The cryptocurrency market experienced a significant development today as a major whale opened a $255 million long position in Bitcoin, utilising 20x leverage at approximately $104,000. This substantial investment comes as Bitcoin approaches the critical $106,000 liquidity zone, demonstrating institutional confidence in the digital asset’s upward trajectory.

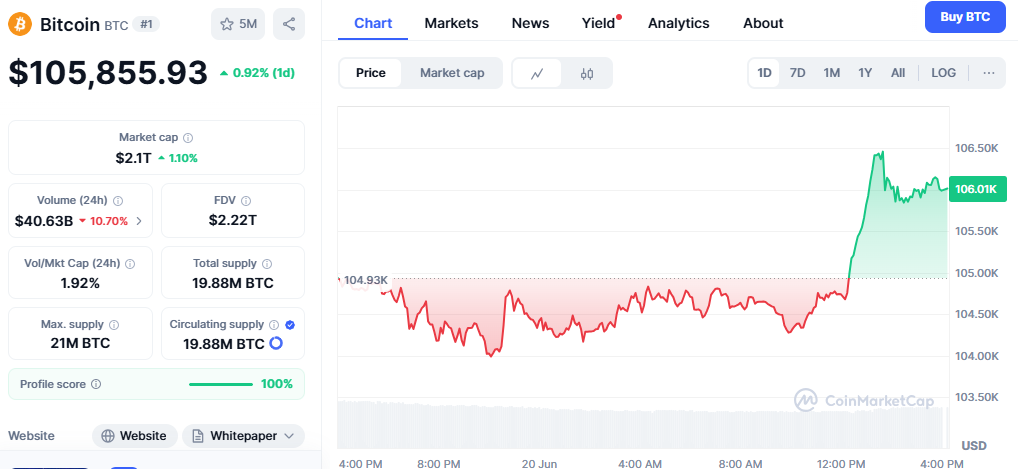

Bitcoin is currently trading at approximately $104,748, positioning itself strategically near key resistance levels that could trigger significant price movements. The whale’s massive leveraged position suggests sophisticated market participants anticipate a breakthrough above current trading ranges.

Market Dynamics and Technical Analysis

The timing of this whale activity is particularly noteworthy as Bitcoin has been consolidating in a sideways pattern for several weeks. Bitcoin price today trades near $104,500 as bulls lose momentum, with key support at $103,400 now under pressure. However, the substantial whale investment could provide the catalyst needed to break out of this consolidation phase.

Technical indicators reveal mixed signals in the current market environment. Recent price forecasts indicate potential value increases of 16.42%, reaching approximately $121,780 by June 21, 202. Technical indicators show a neutral to bullish sentiment at 5%, and the Fear & Greed Index displays a score of 57, indicating a state of greed.

Institutional Confidence and Market Sentiment

The $255 million leveraged position represents more than just speculative trading; it signals deep institutional confidence in Bitcoin’s near-term prospects. Bitcoin surged past $108,000 in June 2021, driven by whale trades, institutional inflows, and macroeconomic momentum, with analysts predicting a new all-time high. This whale activity aligns with broader institutional adoption trends that have been driving Bitcoin’s price appreciation throughout 2025.

The use of 20x leverage amplifies both potential returns and risks, suggesting the whale has firm conviction about Bitcoin’s direction. Such high-leverage positions typically indicate sophisticated risk management strategies and access to substantial capital reserves that can withstand market volatility.

Price Targets and Future Outlook

Market analysts are increasingly optimistic about Bitcoin’s trajectory following this whale activity. Experts expect Bitcoin to create a 2025 high of approximately $168,000, while some projections are even more bullish. Bitcoin price predictions indicate a potential surge to $150,000 by 2025, with the latest Bitcoin news revealing key catalysts driving unprecedented price action.

The $106,000 liquidity level represents a crucial psychological and technical barrier. Once breached, it could trigger algorithmic buying and force short liquidations, potentially accelerating Bitcoin’s upward momentum. The Bitcoin price has the potential to reach $200,000 by the end of 2025, according to several market analysts tracking current trends.

Risk Factors and Market Considerations

While the whale’s massive position signals bullish sentiment, investors should remain aware of the inherent risks in leveraged cryptocurrency trading. The volatile nature of Bitcoin means that significant price swings can occur rapidly, potentially affecting leveraged positions dramatically.

Bitcoin may recover from recent dips if key support near $102,000–$104,000 holds. This support level becomes crucial for maintaining bullish momentum and preventing potential liquidations of leveraged positions.

Broader Market Implications

This whale activity extends beyond individual speculation, reflecting broader institutional adoption of Bitcoin as a legitimate asset class. The sophisticated nature of the trade, combined with its substantial size, suggests professional management and strategic positioning rather than retail speculation.

The cryptocurrency market has matured significantly, with institutional players increasingly comfortable deploying large amounts of capital in Bitcoin. This evolution toward institutional adoption provides underlying support for higher price levels and reduced volatility over time.

Conclusion

The $255 million whale long position at $104,000 represents a significant vote of confidence in Bitcoin’s near-term prospects. As Bitcoin approaches the $106,000 liquidity zone, market participants are closely watching for potential breakouts that could trigger substantial price movements. The combination of whale activity, institutional adoption, and favourable technical conditions suggests Bitcoin may be positioned for another significant rally in the coming weeks.

Investors should monitor key support and resistance levels while considering the broader implications of increased institutional participation in the cryptocurrency market. The whale’s strategic positioning near current price levels suggests that sophisticated market participants expect a significant upward movement, potentially validating bullish price targets for the remainder of 2025.