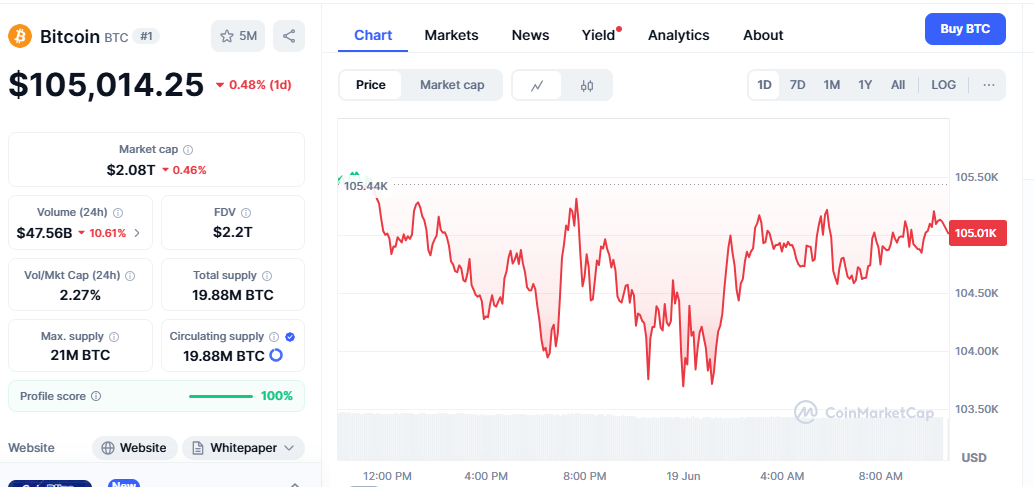

Bitcoin $104K Fed rate policy continues to trade near the psychologically significant $104,000 level as investors digest the latest Federal Open Market Committee (FOMC) developments and the Federal Reserve’s updated economic projections. The cryptocurrency market remains in a state of cautious optimism, with traders closely monitoring the central bank’s stance on interest rates and its implications for risk assets, such as Bitcoin.

Fed Signals Cautious Monetary Policy Amid Economic Uncertainty

The Federal Reserve’s recent communications have painted a picture of economic caution, with policymakers expressing concerns about persistent inflation pressures and slowing growth prospects. The Fed’s quarterly financial projections showed that policymakers expect rates to be at 3.9% by year-end 2025, indicating 50 basis-point cuts this year and a measured approach to monetary policy adjustments.

The central bank’s projections strike a delicate balance between supporting economic growth and maintaining price stability. Fed Chair Jerome Powell has emphasized that the institution remains committed to its dual mandate, but the path forward appears more challenging than previously anticipated. The Fed chairman acknowledged that the Federal Reserve anticipated growth to decline through 2025 and that inflation would likely rise slightly, creating a complex environment for both traditional and digital assets.

Bitcoin’s Technical Position at Critical $104K Level

Bitcoin’s current position around $104,000 represents a crucial technical juncture for the world’s largest cryptocurrency. The Bitcoin price is $105,030 per coin, with today’s traded price range between $104,733 and $105,264, forming a tight consolidation pattern that has characterized recent trading sessions.

Market analysts are closely watching key resistance and support levels that could determine Bitcoin’s next significant directional move. The Bitcoin this month suggests a likely trading range between $100,000 and $120,000, as BTC consolidates near its 200-day exponential moving average (EMA) while maintaining a bullish long-term trend structure. This technical setup suggests that Bitcoin is at a crossroads, with the potential for significant movement in either direction depending on broader market catalysts.

The cryptocurrency’s ability to maintain its position above the $100,000 psychological support level has been particularly noteworthy, demonstrating the underlying strength in institutional and retail demand. However, traders remain cautious about potential downside risks, particularly if macroeconomic headwinds intensify.

Market Sentiment and Rate Cut Expectations

The cryptocurrency market’s reaction to Federal Reserve policy has become increasingly sophisticated, with Bitcoin traders now closely following traditional monetary policy indicators. Fed interest-rate cut odds this week are now less than 0.1%, reflecting market skepticism about aggressive monetary easing in the near term.

This shift in rate cut expectations has created a more complex trading environment for Bitcoin and other risk assets. While the cryptocurrency has historically benefited from loose monetary policy, the current climate requires traders to navigate between concerns about growth and inflation pressures. The market is sensitive to any indications that the Federal Reserve may need to maintain higher rates for longer than previously anticipated.

Professional traders and institutional investors are adapting their strategies to account for this new reality, with many focusing on Bitcoin’s potential as both a growth asset and an inflation hedge. The dual nature of these characteristics becomes particularly relevant in the current economic environment, where concerns about both growth and inflation are elevated.

Implications for Bitcoin’s Price Trajectory

Looking ahead, Bitcoin’s price action will likely remain closely tied to Federal Reserve policy decisions and broader macroeconomic developments. A confirmed breakout above $112,000 could set the stage for a rally toward $120,000 or higher by mid-to-late June, according to technical analysts who are monitoring key resistance levels.

The cryptocurrency’s correlation with traditional risk assets has strengthened in recent months, making it increasingly sensitive to changes in monetary policy expectations. This evolution reflects Bitcoin’s growing integration into mainstream financial markets and its recognition as a legitimate asset class by institutional investors.

However, the path forward is not without challenges. Economic uncertainty, regulatory developments, and shifting investor sentiment all play crucial roles in determining the trajectory of Bitcoin. The Federal Reserve’s commitment to fighting inflation, even at the cost of slower economic growth, creates a backdrop of uncertainty that affects all risk assets, including cryptocurrencies.

Long-term Outlook and Strategic Considerations

Despite near-term volatility and uncertainty surrounding Federal Reserve policy, many analysts remain optimistic about Bitcoin’s long-term prospects. We expect the BTC price to create a 2025 high of approximately $168,000, according to some market forecasters who point to fundamental factors supporting continued adoption and price appreciation.

The cryptocurrency’s position at $104,000 represents more than just a price level; it symbolizes Bitcoin’s evolution from a speculative asset to a recognized store of value and potential hedge against monetary debasement. As central banks worldwide strive to maintain price stability while supporting economic growth, Bitcoin’s unique characteristics become increasingly relevant to portfolio diversification strategies.

Investors and traders are advised to maintain a balanced perspective, recognizing both the opportunities and risks inherent in the current market environment. The Federal Reserve’s policy decisions will continue to influence short-term price movements. Still, Bitcoin’s long-term value proposition remains tied to its fundamental characteristics as a decentralized, finite digital asset.