The cryptocurrency market continues to evolve rapidly, and Ethereum price prediction 2025 news today reveals fascinating insights for investors and enthusiasts worldwide. As we navigate through 2025, Ethereum has established itself as the second-largest cryptocurrency by market capitalization, commanding significant attention from institutional investors, retail traders, and blockchain developers alike. Recent market developments, technological upgrades, and regulatory changes have created a complex landscape that demands careful analysis for accurate price predictions.

Current Ethereum price prediction 2025 news today suggests that ETH is positioned for potential growth, driven by several fundamental factors including increased institutional adoption, the continued expansion of decentralized finance (DeFi) applications, and the successful implementation of Ethereum 2.0 upgrades. Market analysts are closely monitoring these developments as they shape the future trajectory of Ethereum’s value proposition in the global financial ecosystem.

Latest Ethereum Price Prediction 2025 News Today Market Overview

Current Market Performance and Price Analysis

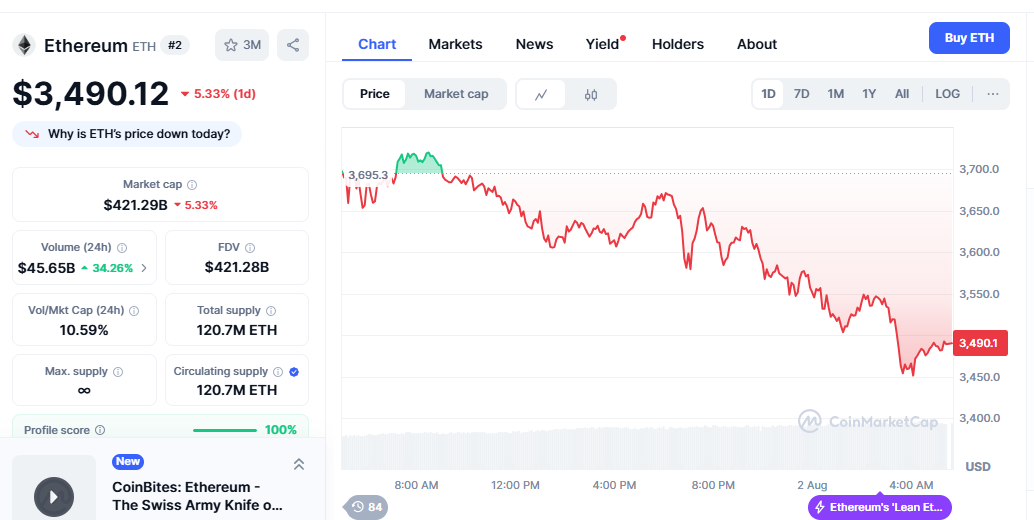

As of August 2025, Ethereum continues to demonstrate remarkable resilience in the face of market volatility. The latest Ethereum price prediction 2025 news today indicates that ETH is trading within a consolidation range, with technical analysts identifying key support and resistance levels that will determine future price movements.

Recent market data reveals that Ethereum has experienced significant institutional inflows, particularly through spot ETF products that have gained traction among traditional investors. BlackRock’s ETHA and other institutional-grade Ethereum products have contributed to increased demand, supporting price stability and potential upward momentum.

The current trading volume and market sentiment indicators suggest that Ethereum is building a strong foundation for potential price appreciation. On-chain metrics, including network activity, transaction volumes, and developer engagement, continue to show positive trends that support bullish price predictions for the remainder of 2025.

Technical Analysis and Chart Patterns

Technical analysis of Ethereum’s price action reveals several important patterns that inform current predictions. The formation of a potential cup and handle pattern on the weekly chart has caught the attention of technical analysts, suggesting a possible breakout scenario that could drive prices significantly higher.

Moving average convergence divergence (MACD) indicators show increasing bullish momentum, while relative strength index (RSI) levels suggest that Ethereum is not yet in overbought territory. These technical factors support the optimistic Ethereum price prediction for 2025, which many analysts are sharing with their followers.

Fibonacci retracement levels have proven to be reliable support and resistance zones for Ethereum, with the 50% retracement level at approximately $2,145 serving as a crucial support level. Breaking above key resistance levels could trigger a substantial rally that aligns with the most optimistic price predictions for 2025.

Ethereum Price Predictions Fundamental Factors Driving

Ethereum 2.0 and Network Upgrades

The ongoing implementation of Ethereum 2.0 upgrades continues to be a significant catalyst for optimistic price predictions. The transition to proof-of-stake consensus mechanism has significantly reduced Ethereum’s energy consumption while improving network scalability and security.

Recent network upgrades, including the Pectra upgrade that introduced account abstraction and validator limit increases, have enhanced Ethereum’s utility and user experience. These improvements directly impact the network’s value proposition and support long-term price appreciation forecasts.

The upcoming Fusaka upgrade, tentatively scheduled for November 2025, promises additional enhancements that could further boost investor confidence and drive positive price momentum. These technological developments are central to current Ethereum price prediction 2025 news today discussions among industry experts.

Institutional Adoption and ETF Developments

Institutional adoption remains a powerful driver for Ethereum price predictions. The approval and launch of spot Ethereum ETFs have opened new avenues for traditional investors to gain exposure to ETH without directly holding the cryptocurrency.

Recent data shows that Ethereum ETFs have experienced substantial inflows, with BlackRock’s ETHA leading the charge with daily inflows exceeding $18 million. This institutional interest validates Ethereum’s position as a legitimate investment asset and supports optimistic price forecasts.

Corporate treasury adoption of Ethereum, while still limited compared to Bitcoin, is gradually increasing as companies recognize the potential benefits of holding ETH as a treasury asset. This trend could accelerate if Ethereum continues to demonstrate price stability and growth potential.

Expert Predictions and Market Analyst Forecasts

Short-term Price Targets for 2025

Leading cryptocurrency analysts have provided various Ethereum price prediction 2025 news updates today, with short-term targets ranging from conservative to highly optimistic scenarios. CoinPedia’s analysis suggests that Ethereum could reach $6,925 in 2025 under favorable market conditions.

Changelly’s price prediction indicates potential growth of 3.76% in the near term, with ETH potentially reaching $3,954 by early August 2025. These predictions are based on current market trends, technical analysis, and fundamental developments within the Ethereum ecosystem.

InvestingHaven’s research points to a potential new all-time high around $5,150 during the summer of 2025, with consolidation expected before the next major rally. These expert opinions contribute to the ongoing Ethereum price prediction 2025 news narrative that suggests continued growth potential.

Long-term Outlook Through 2030

While focusing on 2025 predictions, it’s important to consider longer-term forecasts that provide context for current price movements. Many analysts project that Ethereum could reach $15,575 by 2030, representing significant appreciation from current levels.

The long-term growth thesis for Ethereum is built on its role as the foundation for decentralized applications, smart contracts, and the broader Web3 ecosystem. As these technologies mature and gain mainstream adoption, Ethereum’s value proposition is expected to strengthen considerably.

Factors supporting long-term price appreciation include the continued growth of DeFi protocols, non-fungible token (NFT) marketplaces, and layer-2 scaling solutions that enhance Ethereum’s utility and efficiency.

Market Risks and Challenges

Regulatory Environment and Compliance

The regulatory landscape for cryptocurrencies continues to evolve, with potential implications for Ethereum price predictions. Recent developments in various jurisdictions have created both opportunities and challenges for Ethereum adoption.

The SEC’s approach to cryptocurrency regulation in the United States remains a key factor in market sentiment and price predictions. Clarity on Ethereum’s regulatory status could provide significant upward momentum, while adverse regulatory developments could create downward pressure.

International regulatory coordination and the development of clear frameworks for cryptocurrency operations will likely influence Ethereum price prediction 2025 news today and future market performance.

Also Read: Ethereum Price Prediction 2025 Analysis Expert Forecasts & Market Trends

Market Competition and Technology Risks

Ethereum faces increasing competition from other blockchain platforms that offer similar functionality with potentially better performance characteristics. Solana, Avalanche, and other “Ethereum killers” continue to gain market share and developer mindshare.

However, Ethereum’s first-mover advantage, extensive developer ecosystem, and network effects provide significant competitive moats that support optimistic price predictions. The platform’s ability to adapt and upgrade through ongoing development efforts helps maintain its market leadership position.

Technology risks, including potential security vulnerabilities or upgrade complications, could impact price predictions. However, Ethereum’s proven track record of successful upgrades and robust security measures helps mitigate these concerns.

Investment Strategies and Risk Management

Dollar-Cost Averaging and Long-term Holding

For investors interested in Ethereum based on current price predictions, dollar-cost averaging represents a prudent strategy that reduces the impact of market volatility. This approach allows investors to build positions gradually while managing risk exposure.

Long-term holding strategies align well with the Ethereum price prediction 2025 news today, which suggests continued growth potential. However, investors should carefully consider their risk tolerance and investment objectives before committing capital to cryptocurrency investments.

Diversification remains crucial, with Ethereum representing just one component of a well-balanced cryptocurrency portfolio. Professional financial advice is recommended for investors considering significant allocations to digital assets.

Risk Management and Position Sizing

Effective risk management is essential when investing based on price predictions. Setting stop-loss levels, defining profit-taking targets, and maintaining appropriate position sizes help protect capital while allowing for potential upside participation.

The volatile nature of cryptocurrency markets means that even the most optimistic Ethereum price prediction 2025 news today should be viewed with appropriate caution. Market conditions can change rapidly, requiring adaptive investment strategies.

Regular portfolio rebalancing and staying informed about market developments help investors make informed decisions based on evolving price predictions and market conditions.

Conclusion

The Ethereum price prediction 2025 news today landscape presents a compelling picture of potential growth and opportunity for investors who understand the risks and fundamentals driving market dynamics. With strong institutional support, continued technological development, and growing adoption across various use cases, Ethereum appears well-positioned for potential price appreciation throughout 2025.

However, successful cryptocurrency investing requires more than just following price predictions. Investors should conduct thorough research, consider multiple perspectives, and develop comprehensive risk management strategies that align with their individual financial goals and risk tolerance.

Stay informed about the latest Ethereum price prediction 2025 news today by following reputable cryptocurrency news sources, analyst reports, and market data providers. Remember that all investments carry risk, and past performance does not guarantee future results.