The cryptocurrency landscape continues to evolve rapidly, with liquid staking protocols emerging as major players in the decentralized finance ecosystem. Among these innovative platforms, Ether.fi has captured significant attention from investors seeking comprehensive ether.fi governance token price prediction 2025 insights. As the protocol’s native ETHFI governance token gains momentum in the market, understanding its potential trajectory becomes crucial for informed investment decisions.

This detailed analysis explores market dynamics, technical factors, and expert forecasts to provide you with the most accurate ether.fi governance token price prediction 2025 available. Whether you’re a seasoned cryptocurrency investor or exploring liquid staking opportunities, this comprehensive guide will equip you with essential knowledge about ETHFI token’s future prospects and investment potential.

Understanding Ether.fi Protocol and Its Governance Token

Ether.fi represents a groundbreaking liquid staking protocol built on Ethereum, designed to address the limitations of traditional staking mechanisms. The platform enables users to stake their ETH while maintaining liquidity through innovative tokenization processes. At the heart of this ecosystem lies the ETHFI governance token, which serves multiple critical functions within the protocol’s infrastructure.

The ETHFI token operates as both a governance mechanism and a value accrual instrument for protocol participants. Token holders can participate in crucial decision-making processes, including protocol upgrades, treasury management, and strategic partnerships. This governance structure ensures that the community drives the platform’s development while maintaining decentralized principles.

The protocol’s unique approach to liquid staking differentiates it from competitors through its non-custodial architecture and distributed validator technology. Users retain control over their staking keys while benefiting from professional validator services, creating a secure and efficient staking environment. This innovative design has attracted significant institutional interest, contributing to positive sentiment around ether.fi governance token price prediction 2025 forecasts.

Current Market Position and Performance Analysis

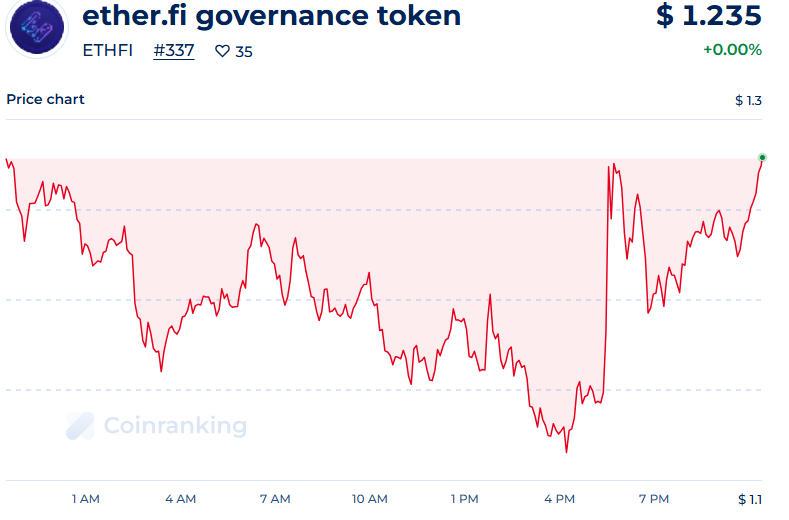

The ETHFI governance token has demonstrated remarkable resilience in the volatile cryptocurrency market since its launch. Current market dynamics show strong correlation with Ethereum’s performance, given the protocol’s direct relationship with ETH staking activities. Trading volumes have consistently increased as more investors recognize the protocol’s potential and seek exposure to liquid staking trends.

Market capitalization metrics reveal growing institutional adoption and retail investor interest. The token’s price movements often reflect broader market sentiment toward decentralized finance protocols and Ethereum’s staking ecosystem. Technical analysis indicates several key support and resistance levels that will influence future price action and contribute to ether.fi governance token price prediction 2025 scenarios.

Liquidity metrics across major exchanges demonstrate healthy trading activity and reduced slippage for large transactions. This improved market structure supports long-term price stability and creates favorable conditions for sustained growth. The token’s integration with major DeFi protocols further enhances its utility and market presence.

Key Factors Influencing Ether.fi Token Price in 2025

Ethereum Network Upgrades and Staking Adoption

Ethereum’s continued evolution significantly impacts ETHFI token valuations through increased staking participation and network security improvements. The transition to proof-of-stake consensus has created unprecedented demand for liquid staking solutions, positioning Ether.fi as a primary beneficiary of this structural shift.

Network upgrades scheduled for 2025 will likely enhance staking efficiency and reduce barriers to participation. These improvements should drive additional ETH into staking protocols, directly benefiting Ether.fi’s total value locked and governance token demand. The correlation between Ethereum’s development roadmap and ether.fi governance token price prediction 2025 remains strongly positive.

Institutional adoption of Ethereum staking continues accelerating as regulatory clarity improves and infrastructure matures. Major financial institutions are increasingly viewing liquid staking as an attractive yield-generating strategy, creating substantial demand for protocols like Ether.fi that offer institutional-grade security and compliance features.

Also Read: Ethereum Price Prediction 2025 Analysis Expert Forecasts & Market Trends

Regulatory Environment and Compliance Developments

The evolving regulatory landscape for cryptocurrency staking protocols will significantly influence ETHFI governance token performance throughout 2025. Positive regulatory developments in major markets could unlock institutional capital and drive substantial price appreciation.

Compliance initiatives within the liquid staking sector are creating competitive advantages for protocols that proactively address regulatory requirements. Ether.fi’s commitment to transparency and regulatory cooperation positions it favorably for potential compliance-driven market expansion.

International regulatory harmonization efforts may reduce operational complexity for global liquid staking protocols. This development would benefit Ether.fi’s expansion plans and contribute positively to ether.fi governance token price prediction 2025 projections.

Technical Analysis and Price Movement Patterns

Technical indicators reveal several bullish patterns that support optimistic ether.fi governance token price prediction 2025 scenarios. Moving average convergence and support level analysis indicate strong underlying demand and reduced selling pressure from early investors.

Chart patterns suggest potential breakout scenarios that could drive significant price appreciation throughout 2025. Key technical levels include resistance at previous highs and support zones established during recent market corrections. These levels serve as important reference points for traders and long-term investors alike.

Volume analysis demonstrates increasing participation from institutional investors and sophisticated trading entities. This development typically precedes major price movements and suggests growing market confidence in the protocol’s long-term prospects.

Expert Price Predictions for ETHFI Token in 2025

Conservative Estimates and Realistic Scenarios

Conservative ether.fi governance token price prediction 2025 estimates range from moderate growth scenarios based on steady protocol adoption and market maturation. These projections assume continued development progress without major breakthrough events or exceptional market conditions.

Fundamental analysis supporting conservative estimates focuses on total addressable market expansion and competitive positioning within the liquid staking sector. These factors suggest sustainable growth potential aligned with broader DeFi market development.

Risk-adjusted return calculations indicate favorable reward-to-risk ratios for ETHFI token investments under conservative growth scenarios. This analysis appeals to institutional investors seeking measured exposure to liquid staking protocols.

Optimistic Growth Projections

Bullish ether.fi governance token price prediction 2025 scenarios anticipate significant protocol breakthroughs and favorable market conditions driving exceptional performance. These projections assume successful implementation of planned upgrades and substantial increase in total value locked.

Optimistic scenarios consider potential partnerships with major financial institutions and integration with traditional finance infrastructure. Such developments could dramatically expand the protocol’s addressable market and drive substantial token appreciation.

Market adoption acceleration under favorable regulatory conditions could exceed current growth projections. This scenario assumes widespread institutional adoption and retail investor participation in liquid staking activities.

Market Analyst Consensus

Professional analysts studying ether.fi governance token price prediction 2025 generally express cautious optimism about the token’s prospects. Consensus estimates reflect balanced consideration of growth opportunities and potential market challenges.

Institutional research reports highlight Ether.fi’s competitive advantages and strong technical fundamentals as key factors supporting positive price projections. These analyses emphasize the protocol’s innovation and market positioning within the liquid staking ecosystem.

Independent analyst surveys reveal growing confidence in the protocol’s long-term viability and governance token utility. This sentiment supports moderate to strong price appreciation expectations for 2025.

Investment Strategies and Risk Management

Long-term Holding Strategies

Strategic ETHFI token accumulation approaches focus on dollar-cost averaging and position building during market corrections. Long-term investors benefit from protocol growth while participating in governance activities that enhance token utility.

Portfolio allocation strategies recommend measured exposure to liquid staking tokens as part of diversified cryptocurrency investments. This approach balances growth potential with risk management considerations appropriate for different investor profiles.

Staking and governance participation strategies allow investors to generate additional returns while supporting protocol development. Active involvement in governance processes creates additional value beyond price appreciation potential.

Risk Assessment and Mitigation

Comprehensive risk analysis for ether.fi governance token price prediction 2025 investments includes protocol-specific risks, market volatility, and regulatory uncertainties. Understanding these factors enables informed decision-making and appropriate position sizing.

Smart contract risk assessment reveals robust security measures and professional audit procedures that reduce technical vulnerabilities. However, investors should maintain awareness of evolving security landscapes in decentralized finance protocols.

Market correlation analysis helps investors understand how ETHFI token prices relate to broader cryptocurrency markets and Ethereum ecosystem developments. This knowledge supports effective hedging and risk management strategies.

Competitive Landscape and Market Positioning

The liquid staking protocol market features intense competition among established platforms and emerging solutions. Ether.fi’s competitive positioning depends on technological innovation, user experience, and community development initiatives that differentiate it from alternatives.

Market share analysis reveals Ether.fi’s growing presence within the total addressable market for liquid staking services. This expansion supports positive ether.fi governance token price prediction 2025 scenarios based on increased protocol adoption and value accrual.

Partnership developments and integration opportunities create potential catalysts for accelerated growth and market share expansion. Strategic alliances with major DeFi protocols and traditional financial institutions could significantly impact token valuations.

Technology Roadmap and Development Milestones

Planned protocol upgrades and feature enhancements scheduled for 2025 will likely influence ETHFI governance token demand and utility. Technical improvements focus on scalability, security, and user experience enhancements that attract additional users and total value locked.

Research and development initiatives explore advanced staking technologies and integration opportunities with emerging blockchain infrastructures. These innovations position Ether.fi for long-term competitiveness and market leadership within the liquid staking sector.

Community development programs and governance improvements enhance token holder engagement and protocol decentralization. These initiatives create positive feedback loops that support sustainable growth and community-driven innovation.

Market Sentiment and Community Analysis

Social media sentiment analysis reveals growing enthusiasm for Ether.fi protocol and its governance token among cryptocurrency communities. Positive sentiment indicators support optimistic ether.fi governance token price prediction 2025 scenarios based on community growth and engagement.

Developer activity metrics demonstrate consistent protocol improvement and community contribution. Active development communities typically correlate with strong token performance and long-term project sustainability.

Institutional interest indicators suggest growing professional investor attention and potential capital allocation toward liquid staking protocols. This development could significantly impact token demand and price trajectories throughout 2025.

Potential Challenges and Market Headwinds

Competitive pressures from established liquid staking protocols and emerging alternatives could limit market share growth and impact token valuations. Understanding competitive dynamics helps investors assess realistic growth expectations and potential market challenges.

Regulatory uncertainty in key markets represents a significant risk factor for ether.fi governance token price prediction 2025 scenarios. Adverse regulatory developments could restrict protocol operations and negatively impact token demand.

Technical challenges and smart contract vulnerabilities pose ongoing risks that could affect investor confidence and protocol adoption. Continuous security improvements and professional audit procedures help mitigate these concerns.

Conclusion

The comprehensive analysis of ether.fi governance token price prediction 2025 reveals compelling growth opportunities balanced against inherent cryptocurrency market risks. Technical fundamentals, competitive positioning, and market trends support cautiously optimistic price projections for the coming year.

Investors considering ETHFI token positions should evaluate their risk tolerance and investment objectives while maintaining diversified cryptocurrency portfolios. The protocol’s innovative approach to liquid staking and strong community support create favorable conditions for sustained growth.

As the liquid staking market continues expanding and Ethereum adoption accelerates, Ether.fi appears well-positioned to capture significant market share and deliver value to governance token holders. Consider conducting additional research and consulting financial advisors before making investment decisions based on these ether.fi governance token price prediction 2025 insights.

For the most current market analysis and ETHFI token price updates, monitor official protocol communications and reputable cryptocurrency market data sources. Stay informed about regulatory developments and protocol upgrades that could influence token valuations throughout 2025.