful attacks could undermine confidence and affect prices.

Scalability Challenges: Bitcoin’s transaction throughput limitations could hinder adoption as a medium of exchange, potentially limiting its appeal beyond its store of value properties.

Market Structure Evolution

Institutional Manipulation: As large institutions increase their Bitcoin holdings, they may have the ability to influence prices in ways that could disrupt natural market dynamics.

Derivative Markets Impact: The growth of Bitcoin derivatives markets could lead to increased price volatility and potentially dampen the benefits of Bitcoin from the money printing thesis if leveraged positions create instability.

Investment Implications and Strategic Considerations

For investors considering Hayes’ Arthur Hayes’ Bitcoin surge predictions, several strategic factors warrant careful consideration:

Portfolio Allocation Strategies

Risk Management: Hayes suggests that Bitcoin should comprise a meaningful but measured portion of investment portfolios, with allocation percentages depending on individual risk tolerance and investment objectives.

Dollar-Cost Averaging: Given Bitcoin’s volatility, Hayes often advocates for systematic accumulation strategies rather than attempting to time market entries perfectly.

Long-Term Perspective: The money printing Bitcoin thesis requires patience, as the full effects of monetary policies may take time to materialise in cryptocurrency markets.

Timing Considerations

Hayes’ analysis suggests that the optimal time for Bitcoin accumulation may be during periods when money printing policies are announced or implemented, as markets may not immediately price in the long-term implications for scarce assets.

Market Cycle Awareness: Understanding Bitcoin’s four-year halving cycles and their interaction with macroeconomic trends can help investors align their strategies with Hayes’ Bitcoin surge analysis.

Comparing Hayes’ Predictions with Other Analysts

Arthur Hayes’ Bitcoin surge predictions are part of a broader ecosystem of cryptocurrency analysis and forecasting. Comparing his views with those of other prominent analysts provides additional perspective on potential market directions.

Institutional Analyst Views

Goldman Sachs: The investment bank has published research suggesting Bitcoin could reach $100,000, citing similar macroeconomic factors to those emphasised by Hayes.

JPMorgan Analysis: Despite Jamie Dimon’s sceptical public statements, JPMorgan’s research teams have noted Bitcoin’s potential as a portfolio diversifier, particularly during periods of currency debasement.

Independent Cryptocurrency Analysts

PlanB’s Stock-to-Flow Model: This popular valuation model suggests Bitcoin prices could reach significantly higher levels, supporting aspects of Hayes’ Bitcoin price predictions.

Willy Woo’s On-Chain Analysis: Prominent on-chain analyst Willy Woo’s metrics often align with Hayes’ conclusions about supply scarcity and institutional accumulation trends.

The Role of Technology in Hayes’ Bitcoin Thesis

Beyond macroeconomic factors, Hayes’ Bitcoin surge predictions incorporate technological developments that could enhance Bitcoin’s utility and adoption.

Lightning Network Development

The Lightning Network’s continued evolution addresses Bitcoin’s scalability limitations, potentially increasing its utility as both a store of value and medium of exchange. Hayes views these technological improvements as supportive of his Bitcoin price forecast.

Layer 2 Solutions: Additional scaling solutions being developed for Bitcoin could further enhance its appeal to users and institutions, creating additional demand drivers that complement the relationship between Bitcoin and money printing.

Infrastructure Improvements

Custody Solutions: The development of institutional-grade custody services makes Bitcoin more accessible to large investors, supporting Hayes’ thesis about increased institutional adoption.

Payment Integration: Growing integration of Bitcoin into payment systems and financial services could expand its user base and utility, contributing to the demand factors underlying Hayes’ Bitcoin surge analysis.

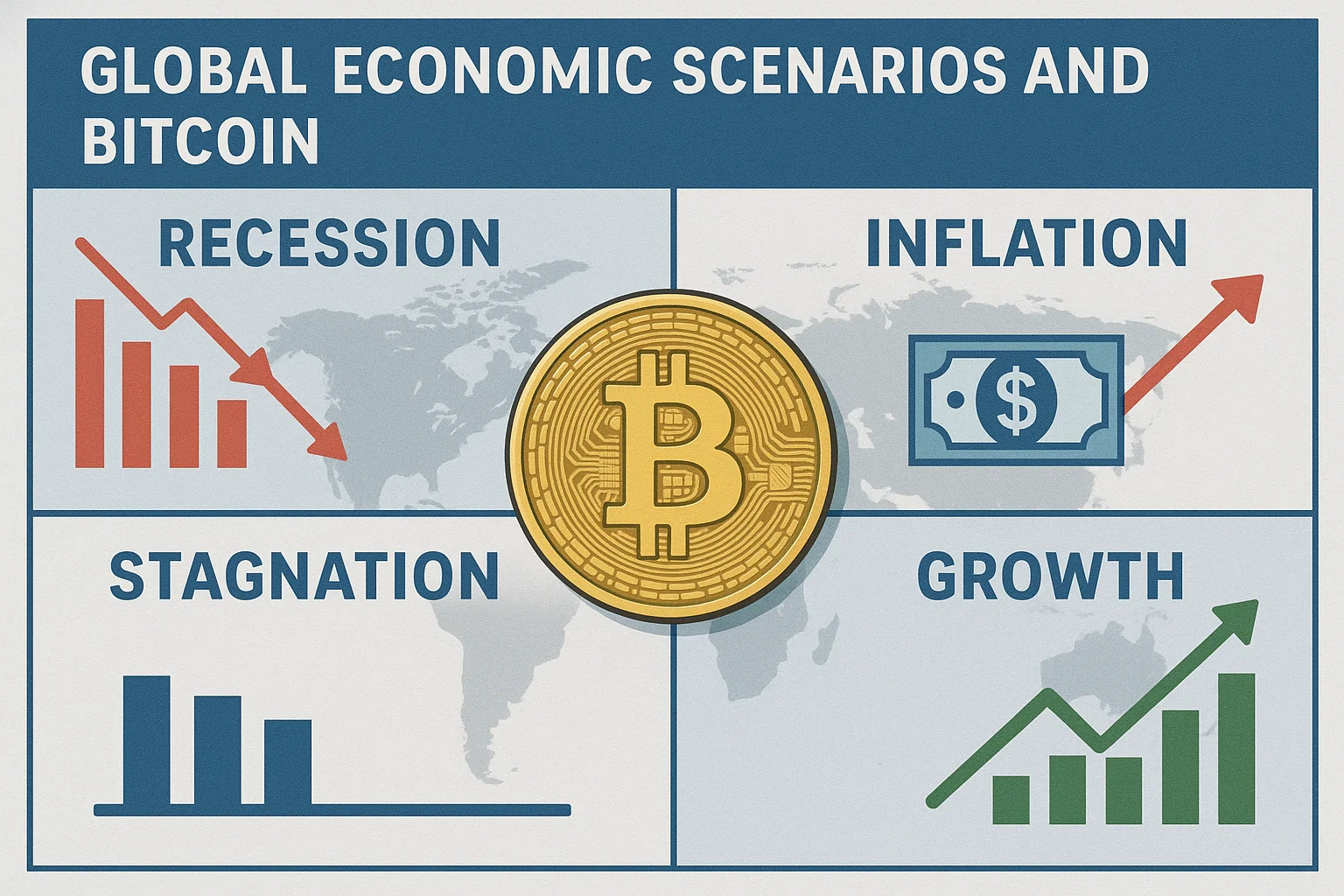

Global Economic Scenarios and Bitcoin

Hayes’ predictions consider various potential global economic scenarios and their implications for Bitcoin, benefiting from the money printing thesis:

Stagflation Scenario

If the global economy experiences stagflation (high inflation combined with slow growth), Hayes argues that Bitcoin’s properties as both an inflation hedge and growth asset could drive significant appreciation.

Currency Crisis Potential: In scenarios where major fiat currencies face crisis-level devaluation, Hayes suggests Bitcoin could serve as a global reserve asset, driving unprecedented demand.

Deflationary Pressures

Even in deflationary scenarios, Hayes contends that central bank responses would likely involve aggressive monetary expansion, ultimately supporting his money-printing Bitcoin thesis.

Conclusion:

Arthur Hayes’ Bitcoin surge predictions represent a compelling synthesis of macroeconomic analysis, cryptocurrency fundamentals, and market dynamics. His thesis that ongoing money printing policies will drive Bitcoin appreciation rests on solid economic principles and historical precedents, while acknowledging the inherent risks and uncertainties associated with any investment prediction.

As global central banks continue to navigate challenging economic conditions with expansionary monetary policies, Hayes’ analysis suggests that Bitcoin’s role as a scarce, decentralised store of value becomes increasingly relevant. The relationship between money printing and Bitcoin that he emphasises has shown historical validity and appears likely to continue as long as fiat currencies face debasement pressures.